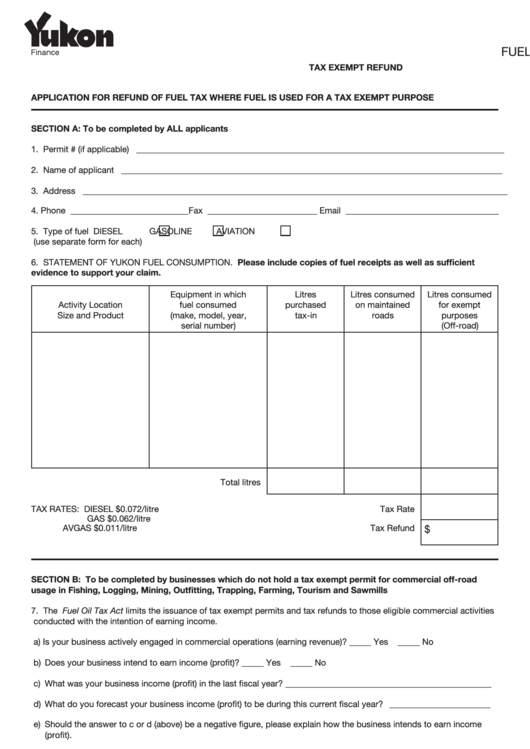

F.O.T. APPLICATION 6A

FUEL OIL TAX ACT

TAX EXEMPT REFUND

APPLICATION FOR REFUND OF FUEL TAX WHERE FUEL IS USED FOR A TAX EXEMPT PURPOSE

SECTION A: To be completed by ALL applicants

1. Permit # (if applicable) ____________________________________________________________________________________

2. Name of applicant _______________________________________________________________________________________

3. Address _________________________________________________________________________________________________

4. Phone ___________________________ Fax _________________________ Email ___________________________________

5. Type of fuel

DIESEL

GASOLINE

AVIATION

(use separate form for each)

6. STATEMENT OF YUKON FUEL CONSUMPTION. Please include copies of fuel receipts as well as sufficient

evidence to support your claim.

Equipment in which

Litres

Litres consumed

Litres consumed

Activity Location

fuel consumed

purchased

on maintained

for exempt

Size and Product

(make, model, year,

tax-in

roads

purposes

serial number)

(Off-road)

Total litres

TAX RATES:

DIESEL

$0.072/litre

Tax Rate

GAS

$0.062/litre

$

AVGAS

$0.011/litre

Tax Refund

SECTION B: To be completed by businesses which do not hold a tax exempt permit for commercial off-road

usage in Fishing, Logging, Mining, Outfitting, Trapping, Farming, Tourism and Sawmills

7. The Fuel Oil Tax Act limits the issuance of tax exempt permits and tax refunds to those eligible commercial activities

conducted with the intention of earning income.

a) Is your business actively engaged in commercial operations (earning revenue)? _____ Yes

_____ No

b) Does your business intend to earn income (profit)? _____ Yes

_____ No

c) What was your business income (profit) in the last fiscal year? _______________________________________________

d) What do you forecast your business income (profit) to be during this current fiscal year? _______________________

e) Should the answer to c or d (above) be a negative figure, please explain how the business intends to earn income

(profit).

______________________________________________________________________________________________________

f) Is greater than 50% of revenue derived from non-arm’s length customer? _____ Yes

_____ No

If Yes, provide details: ___________________________________________________________________________________

8. List other commercial activities in which you are involved. _____________________________________________________

Formulaire disponible en français

YG(3369QE)F1 Rev.11/2013

1

1 2

2