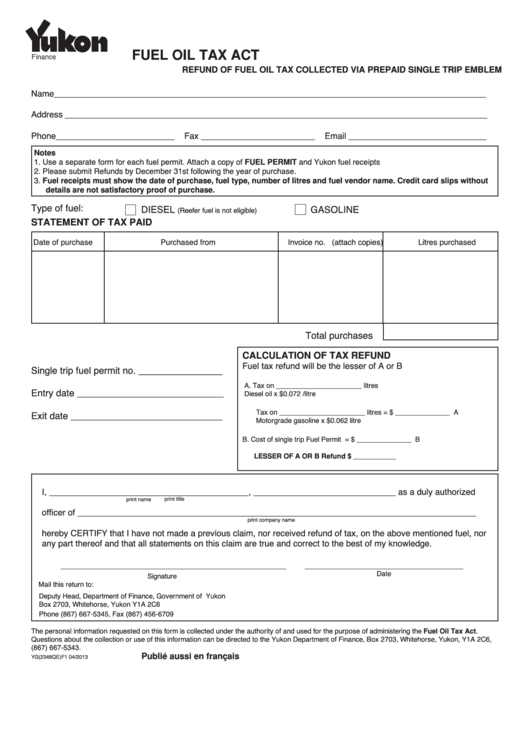

F.O.T. APPLICATION 7A

FUEL OIL TAX ACT

REFUND OF FUEL OIL TAX COLLECTED VIA PREPAID SINGLE TRIP EMBLEM

Name___________________________________________________________________________________________

Address _________________________________________________________________________________________

Phone _________________________

Fax ________________________

Email _____________________________

Notes

1. Use a separate form for each fuel permit. Attach a copy of FUEL PERMIT and Yukon fuel receipts

2. Please submit Refunds by December 31st following the year of purchase.

3. Fuel receipts must show the date of purchase, fuel type, number of litres and fuel vendor name. Credit card slips without

details are not satisfactory proof of purchase.

Type of fuel:

DIESEL

GASOLINE

(Reefer fuel is not eligible)

STATEMENT OF TAX PAID

Date of purchase

Purchased from

Invoice no. (attach copies)

Litres purchased

Total purchases

CALCULATION OF TAX REFUND

Fuel tax refund will be the lesser of A or B

Single trip fuel permit no. ________________

A. Tax on ______________________ litres

Entry date ____________________________

Diesel oil x $0.072 /litre

Tax on ______________________ litres

=

$ ______________ A

Exit date _____________________________

Motorgrade gasoline x $0.062 litre

B. Cost of single trip Fuel Permit

= $ ______________ B

Refund $ ___________

LESSER OF A OR B

I, __________________________________________, ______________________________ as a duly authorized

print name

print title

officer of ____________________________________________________________________________________

print company name

hereby CERTIFY that I have not made a previous claim, nor received refund of tax, on the above mentioned fuel, nor

any part thereof and that all statements on this claim are true and correct to the best of my knowledge.

Date

Signature

Mail this return to:

Deputy Head, Department of Finance, Government of Yukon

Box 2703, Whitehorse, Yukon Y1A 2C6

Phone (867) 667-5345, Fax (867) 456-6709

The personal information requested on this form is collected under the authority of and used for the purpose of administering the Fuel Oil Tax Act.

Questions about the collection or use of this information can be directed to the Yukon Department of Finance, Box 2703, Whitehorse, Yukon, Y1A 2C6,

(867) 667-5343.

Publié aussi en français

YG(2348QE)F1 04/2013

1

1