Form 37-S - Schedule Sf Computation Of Separate Income, Losses, Deductions, And Federal Tax Amounts To Be Used By Married Person(S) Required To File Separate State Return(S) Template (1999)

ADVERTISEMENT

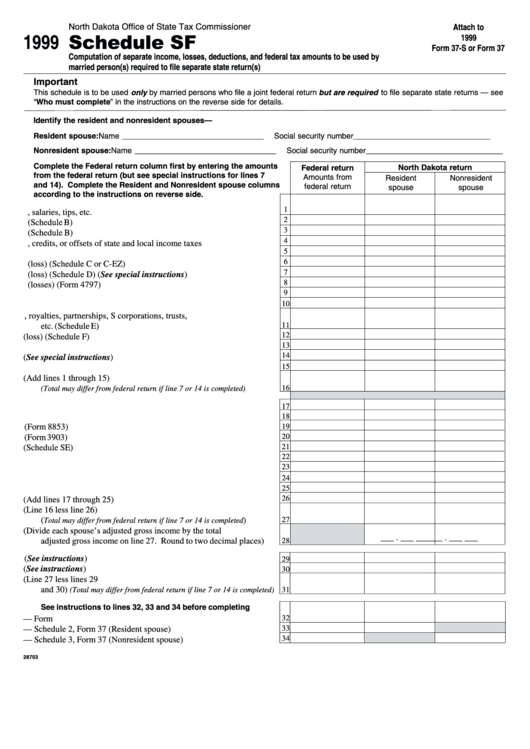

North Dakota Office of State Tax Commissioner

Attach to

1999

1999

Schedule SF

Form 37-S or Form 37

Computation of separate income, losses, deductions, and federal tax amounts to be used by

married person(s) required to file separate state return(s)

Important

This schedule is to be used only by married persons who file a joint federal return but are required to file separate state returns — see

“Who must complete” in the instructions on the reverse side for details.

Identify the resident and nonresident spouses—

Resident spouse:

Name ________________________________

Social security number_______________________________

Nonresident spouse: Name ________________________________

Social security number_______________________________

Complete the Federal return column first by entering the amounts

Federal return

North Dakota return

from the federal return (but see special instructions for lines 7

Amounts from

Resident

Nonresident

and 14). Complete the Resident and Nonresident spouse columns

federal return

spouse

spouse

according to the instructions on reverse side.

1

1. Wages, salaries, tips, etc. ................................................................

2

2. Taxable interest (Schedule B) ..........................................................

3

3. Ordinary dividends (Schedule B) ....................................................

4

4. Taxable refunds, credits, or offsets of state and local income taxes

5

5. Alimony received ............................................................................

6

6. Business income or (loss) (Schedule C or C-EZ) ...........................

7

7. Capital gain or (loss) (Schedule D) (See special instructions) ......

8

8. Other gains or (losses) (Form 4797) ...............................................

9

9. Taxable amount of IRA distributions .............................................

10

10. Taxable amount of pensions and annuities .....................................

11. Rental real estate, royalties, partnerships, S corporations, trusts,

11

etc. (Schedule E) ..............................................................................

12

12. Farm income or (loss) (Schedule F) ................................................

13

13. Unemployment compensation .........................................................

14

14. Taxable amount of social security benefits (See special instructions)

15

15. Other income ...................................................................................

16. Total income for North Dakota purposes (Add lines 1 through 15)

16

(Total may differ from federal return if line 7 or 14 is completed) ............

17. IRA deduction .................................................................................

17

18. Student loan interest deduction .......................................................

18

19. Medical savings account deduction (Form 8853) ...........................

19

20. Moving expenses (Form 3903) ........................................................

20

21. One-half of self-employment tax (Schedule SE) ............................

21

22

22. Self-employed health insurance deduction .....................................

23

23. Keogh and self-employed SEP and SIMPLE plans ........................

24. Penalty on early withdrawal of savings ...........................................

24

25. Alimony paid ..................................................................................

25

26

26. Total adjustments (Add lines 17 through 25) .................................

27. Adjusted gross income for N.D. purposes (Line 16 less line 26)

(

) ..........

27

Total may differ from federal return if line 7 or 14 is completed

28. Ratio (Divide each spouse’s adjusted gross income by the total

___ . ___ ___

___ . ___ ___

adjusted gross income on line 27. Round to two decimal places)

28

29. Standard deduction or itemized deductions (See instructions) ......

29

30. Exemptions (See instructions) .......................................................

30

31. Federal taxable income for N.D. purposes (Line 27 less lines 29

and 30)

31

(Total may differ from federal return if line 7 or 14 is completed)

See instructions to lines 32, 33 and 34 before completing

32

32. Federal income tax liability — Form 37-S .....................................

33

33. Federal income tax — Schedule 2, Form 37 (Resident spouse) .....

34

34. Federal income tax — Schedule 3, Form 37 (Nonresident spouse)

28703

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1