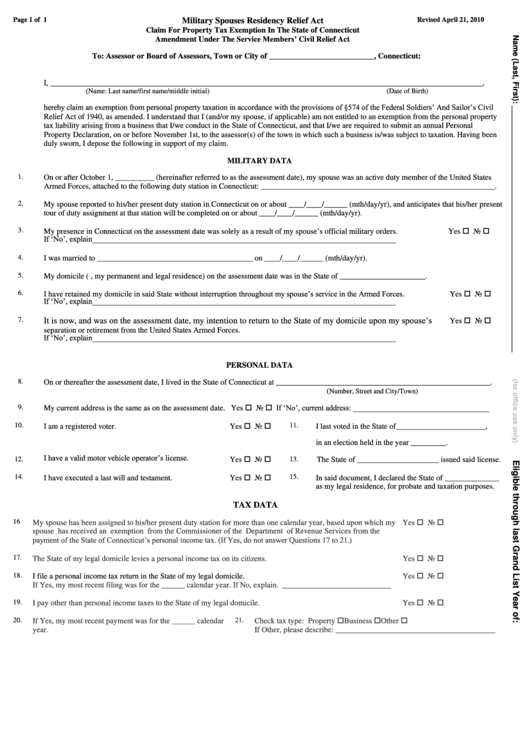

Claim For Property Tax Exemption In The State Of Connecticut Amendment Under The Service Members' Civil Relief Act Form

ADVERTISEMENT

Page 1 of 1

Revised April 21, 2010

Military Spouses Residency Relief Act

Claim For Property Tax Exemption In The State of Connecticut

Amendment Under The Service Members’ Civil Relief Act

To: Assessor or Board of Assessors, Town or City of ___________________________, Connecticut:

I, _______________________________________________________________________________________________________________,

(Name: Last name/first name/middle initial)

(Date of Birth)

hereby claim an exemption from personal property taxation in accordance with the provisions of §574 of the Federal Soldiers’ And Sailor’s Civil

Relief Act of 1940, as amended. I understand that I (and/or my spouse, if applicable) am not entitled to an exemption from the personal property

tax liability arising from a business that I/we conduct in the State of Connecticut, and that I/we are required to submit an annual Personal

Property Declaration, on or before November 1st, to the assessor(s) of the town in which such a business is/was subject to taxation. Having been

duly sworn, I depose the following in support of my claim.

MILITARY DATA

1.

On or after October 1, __________ (hereinafter referred to as the assessment date), my spouse was an active duty member of the United States

Armed Forces, attached to the following duty station in Connecticut: ____________________________________________________________.

2.

My spouse reported to his/her present duty station in Connecticut on or about ____/____/______ (mth/day/yr), and anticipates that his/her present

tour of duty assignment at that station will be completed on or about ____/____/______ (mth/day/yr).

Yes No

3.

My presence in Connecticut on the assessment date was solely as a result of my spouse’s official military orders.

If ‘No’, explain______________________________________________________________________________

4.

I was married to ________________________________________ on ____/____/______ (mth/day/yr).

5.

My domicile (i.e., my permanent and legal residence) on the assessment date was in the State of ______________________.

I have retained my domicile in said State without interruption throughout my spouse’s service in the Armed Forces.

Yes No

6.

If ‘No’, explain______________________________________________________________________________

It is now, and was on the assessment date, my intention to return to the State of my domicile upon my spouse’s

Yes No

7.

separation or retirement from the United States Armed Forces.

If ‘No’, explain______________________________________________________________________________

PERSONAL DATA

8.

On or thereafter the assessment date, I lived in the State of Connecticut at _______________________________________________________.

(

Number, Street and City/Town)

My current address is the same as on the assessment date. Yes No If ‘No’, current address: ___________________________________

9.

Yes No

10.

11.

I am a registered voter.

I last voted in the State of_______________________,

in an election held in the year _________.

I have a valid motor vehicle operator’s license.

Yes No

12.

13.

The State of _____________________ issued said license.

Yes No

14.

I have executed a last will and testament.

15.

In said document, I declared the State of ______________

as my legal residence, for probate and taxation purposes.

TAX DATA

Yes No

16

My spouse has been assigned to his/her present duty station for more than one calendar year, based upon which my

spouse has received an exemption from the Commissioner of the Department of Revenue Services from the

payment of the State of Connecticut’s personal income tax. (If Yes, do not answer Questions 17 to 21.)

Yes No

17.

The State of my legal domicile levies a personal income tax on its citizens.

Yes No

18.

I file a personal income tax return in the State of my legal domicile.

If Yes, my most recent filing was for the ______ calendar year. If No, explain. ____________________________

Yes No

19.

I pay other than personal income taxes to the State of my legal domicile.

Check tax type: Property Business Other

20.

If Yes, my most recent payment was for the ______ calendar

21.

year.

If Other, please describe: _________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2