1998

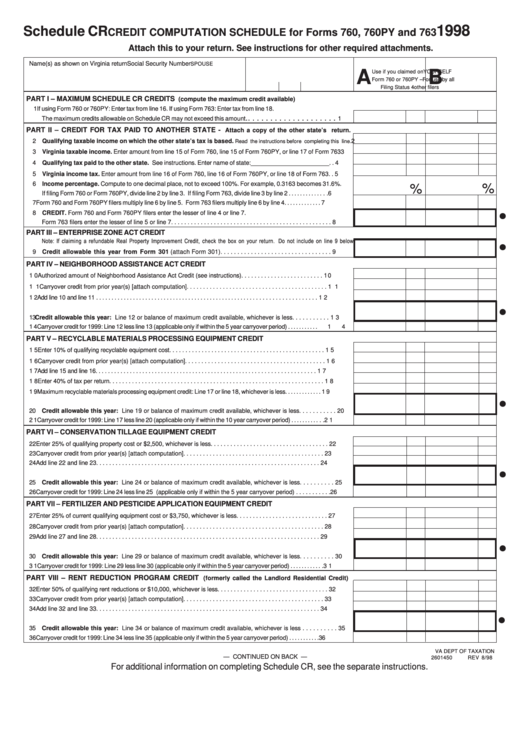

Schedule CR

CREDIT COMPUTATION SCHEDULE for Forms 760, 760PY and 763

Attach this to your return. See instructions for other required attachments.

Name(s) as shown on Virginia return

Social Security Number

SPOUSE

A

B

Use if you claimed on

YOURSELF

Form 760 or 760PY –

For use by all

Filing Status 4

other filers

PART I – MAXIMUM SCHEDULE CR CREDITS

(compute the maximum credit available)

1 If using Form 760 or 760PY: Enter tax from line 16. If using Form 763: Enter tax from line 18.

. . . . . . . . . . . . . . . . . . . . .

The maximum credits allowable on Schedule CR may not exceed this amount

1

PART II – CREDIT FOR TAX PAID TO ANOTHER STATE -

Attach a copy of the other state’s return.

2 Qualifying taxable income on which the other state’s tax is based.

2

Read the instructions before completing this line.

3 Virginia taxable income. Enter amount from line 15 of Form 760, line 15 of Form 760PY, or line 17 of Form 763

3

4 Qualifying tax paid to the other state. See instructions. Enter name of state:_______________________ . .

4

5 Virginia income tax. Enter amount from line 16 of Form 760, line 16 of Form 760PY, or line 18 of Form 763 . .

5

6 Income percentage. Compute to one decimal place, not to exceed 100%. For example, 0.3163 becomes 31.6%.

%

%

If filing Form 760 or Form 760PY, divide line 2 by line 3. If filing Form 763, divide line 3 by line 2 . . . . . . . . . . . . . .

6

7 Form 760 and Form 760PY filers multiply line 6 by line 5. Form 763 filers multiply line 6 by line 4 . . . . . . . . . . . . .

7

8 CREDIT. Form 760 and Form 760PY filers enter the lesser of line 4 or line 7.

Form 763 filers enter the lesser of line 5 or line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

PART III – ENTERPRISE ZONE ACT CREDIT

9 Credit allowable this year from Form 301 (attach Form 301) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

PART IV – NEIGHBORHOOD ASSISTANCE ACT CREDIT

1 0 Authorized amount of Neighborhood Assistance Act Credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . .

1 0

1 1 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 1

1 2 Add line 10 and line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 2

1 3 Credit allowable this year: Line 12 or balance of maximum credit available, whichever is less . . . . . . . . . . .

1 3

1 4 Carryover credit for 1999: Line 12 less line 13 (applicable only if within the 5 year carryover period) . . . . . . . . . . .

1 4

PART V – RECYCLABLE MATERIALS PROCESSING EQUIPMENT CREDIT

1 5 Enter 10% of qualifying recyclable equipment cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 5

1 6 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 6

1 7 Add line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 7

1 8 Enter 40% of tax per return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 8

1 9 Maximum recyclable materials processing equipment credit: Line 17 or line 18, whichever is less . . . . . . . . . . . . .

1 9

20 Credit allowable this year: Line 19 or balance of maximum credit available, whichever is less . . . . . . . . . . .

20

2 1 Carryover credit for 1999: Line 17 less line 20 (applicable only if within the 10 year carryover period) . . . . . . . . . . . .

2 1

PART VI – CONSERVATION TILLAGE EQUIPMENT CREDIT

22 Enter 25% of qualifying property cost or $2,500, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

23 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Add line 22 and line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Credit allowable this year: Line 24 or balance of maximum credit available, whichever is less . . . . . . . . . .

25

26 Carryover credit for 1999: Line 24 less line 25 (applicable only if within the 5 year carryover period) . . . . . . . . . . .

26

PART VII – FERTILIZER AND PESTICIDE APPLICATION EQUIPMENT CREDIT

27 Enter 25% of current qualifying equipment cost or $3,750, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

28 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28

29 Add line 27 and line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

29

30 Credit allowable this year: Line 29 or balance of maximum credit available, whichever is less . . . . . . . . . .

30

3 1 Carryover credit for 1999: Line 29 less line 30 (applicable only if within the 5 year carryover period) . . . . . . . . . . . .

3 1

PART VIII – RENT REDUCTION PROGRAM CREDIT

(formerly called the Landlord Residential Credit)

32 Enter 50% of qualifying rent reductions or $10,000, whichever is less . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

32

33 Carryover credit from prior year(s) [attach computation] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

33

34 Add line 32 and line 33 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34

35 Credit allowable this year: Line 34 or balance of maximum credit available, whichever is less . . . . . . . . . .

35

36 Carryover credit for 1999: Line 34 less line 35 (applicable only if within the 5 year carryover period) . . . . . . . . . . .

36

VA DEPT OF TAXATION

— CONTINUED ON BACK —

2601450

REV 8/98

For additional information on completing Schedule CR, see the separate instructions.

1

1 2

2