Form It-140 - West Virginia Resident Income Tax Return 2001

ADVERTISEMENT

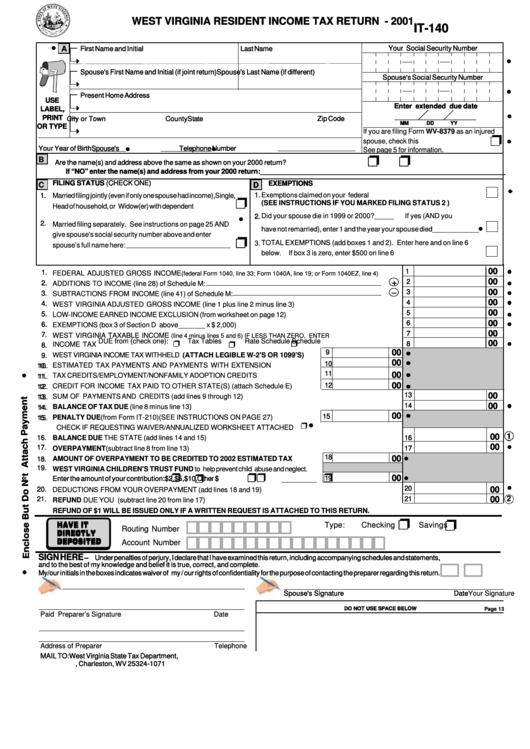

WEST VIRGINIA RESIDENT INCOME TAX RETURN - 2001

WEST VIRGINIA RESIDENT INCOME TAX RETURN - 2001

IT-140

IT-140

A

First Name and Initial

First Name and Initial

Last Name

Last Name

Your Social Security Number

Your Social Security Number

Spouse's First Name and Initial (if joint return)

Spouse's First Name and Initial (if joint return)

Spouse's Last Name (if different)

Spouse's Last Name (if different)

Spouse's Social Security Number

Spouse's Social Security Number

Present Home Address

Present Home Address

USE

USE

Enter extended due date

Enter extended due date

LABEL,

LABEL,

PRINT

PRINT

City or Town

City or Town

County

County

State

State

Zip Code

Zip Code

MM

MM

DD

DD

YY

YY

OR TYPE

OR TYPE

If you are filing Form WV-8379 as an injured

spouse, check this box............................

Your Year of Birth

Your Year of Birth

Spouse's

Spouse's

Telephone Number

Telephone Number

See page 5 for information.

B

Are the name(s) and address above the same as shown on your 2000 return?................................... YES

Are the name(s) and address above the same as shown on your 2000 return?................................... YES

NO

NO

If “NO” enter the name(s) and address from your 2000 return:________________________________________________________________

If “NO” enter the name(s) and address from your 2000 return:________________________________________________________________

FILING STATUS (CHECK ONE)

FILING STATUS (CHECK ONE)

EXEMPTIONS

EXEMPTIONS

C

D

D

1.

1.

Exemptions claimed on your federal return..................................................

1.

1.

Married filing jointly (even if only one spouse had income),Single,

(SEE INSTRUCTIONS IF YOU MARKED FILING STATUS 2 )

Head of household, or Widow(er) with dependent child...............

Did your spouse die in 1999 or 2000?_____

If yes (AND you

2.

2.

2.

2.

Married filing separately. See instructions on page 25 AND

have not remarried), enter 1 and the year your spouse died____________

give spouse's social security number above and enter

3.

TOTAL EXEMPTIONS (add boxes 1 and 2). Enter here and on line 6

spouse’s full name here:

below. If box 3 is zero, enter $500 on line 6 below..................................

00

00

1

1

1.

1.

FEDERAL ADJUSTED GROSS INCOME

(federal Form 1040, line 33; Form 1040A, line 19; or Form 1040EZ, line 4) ............

00

00

2

2

+

+

2.

2.

ADDITIONS TO INCOME (line 28) of Schedule M:

−

−

00

00

3

3

3.

