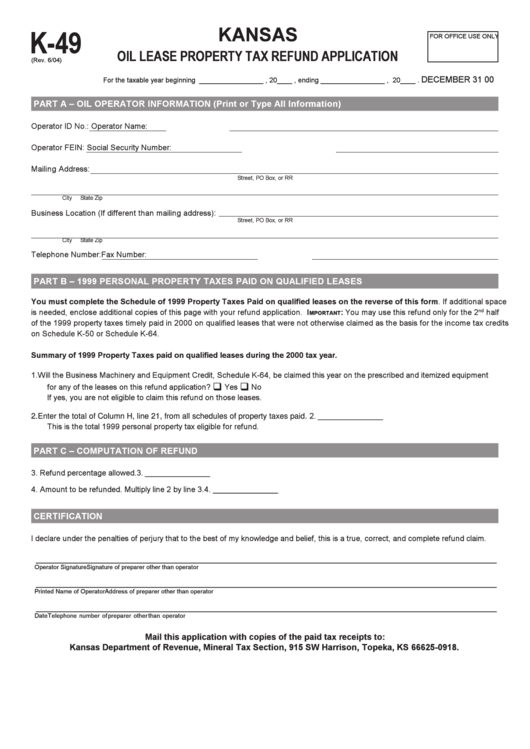

Form K-49 - Kansas Oil Lease Property Tax Refund Application

ADVERTISEMENT

K-49

KANSAS

FOR OFFICE USE ONLY

OIL LEASE PROPERTY TAX REFUND APPLICATION

(Rev. 6/04)

DECEMBER 31

00

For the taxable year beginning _________________ , 20____ , ending _________________ , 20____ .

PART A – OIL OPERATOR INFORMATION (Print or Type All Information)

Operator ID No.:

Operator Name:

Operator FEIN:

Social Security Number:

Mailing Address:

Street, PO Box, or RR

City

State

Zip

Business Location (If different than mailing address):

Street, PO Box, or RR

City

State

Zip

Telephone Number:

Fax Number:

PART B – 1999 PERSONAL PROPERTY TAXES PAID ON QUALIFIED LEASES

You must complete the Schedule of 1999 Property Taxes Paid on qualified leases on the reverse of this form. If additional space

is needed, enclose additional copies of this page with your refund application. I

: You may use this refund only for the 2

half

nd

MPORTANT

of the 1999 property taxes timely paid in 2000 on qualified leases that were not otherwise claimed as the basis for the income tax credits

on Schedule K-50 or Schedule K-64.

Summary of 1999 Property Taxes paid on qualified leases during the 2000 tax year.

1. Will the Business Machinery and Equipment Credit, Schedule K-64, be claimed this year on the prescribed and itemized equipment

q

q

for any of the leases on this refund application?

Yes

No

If yes, you are not eligible to claim this refund on those leases.

2. _______________

2. Enter the total of Column H, line 21, from all schedules of property taxes paid.

This is the total 1999 personal property tax eligible for refund.

PART C – COMPUTATION OF REFUND

3.

Refund percentage allowed.

3. _______________

4.

Amount to be refunded. Multiply line 2 by line 3.

4. _______________

CERTIFICATION

I declare under the penalties of perjury that to the best of my knowledge and belief, this is a true, correct, and complete refund claim.

__________________________________________________________________________________________________________

Operator Signature

Signature of preparer other than operator

__________________________________________________________________________________________________________

Printed Name of Operator

Address of preparer other than operator

__________________________________________________________________________________________________________

Date

Telephone number of preparer other than operator

Mail this application with copies of the paid tax receipts to:

Kansas Department of Revenue, Mineral Tax Section, 915 SW Harrison, Topeka, KS 66625-0918.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2