Form Jcot 1 - Jessamine County Occupational Tax

ADVERTISEMENT

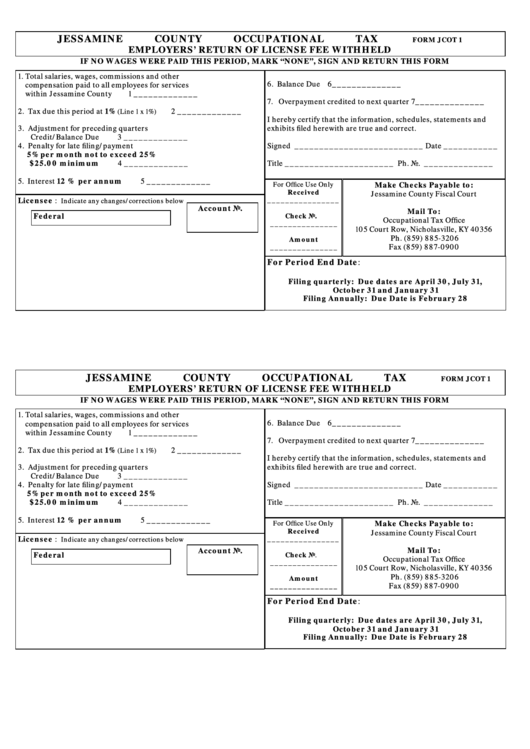

JESSAMINE COUNTY OCCUPATIONAL TAX

FORM JCOT 1

EMPLOYERS’ RETURN OF LICENSE FEE WITHHELD

IF NO WAGES WERE PAID THIS PERIOD, MARK “NONE”, SIGN AND RETURN THIS FORM

1. Total salaries, wages, commissions and other

6. Balance Due

6______________

compensation paid to all employees for services

within Jessamine County

1 _____________

7. Overpayment credited to next quarter

7______________

2. Tax due this period at 1%

2 _____________

(Line 1 x 1%)

I hereby certify that the information, schedules, statements and

3. Adjustment for preceding quarters

exhibits filed herewith are true and correct.

Credit/Balance Due

3 _____________

4. Penalty for late filing/payment

Signed __________________________ Date ___________

5% per month not to exceed 25%

$25.00 minimum

4 _____________

Title ______________________ Ph. No. ______________

5. Interest 12 % per annum

5 _____________

For Office Use Only

Make Checks Payable to:

Received

Jessamine County Fiscal Court

Licensee :

________________

Indicate any changes/corrections below

Account No.

Mail To:

Federal I.d.

Check No.

Occupational Tax Office

_______________

105 Court Row, Nicholasville, KY 40356

Ph. (859) 885-3206

Amount

Fax (859) 887-0900

_______________

For Period End Date:

Filing quarterly: Due dates are April 30, July 31,

October 31 and January 31

Filing Annually: Due Date is February 28

JESSAMINE COUNTY OCCUPATIONAL TAX

FORM JCOT 1

EMPLOYERS’ RETURN OF LICENSE FEE WITHHELD

IF NO WAGES WERE PAID THIS PERIOD, MARK “NONE”, SIGN AND RETURN THIS FORM

1. Total salaries, wages, commissions and other

6. Balance Due

6______________

compensation paid to all employees for services

within Jessamine County

1 _____________

7. Overpayment credited to next quarter

7______________

2. Tax due this period at 1%

2 _____________

(Line 1 x 1%)

I hereby certify that the information, schedules, statements and

3. Adjustment for preceding quarters

exhibits filed herewith are true and correct.

Credit/Balance Due

3 _____________

4. Penalty for late filing/payment

Signed __________________________ Date ___________

5% per month not to exceed 25%

$25.00 minimum

4 _____________

Title ______________________ Ph. No. ______________

5. Interest 12 % per annum

5 _____________

For Office Use Only

Make Checks Payable to:

Received

Jessamine County Fiscal Court

Licensee :

________________

Indicate any changes/corrections below

Mail To:

Account No.

Federal I.d.

Check No.

Occupational Tax Office

_______________

105 Court Row, Nicholasville, KY 40356

Ph. (859) 885-3206

Amount

Fax (859) 887-0900

_______________

For Period End Date:

Filing quarterly: Due dates are April 30, July 31,

October 31 and January 31

Filing Annually: Due Date is February 28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1