3.

SUBTRACTIONS FROM INCOME (line 41) of Schedule M:

00

00

4

4

4.

4.

WEST VIRGINIA ADJUSTED GROSS INCOME (line 1 plus line 2 minus line 3). ......................................................

00

00

5

5

5.

5.

LOW-INCOME EARNED INCOME EXCLUSION (from worksheet on page 12). ..........................................................

00

00

6

6

6.

6.

EXEMPTIONS (box 3 of Section D above_______ x $ 2,000) ......................................................................................

00

00

7

7

7.

7.

WEST VIRGINIA TAXABLE INCOME

(line 4 minus lines 5 and 6) IF LESS THAN ZERO, ENTER ZERO ...............................

00

00

8

8

INCOME TAX DUE from (check one):

Tax Tables

Rate Schedule

Schedule T ..............................

8.

8.

00

00

9

9

WEST VIRGINIA INCOME TAX WITHHELD (ATTACH LEGIBLE W-2'S OR 1099'S) .....

9.

9.

00

00

10

10

ESTIMATED TAX PAYMENTS AND PAYMENTS WITH EXTENSION ......................

10.

10.

11

11

00

00

TAX CREDITS/EMPLOYMENT/NONFAMILY ADOPTION CREDITS ..............................

11.

11.

00

00

12

12

CREDIT FOR INCOME TAX PAID TO OTHER STATE(S) (attach Schedule E) ...........

12.

12.

13

13

00

00

SUM OF PAYMENTS AND CREDITS (add lines 9 through 12) ..................................................................................

13.

13.

14

14

00

00

BALANCE OF TAX DUE (line 8 minus line 13) .............................................................................................................

14.

14.

00

00

15

15

PENALTY DUE (from Form IT-210)(SEE INSTRUCTIONS ON PAGE 27) ..................

15.

15.

CHECK IF REQUESTING WAIVER/ANNUALIZED WORKSHEET ATTACHED

1

1

00

00

16.

16.

BALANCE DUE THE STATE (add lines 14 and 15) ....................................................................................................

16

16

00

00

17.

17.

OVERPAYMENT (subtract line 8 from line 13) .............................................................................................................

17

17

18

18

00

00

AMOUNT OF OVERPAYMENT TO BE CREDITED TO 2002 ESTIMATED TAX ...........

18.

18.

19.

19.

WEST VIRGINIA CHILDREN'S TRUST FUND to help prevent child abuse and neglect.

00

00

19

19

Enter the amount of your contribution:

Enter the amount of your contribution:

$2,

$2,

$5,

$5,

$10,

$10,

Other $

Other $

20

20

00

00

20.

20.

DEDUCTIONS FROM YOUR OVERPAYMENT (add lines 18 and 19) ........................................................................

21

21

00

00

2

21.

21.

REFUND DUE YOU (subtract line 20 from line 17) ......................................................................................................

REFUND OF $1 WILL BE ISSUED ONLY IF A WRITTEN REQUEST IS ATTACHED TO THIS RETURN.

Type:

Checking

Savings

Routing Number

Account Number

SIGN HERE

SIGN HERE

– Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements,

– Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief it is true, correct, and complete.

and to the best of my knowledge and belief it is true, correct, and complete.

My/our initials in the boxes indicates waiver of my / our rights of confidentiality for the purpose of contacting the preparer regarding this return.

My/our initials in the boxes indicates waiver of my / our rights of confidentiality for the purpose of contacting the preparer regarding this return.

Your Signature

Date

Spouse's Signature

Spouse's Signature

Date

Date

DO NOT USE SPACE BELOW

DO NOT USE SPACE BELOW

Page 13

Paid Preparer’s Signature

Date

Address of Preparer

Telephone

MAIL TO: West Virginia State Tax Department,

MAIL TO: West Virginia State Tax Department,

P.O. Box 1071, Charleston, WV 25324-1071

P.O. Box 1071, Charleston, WV 25324-1071

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2