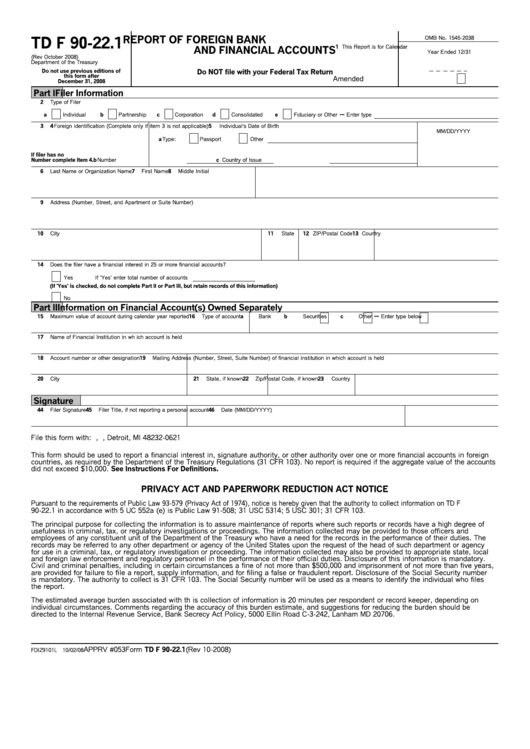

Form Td F 90-22.1 - Report Of Foreign Bank And Financial Accounts

ADVERTISEMENT

REPORT OF FOREIGN BANK

OMB No. 1545-2038

TD F 90-22.1

1 This Report is for Calendar

AND FINANCIAL ACCOUNTS

Year Ended 12/31

(Rev October 2008)

Department of the Treasury

Do not use previous editions of

Do NOT file with your Federal Tax Return

this form after

Amended

December 31, 2008

Part I

Filer Information

2

Type of Filer

'

a

Individual

b

Partnership

c

Corporation

d

Consolidated

e

Fiduciary or Other

Enter type

3

U.S. Taxpayer Identification Number

4 Foreign identification (Complete only if item 3 is not applicable)

5

Individual's Date of Birth

MM/DD/YYYY

a Type:

Passport

Other

If filer has no U.S. Identification

Number complete Item 4.

b Number

c Country of Issue

6

Last Name or Organization Name

7

First Name

8

Middle Initial

9

Address (Number, Street, and Apartment or Suite Number)

10

City

11

State

12 ZIP/Postal Code

13 Country

14

Does the filer have a financial interest in 25 or more financial accounts?

Yes

If 'Yes' enter total number of accounts

(If 'Yes' is checked, do not complete Part II or Part III, but retain records of this information)

No

Part II Information on Financial Account(s) Owned Separately

'

15

Maximum value of account during calendar year reported

16

Type of account

a

Bank

b

Securities

c

Other

Enter type below

17

Name of Financial Institution in wh ich account is held

18

Account number or other designation

19

Mailing Address (Number, Street, Suite Number) of financial institution in which account is held

20

City

21

State, if known

22

Zip/Postal Code, if known

23

Country

Signature

44

Filer Signature

45

Filer Title, if not reporting a personal account

46

Date (MM/DD/YYYY)

File this form with: U.S. Department of the Treasury, P.O. Box 32621, Detroit, MI 48232-0621

This form should be used to report a financial interest in, signature authority, or other authority over one or more financial accounts in foreign

countries, as required by the Department of the Treasury Regulations (31 CFR 103). No report is required if the aggregate value of the accounts

did not exceed $10,000. See Instructions For Definitions.

PRIVACY ACT AND PAPERWORK REDUCTION ACT NOTICE

Pursuant to the requirements of Public Law 93-579 (Privacy Act of 1974), notice is hereby given that the authority to collect information on TD F

90-22.1 in accordance with 5 UC 552a (e) is Public Law 91-508; 31 USC 5314; 5 USC 301; 31 CFR 103.

The principal purpose for collecting the information is to assure maintenance of reports where such reports or records have a high degree of

usefulness in criminal, tax, or regulatory investigations or proceedings. The information collected may be provided to those officers and

employees of any constituent unit of the Department of the Treasury who have a need for the records in the performance of their duties. The

records may be referred to any other department or agency of the United States upon the request of the head of such department or agency

for use in a criminal, tax, or regulatory investigation or proceeding. The information collected may also be provided to appropriate state, local

and foreign law enforcement and regulatory personnel in the performance of their official duties. Disclosure of this information is mandatory.

Civil and criminal penalties, including in certain circumstances a fine of not more than $500,000 and imprisonment of not more than five years,

are provided for failure to file a report, supply information, and for filing a false or fraudulent report. Disclosure of the Social Security number

is mandatory. The authority to collect is 31 CFR 103. The Social Security number will be used as a means to identify the individual who files

the report.

The estimated average burden associated with th is collection of information is 20 minutes per respondent or record keeper, depending on

individual circumstances. Comments regarding the accuracy of this burden estimate, and suggestions for reducing the burden should be

directed to the Internal Revenue Service, Bank Secrecy Act Policy, 5000 Ellin Road C-3-242, Lanham MD 20706.

APPRV #053

Form TD F 90-22.1 (Rev 10-2008)

FDIZ9101L 10/02/08

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1