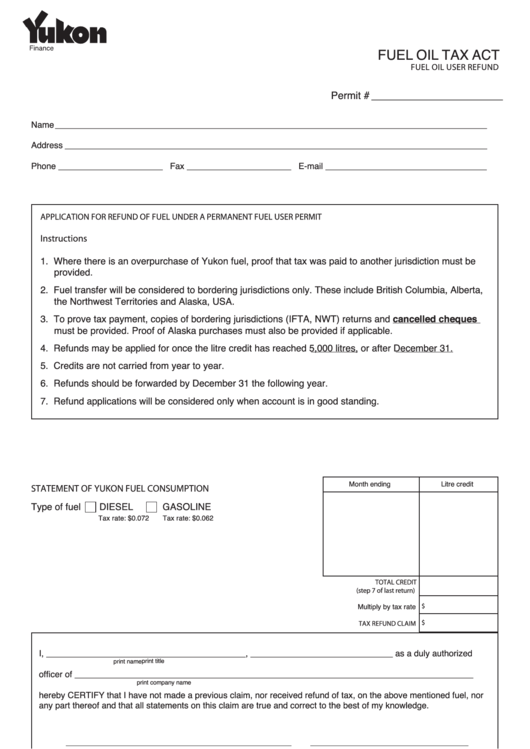

F.O.T. APPLICATION 7

FUEL OIL TAX ACT

FUEL OIL USER REFUND

Permit # _______________________

Name ___________________________________________________________________________________________

Address _________________________________________________________________________________________

Phone ______________________ Fax ______________________ E-mail __________________________________

APPLICATION FOR REFUND OF FUEL UNDER A PERMANENT FUEL USER PERMIT

Instructions

1. Where there is an overpurchase of Yukon fuel, proof that tax was paid to another jurisdiction must be

provided.

2. Fuel transfer will be considered to bordering jurisdictions only. These include British Columbia, Alberta,

the Northwest Territories and Alaska, USA.

3. To prove tax payment, copies of bordering jurisdictions (IFTA, NWT) returns and cancelled cheques

must be provided. Proof of Alaska purchases must also be provided if applicable.

4. Refunds may be applied for once the litre credit has reached 5,000 litres, or after December 31.

5. Credits are not carried from year to year.

6. Refunds should be forwarded by December 31 the following year.

7. Refund applications will be considered only when account is in good standing.

Month ending

Litre credit

STATEMENT OF YUKON FUEL CONSUMPTION

Type of fuel

DIESEL

GASOLINE

Tax rate: $0.072

Tax rate: $0.062

TOTAL CREDIT

(step 7 of last return)

Multiply by tax rate

$

$

TAX REFUND CLAIM

I, __________________________________________, ______________________________ as a duly authorized

print title

print name

officer of ____________________________________________________________________________________

print company name

hereby CERTIFY that I have not made a previous claim, nor received refund of tax, on the above mentioned fuel, nor

any part thereof and that all statements on this claim are true and correct to the best of my knowledge.

Signature

Date

Mail this return to:

Deputy Head, Department of Finance, Government of Yukon

Box 2703, Whitehorse, Yukon Y1A 2C6

phone (867) 667-5345, fax (867) 456-6709

The personal information requested on this form is collected under the authority of and used for the purpose of administering the Fuel Oil Tax Act.

Questions about the collection or use of this information can be directed to the Yukon Department of Finance, Box 2703, Whitehorse, Yukon, Y1A 2C6,

(867) 667-5343.

Publié aussi en français

YG(1787QE)F1 Rev. 01/2013

1

1