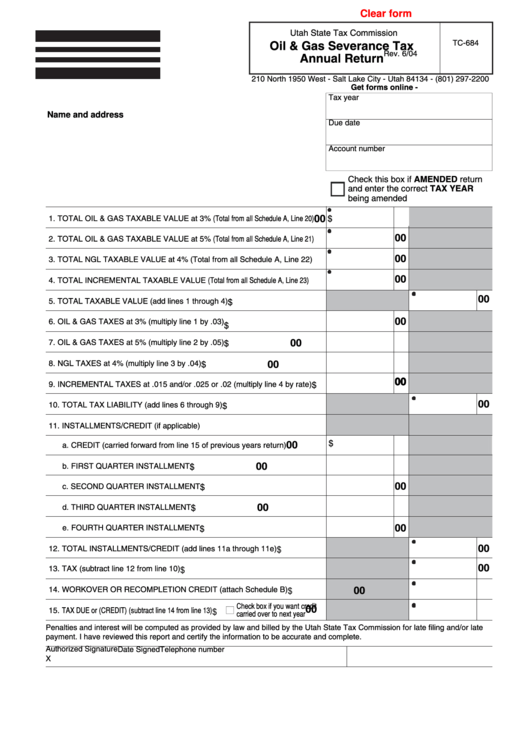

Clear form

Utah State Tax Commission

TC-684

Oil & Gas Severance Tax

Rev. 6/04

Annual Return

210 North 1950 West - Salt Lake City - Utah 84134 - (801) 297-2200

Get forms online - tax.utah.gov

Tax year

Name and address

Due date

Account number

Check this box if AMENDED return

and enter the correct TAX YEAR

being amended

00

1. TOTAL OIL & GAS TAXABLE VALUE at 3% (Total from all Schedule A, Line 20)

$

00

2. TOTAL OIL & GAS TAXABLE VALUE at 5% (Total from all Schedule A, Line 21)

00

3. TOTAL NGL TAXABLE VALUE at 4% (Total from all Schedule A, Line 22)

00

4. TOTAL INCREMENTAL TAXABLE VALUE (Total from all Schedule A, Line 23)

00

5. TOTAL TAXABLE VALUE (add lines 1 through 4)

$

00

6. OIL & GAS TAXES at 3% (multiply line 1 by .03)

$

00

7. OIL & GAS TAXES at 5% (multiply line 2 by .05)

$

8. NGL TAXES at 4% (multiply line 3 by .04)

00

$

00

00

9. INCREMENTAL TAXES at .015 and/or .025 or .02 (multiply line 4 by rate)

$

00

10. TOTAL TAX LIABILITY (add lines 6 through 9)

$

11. INSTALLMENTS/CREDIT (if applicable)

$

00

a. CREDIT (carried forward from line 15 of previous years return)

00

b. FIRST QUARTER INSTALLMENT

$

00

c. SECOND QUARTER INSTALLMENT

$

00

d. THIRD QUARTER INSTALLMENT

$

00

e. FOURTH QUARTER INSTALLMENT

$

$

00

12. TOTAL INSTALLMENTS/CREDIT (add lines 11a through 11e)

00

$

13. TAX (subtract line 12 from line 10)

$

14. WORKOVER OR RECOMPLETION CREDIT (attach Schedule B)

00

Check box if you want credit

00

$

15. TAX DUE or (CREDIT) (subtract line 14 from line 13)

carried over to next year

Penalties and interest will be computed as provided by law and billed by the Utah State Tax Commission for late filing and/or late

payment. I have reviewed this report and certify the information to be accurate and complete.

Authorized Signature

Date Signed Telephone number

X

1

1 2

2 3

3