Print

Clear

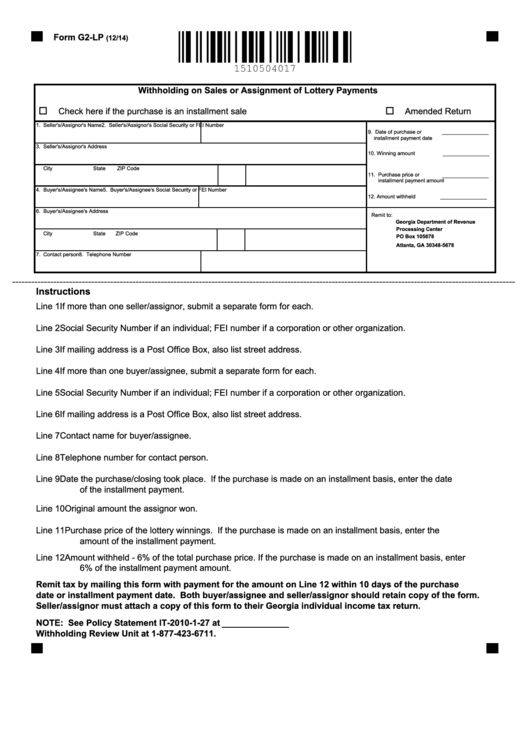

Form G2-LP

(12/14)

Withholding on Sales or Assignment of Lottery Payments

Check here if the purchase is an installment sale

Amended Return

1. Seller's/Assignor's Name

2. Seller's/Assignor's Social Security or FEI Number

9. Date of purchase or

________________

installment payment date

3. Seller's/Assignor's Address

10. Winning amount

________________

City

State

ZIP Code

11. Purchase price or

________________

installment payment amount

4. Buyer's/Assignee's Name

5. Buyer's/Assignee's Social Security or FEI Number

12. Amount withheld

________________

6. Buyer's/Assignee's Address

Remit to:

Georgia Department of Revenue

Processing Center

City

State

ZIP Code

PO Box 105678

Atlanta, GA 30348-5678

7. Contact person

8. Telephone Number

---------------------------------------------------------------------------------------------------------------------------------------------------------------

Instructions

Line 1

If more than one seller/assignor, submit a separate form for each.

Line 2

Social Security Number if an individual; FEI number if a corporation or other organization.

Line 3

If mailing address is a Post Office Box, also list street address.

Line 4

If more than one buyer/assignee, submit a separate form for each.

Line 5

Social Security Number if an individual; FEI number if a corporation or other organization.

Line 6

If mailing address is a Post Office Box, also list street address.

Line 7

Contact name for buyer/assignee.

Line 8

Telephone number for contact person.

Line 9

Date the purchase/closing took place. If the purchase is made on an installment basis, enter the date

of the installment payment.

Line 10

Original amount the assignor won.

Line 11

Purchase price of the lottery winnings. If the purchase is made on an installment basis, enter the

amount of the installment payment.

Line 12

Amount withheld - 6% of the total purchase price. If the purchase is made on an installment basis, enter

6% of the installment payment amount.

Remit tax by mailing this form with payment for the amount on Line 12 within 10 days of the purchase

date or installment payment date. Both buyer/assignee and seller/assignor should retain copy of the form.

Seller/assignor must attach a copy of this form to their Georgia individual income tax return.

NOTE: See Policy Statement IT-2010-1-27 at for more information or contact the

Withholding Review Unit at 1-877-423-6711.

1

1