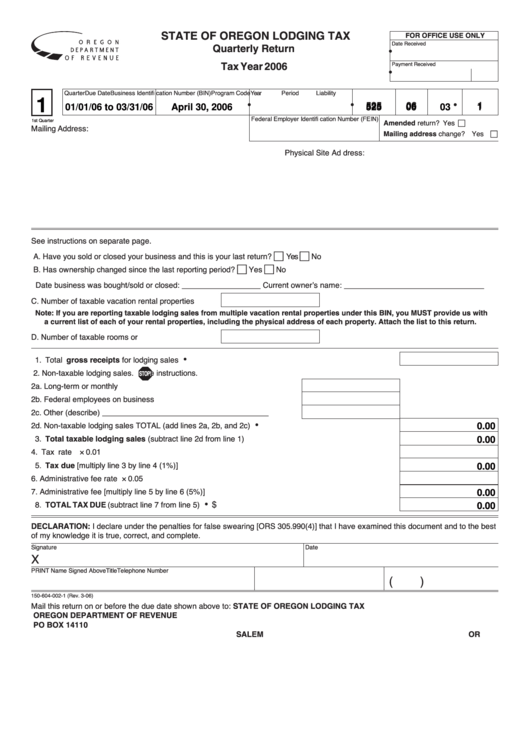

STATE OF OREGON LODGING TAX

FOR OFFICE USE ONLY

Date Received

Quarterly Return

•

Payment Received

Tax Year 2006

•

Quarter

Due Date

Business Identifi cation Number (BIN) Program Code Year

Period

Liability

1

•

•

•

•

525

06

1

01/01/06 to 03/31/06

April 30, 2006

525

06

03

1

Federal Employer Identifi cation Number (FEIN)

1st Quarter

Amended return? Yes c

Mailing Address:

Mailing address change? Yes c

Physical Site Ad dress:

See instructions on separate page.

c

c

A. Have you sold or closed your business and this is your last return?

Yes

No

c

c

B. Has ownership changed since the last reporting period?

Yes

No

Date business was bought/sold or closed: __________________ Current ownerʼs name: ________________________________

C. Number of taxable vacation rental properties .........

Note: If you are reporting taxable lodging sales from multiple vacation rental properties under this BIN, you MUST provide us with

a current list of each of your rental properties, including the physical address of each property. Attach the list to this return.

D. Number of taxable rooms or sites...........................

•

1. Total gross receipts for lodging sales ................................................................................................... 1

2. Non-taxable lodging sales.

See instructions.

STOP!

2a. Long-term or monthly rentals............................................................. 2a

2b. Federal employees on business ........................................................ 2b

2c. Other (describe) ______________________________________ .... 2c

•

2d. Non-taxable lodging sales TOTAL (add lines 2a, 2b, and 2c) ........................................................ 2d

0.00

3. Total taxable lodging sales (subtract line 2d from line 1) .................................................................... 3

0.00

4. Tax rate ................................................................................................................................................... 4

× 0.01

5. Tax due [multiply line 3 by line 4 (1%)] .................................................................................................. 5

0.00

6. Administrative fee rate ............................................................................................................................ 6

× 0.05

7. Administrative fee [multiply line 5 by line 6 (5%)] ................................................................................... 7

0.00

•

$

8. TOTAL TAX DUE (subtract line 7 from line 5) ........................................................................................ 8

0.00

DECLARATION: I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document and to the best

of my knowledge it is true, correct, and complete.

Signature

Date

X

PRINT Name Signed Above

Title

Telephone Number

(

)

150-604-002-1 (Rev. 3-06)

Mail this return on or before the due date shown above to: STATE OF OREGON LODGING TAX

OREGON DEPARTMENT OF REVENUE

PO BOX 14110

SALEM OR 97309-0910

1

1 2

2