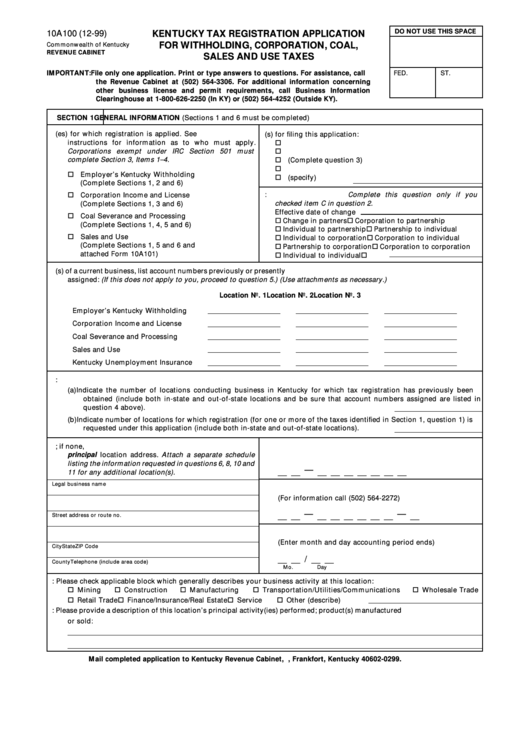

Form 10a100 - Kentucky Tax Registration Application

ADVERTISEMENT

DO NOT USE THIS SPACE

10A100 (12-99)

KENTUCKY TAX REGISTRATION APPLICATION

FOR WITHHOLDING, CORPORATION, COAL,

Commonwealth of Kentucky

REVENUE CABINET

SALES AND USE TAXES

IMPORTANT: File only one application. Print or type answers to questions. For assistance, call

FED.

ST.

the Revenue Cabinet at (502) 564-3306. For additional information concerning

other business license and permit requirements, call Business Information

Clearinghouse at 1-800-626-2250 (In KY) or (502) 564-4252 (Outside KY).

SECTION 1

GENERAL INFORMATION (Sections 1 and 6 must be completed)

1. Check the tax(es) for which registration is applied. See

2. Check the reason(s) for filing this application:

instructions for information as to who must apply.

A. Opened new business

Corporations exempt under IRC Section 501 must

B. Opened new location of current business

complete Section 3, Items 1–4.

C. Change in ownership (Complete question 3)

D. Resumption of business

Employer’s Kentucky Withholding

E. Other (specify)

(Complete Sections 1, 2 and 6)

3. Ownership change: Complete this question only if you

Corporation Income and License

checked item C in question 2.

(Complete Sections 1, 3 and 6)

Effective date of change

Coal Severance and Processing

Change in partners

Corporation to partnership

(Complete Sections 1, 4, 5 and 6)

Individual to partnership

Partnership to individual

Sales and Use

Individual to corporation

Corporation to individual

(Complete Sections 1, 5 and 6 and

Partnership to corporation

Corporation to corporation

attached Form 10A101)

Individual to individual

4. If you are resuming business or opening a new location(s) of a current business, list account numbers previously or presently

assigned: (If this does not apply to you, proceed to question 5.) (Use attachments as necessary.)

Location No. 1

Location No. 2

Location No. 3

Employer’s Kentucky Withholding

Corporation Income and License

Coal Severance and Processing

Sales and Use

Kentucky Unemployment Insurance

5. Number of business locations:

(a) Indicate the number of locations conducting business in Kentucky for which tax registration has previously been

obtained (include both in-state and out-of-state locations and be sure that account numbers assigned are listed in

question 4 above).

(b) Indicate number of locations for which registration (for one or more of the taxes identified in Section 1, question 1) is

requested under this application (include both in-state and out-of-state locations).

6. Complete business name and Kentucky location; if none,

7. Federal Employer I.D. No.

principal location address. Attach a separate schedule

listing the information requested in questions 6, 8, 10 and

__ __ — __ __ __ __ __ __ __

11 for any additional location(s).

Legal business name

8. Kentucky Unemployment Insurance Number

(For information call (502) 564-2272)

__ __ — __ __ __ __ __ __ — __

Street address or route no.

9. Accounting period

(Enter month and day accounting period ends)

City

State

ZIP Code

__ __ / __ __

County

Telephone (include area code)

Mo.

Day

10. Principal business activity: Please check applicable block which generally describes your business activity at this location:

Mining

Construction

Manufacturing

Transportation/Utilities/Communications

Wholesale Trade

Retail Trade

Finance/Insurance/Real Estate

Service

Other (describe)

11. Nature of business: Please provide a description of this location’s principal activity(ies) performed; product(s) manufactured

or sold:

Mail completed application to Kentucky Revenue Cabinet, P.O. Box 299, Frankfort, Kentucky 40602-0299.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

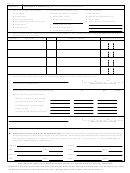

1

1 2

2 3

3 4

4