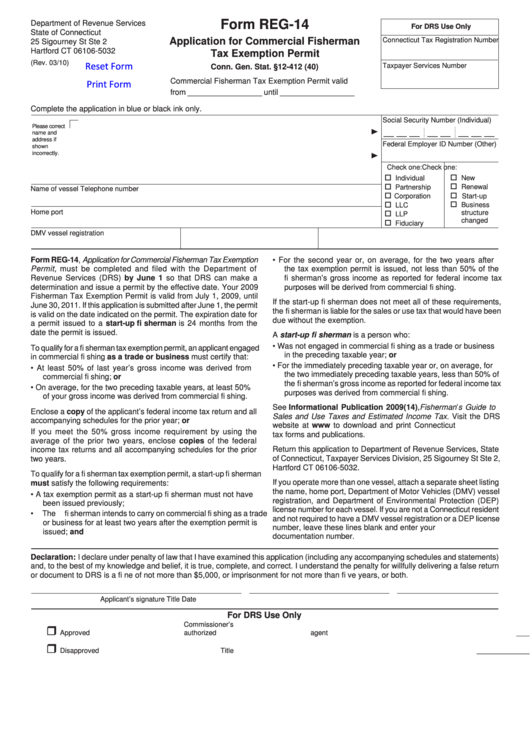

Form REG-14

Department of Revenue Services

For DRS Use Only

State of Connecticut

Application for Commercial Fisherman

Connecticut Tax Registration Number

25 Sigourney St Ste 2

Hartford CT 06106-5032

Tax Exemption Permit

(Rev. 03/10)

Reset Form

Taxpayer Services Number

Conn. Gen. Stat. §12-412 (40)

Print Form

Commercial Fisherman Tax Exemption Permit valid

from _________________ until _________________

Complete the application in blue or black ink only.

Social Security Number (Individual)

Please correct

name and

— — — — — — — —

address if

Federal Employer ID Number (Other)

shown

incorrectly.

Check one:

Check one:

New

Individual

Renewal

Partnership

Name of vessel

Telephone number

Corporation

Start-up

LLC

Business

Home port

structure

LLP

changed

Fiduciary

DMV vessel registration

U.S. Coast Guard documentation number

DEP license number

Form REG-14, Application for Commercial Fisherman Tax Exemption

•

For the second year or, on average, for the two years after

Permit, must be completed and filed with the Department of

the tax exemption permit is issued, not less than 50% of the

Revenue Services (DRS) by June 1 so that DRS can make a

fi sherman’s gross income as reported for federal income tax

determination and issue a permit by the effective date. Your 2009

purposes will be derived from commercial fi shing.

Fisherman Tax Exemption Permit is valid from July 1, 2009, until

If the start-up fi sherman does not meet all of these requirements,

June 30, 2011. If this application is submitted after June 1, the permit

the fi sherman is liable for the sales or use tax that would have been

is valid on the date indicated on the permit. The expiration date for

due without the exemption.

a permit issued to a start-up fi sherman is 24 months from the

date the permit is issued.

A start-up fi sherman is a person who:

•

Was not engaged in commercial fi shing as a trade or business

To qualify for a fi sherman tax exemption permit, an applicant engaged

in the preceding taxable year; or

in commercial fi shing as a trade or business must certify that:

•

For the immediately preceding taxable year or, on average, for

•

At least 50% of last year’s gross income was derived from

the two immediately preceding taxable years, less than 50% of

commercial fi shing; or

the fi sherman’s gross income as reported for federal income tax

•

On average, for the two preceding taxable years, at least 50%

purposes was derived from commercial fi shing.

of your gross income was derived from commercial fi shing.

See Informational Publication 2009(14), Fisherman’s Guide to

Enclose a copy of the applicant’s federal income tax return and all

Sales and Use Taxes and Estimated Income Tax. Visit the DRS

accompanying schedules for the prior year; or

website at to download and print Connecticut

If you meet the 50% gross income requirement by using the

tax forms and publications.

average of the prior two years, enclose copies of the federal

Return this application to Department of Revenue Services, State

income tax returns and all accompanying schedules for the prior

two years.

of Connecticut, Taxpayer Services Division, 25 Sigourney St Ste 2,

Hartford CT 06106-5032.

To qualify for a fi sherman tax exemption permit, a start-up fi sherman

If you operate more than one vessel, attach a separate sheet listing

must satisfy the following requirements:

the name, home port, Department of Motor Vehicles (DMV) vessel

•

A tax exemption permit as a start-up fi sherman must not have

registration, and Department of Environmental Protection (DEP)

been issued previously;

license number for each vessel. If you are not a Connecticut resident

•

The fi sherman intends to carry on commercial fi shing as a trade

and not required to have a DMV vessel registration or a DEP license

or business for at least two years after the exemption permit is

number, leave these lines blank and enter your U.S. Coast Guard

issued; and

documentation number.

Declaration: I declare under penalty of law that I have examined this application (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return

or document to DRS is a fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

Applicant’s signature

Title

Date

For DRS Use Only

Commissioner’s

Approved

authorized agent ______________________________________________________________

Disapproved

Title

__________________________________________ Date ______________

1

1