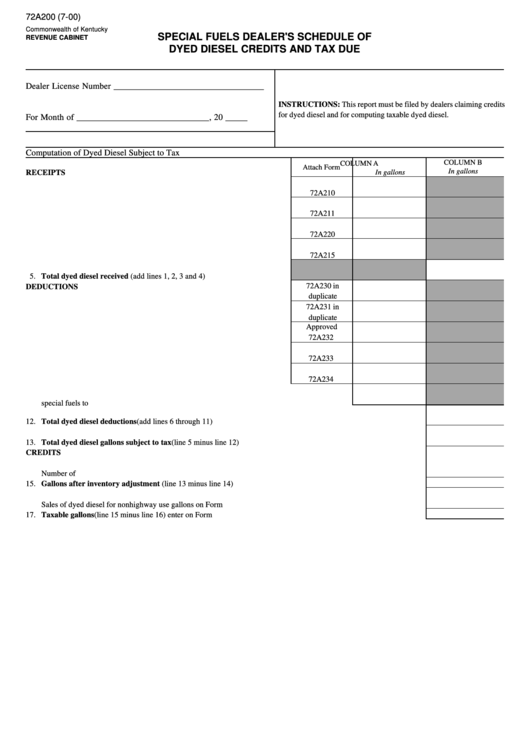

Form 72a200 - Special Fuels Dealer'S Schedule Of Dyed Diesel Credits And Tax Due

ADVERTISEMENT

72A200 (7-00)

Commonwealth of Kentucky

SPECIAL FUELS DEALER'S SCHEDULE OF

REVENUE CABINET

DYED DIESEL CREDITS AND TAX DUE

Dealer License Number __________________________________

INSTRUCTIONS: This report must be filed by dealers claiming credits

for dyed diesel and for computing taxable dyed diesel.

For Month of ______________________________, 20 _____

Computation of Dyed Diesel Subject to Tax

COLUMN B

COLUMN A

Attach Form

In gallons

RECEIPTS

In gallons

72A210

1. Dyed diesel purchased in Kentucky .................................................................

72A211

2. Dyed diesel imported into Kentucky from other states ....................................

72A220

3. Dyed diesel withdrawals from terminal storage ...............................................

72A215

4. Kerosene blended with dyed diesel and all other receipts ...............................

5. Total dyed diesel received (add lines 1, 2, 3 and 4) .......................................

72A230 in

DEDUCTIONS

duplicate

6. Dyed diesel exported from Kentucky ...............................................................

72A231 in

duplicate

7. Dyed diesel sold to other Kentucky licensed dealers .......................................

Approved

72A232

8. Dyed diesel lost through accountable losses ....................................................

72A233

9. Dyed diesel sold to railroad companies for nonhighway purposes ..................

72A234

10. Dyed diesel sold to U.S. government ...............................................................

11. Dyed diesel used by licensed dealer for nonhighway purposes related to the distribution of

special fuels to others ..........................................................................................................................

12. Total dyed diesel deductions (add lines 6 through 11) ..........................................................................................................

13. Total dyed diesel gallons subject to tax (line 5 minus line 12) ............................................................................................

CREDITS

14. Dyed diesel gallonage adjustment for gallons inventory held in bulk storage on the last day of the month.

Number of gallons .....................................................................................................................................................................

15. Gallons after inventory adjustment (line 13 minus line 14) ................................................................................................

16. Nonhighway dealer credits

Sales of dyed diesel for nonhighway use gallons on Form 72A240 ........................................................................................

17. Taxable gallons (line 15 minus line 16) enter on Form 72A124 ............................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1