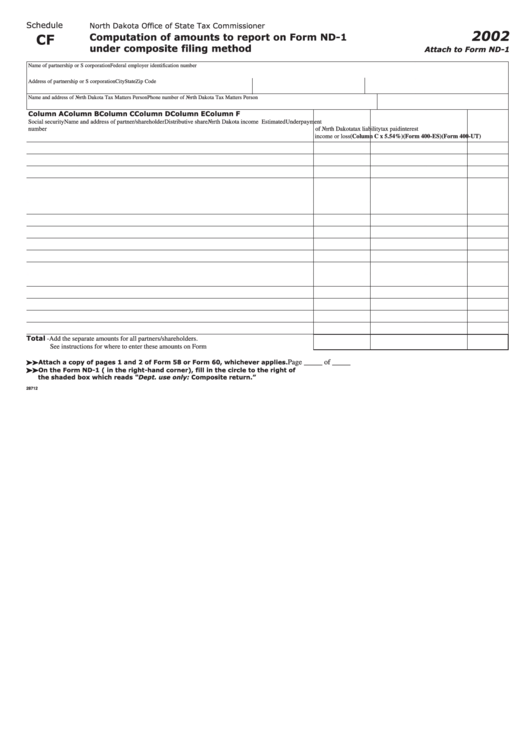

Schedule Cf - Attach To Form Nd-1 - Computation Of Amounts To Report Under Composite Filing Method - 2002

ADVERTISEMENT

North Dakota Office of State Tax Commissioner

2002

Computation of amounts to report on Form ND-1

under composite filing method

Attach to Form ND-1

Name of partnership or S corporation

Federal employer identification number

Address of partnership or S corporation

City

State

Zip Code

Name and address of North Dakota Tax Matters Person

Phone number of North Dakota Tax Matters Person

Column A

Column B

Column C

Column D

Column E

Column F

Social security

Name and address of partner/shareholder

Distributive share

North Dakota income Estimated

Underpayment

number

of North Dakota

tax liability

tax paid

interest

income or loss

(Column C x 5.54%) (Form 400-ES) (Form 400-UT)

Total - Add the separate amounts for all partners/shareholders.

See instructions for where to enter these amounts on Form ND-1 .....................................................

® ® ® ® ® Attach a copy of pages 1 and 2 of Form 58 or Form 60, whichever applies.

Page _____ of _____

® ® ® ® ® On the Form ND-1 ( in the right-hand corner), fill in the circle to the right of

the shaded box which reads “Dept. use only: Composite return.”

28712

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1