Form 41a720rc-R - Schedule Rc-R Disposition Of Recycling Or Composting Equipment Schedule

ADVERTISEMENT

*0800010236*

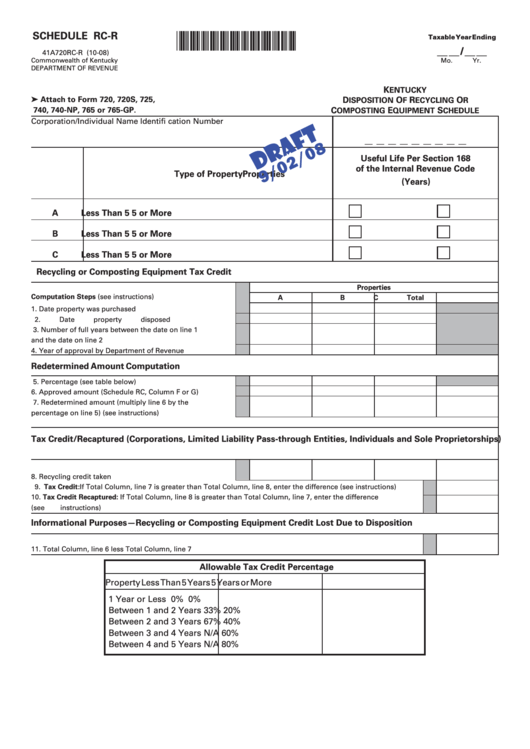

SCHEDULE RC-R

Taxable Year Ending

__ __ / __ __

41A720RC-R (10-08)

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

K

ENTUCKY

➤ Attach to Form 720, 720S, 725,

D

O

R

O

ISPOSITION

F

ECYCLING

R

740, 740-NP , 765 or 765-GP .

C

E

S

OMPOSTING

QUIPMENT

CHEDULE

Corporation/Individual Name

Identifi cation Number

__ __ __ __ __ __ __ __ __

Useful Life Per Section 168

of the Internal Revenue Code

Properties

Type of Property

(Years)

A

Less Than 5

5 or More

B

Less Than 5

5 or More

C

Less Than 5

5 or More

Recycling or Composting Equipment Tax Credit

Properties

Computation Steps (see instructions)

A

B

C

Total

1. Date property was purchased ............................................... 1

/

/

/

/

/

/

2. Date property disposed ......................................................... 2

/

/

/

/

/

/

3. Number of full years between the date on line 1

and the date on line 2 ............................................................ 3

4. Year of approval by Department of Revenue ...................... 4

Redetermined Amount Computation

5. Percentage (see table below) ................................................ 5

6. Approved amount (Schedule RC, Column F or G) .............. 6

7.

Redetermined amount (multiply line 6 by the

percentage on line 5) (see instructions) .............................. 7

Tax Credit/Recaptured (Corporations, Limited Liability Pass-through Entities, Individuals and Sole Proprietorships)

8. Recycling credit taken ........................................................... 8

9. Tax Credit: If Total Column, line 7 is greater than Total Column, line 8, enter the difference (see instructions) ............. 9

10. Tax Credit Recaptured: If Total Column, line 8 is greater than Total Column, line 7, enter the difference

(see instructions) .................................................................................................................................................................... 10

Informational Purposes—Recycling or Composting Equipment Credit Lost Due to Disposition

11.

Total Column, line 6 less Total Column, line 7 ...................................................................................................................... 11

Allowable Tax Credit Percentage

Property

Less Than 5 Years

5 Years or More

1 Year or Less

0%

0%

Between 1 and 2 Years

33%

20%

Between 2 and 3 Years

67%

40%

Between 3 and 4 Years

N/A

60%

Between 4 and 5 Years

N/A

80%

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2