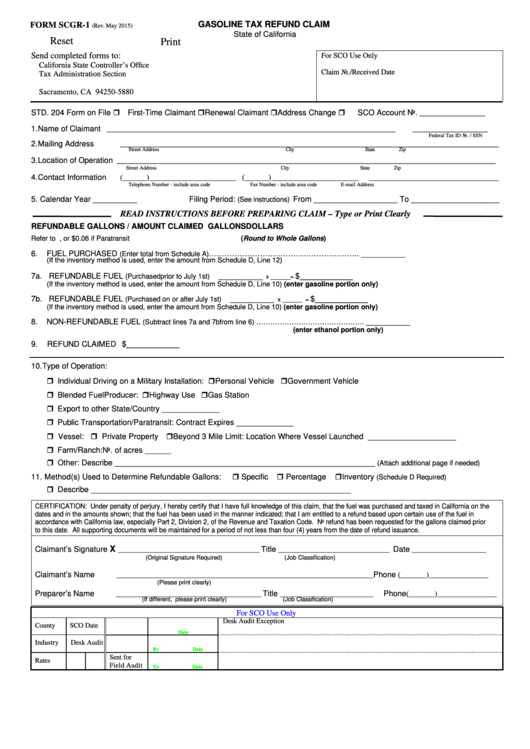

GASOLINE TAX REFUND CLAIM

FORM SCGR-1

(Rev. May 2015)

State of California

Reset

Print

Send completed forms to:

For SCO Use Only

California State Controller’s Office

Claim No./Received Date

Tax Administration Section

P.O. Box 942850

Sacramento, CA 94250-5880

STD. 204 Form on File First-Time Claimant

Renewal Claimant

Address Change

SCO Account No. _________________

1.

Name of Claimant

_________________________________________________________________________

___________________

Federal Tax ID No. / SSN

2.

Mailing Address

________________________________________________________________________________________________

Street Address

City

State

Zip

3.

Location of Operation ________________________________________________________________________________________________

Street Address

City

State

Zip

4.

Contact Information

(______)______________________ (______)______________________

_________________________________

Telephone Number - include area code

Fax Number - include area code

E-mail Address

5.

Calendar Year __________

Filing Period:

From ___________________ To ____________________

(See instructions)

READ INSTRUCTIONS BEFORE PREPARING CLAIM – Type or Print Clearly

REFUNDABLE GALLONS / AMOUNT CLAIMED

GALLONS

DOLLARS

Refer to for the current rate, or $0.06 if Paratransit

(Round to Whole Gallons)

6.

FUEL PURCHASED

………………………………………………….. __________

(Enter total from Schedule A)

(If the inventory method is used, enter the amount from Schedule D, Line 12)

7a. REFUNDABLE FUEL

.................................................................... __________

$____________

(Purchased prior to July 1st)

x ______ =

(If the inventory method is used, enter the amount from Schedule D, Line 10) (enter gasoline portion only)

7b. REFUNDABLE FUEL

................................................................ __________

$____________

(Purchased on or after July 1st)

x ______ =

(If the inventory method is used, enter the amount from Schedule D, Line 10) (enter gasoline portion only)

8.

NON-REFUNDABLE FUEL

__________

(Subtract lines 7a and 7b from line 6) ……………………………………….

(enter ethanol portion only)

9.

REFUND CLAIMED

$____________

....................................................................................................................................................................................................

10. Type of Operation:

Individual Driving on a Military Installation: Personal Vehicle Government Vehicle

Blended Fuel Producer: Highway Use Gas Station

Export to other State/Country _____________

Public Transportation/Paratransit: Contract Expires _____________

Vessel: Private Property Beyond 3 Mile Limit: Location Where Vessel Launched ____________________

Farm/Ranch: No. of acres ______

Other: Describe ___________________________________________________________

(Attach additional page if needed)

Specific

Percentage

Inventory

11. Method(s) Used to Determine Refundable Gallons:

(Schedule D Required)

Describe ___________________________________________________________

CERTIFICATION: Under penalty of perjury, I hereby certify that I have full knowledge of this claim, that the fuel was purchased and taxed in California on the

dates and in the amounts shown; that the fuel has been used in the manner indicated; that I am entitled to a refund based upon certain use of the fuel in

accordance with California law, especially Part 2, Division 2, of the Revenue and Taxation Code. No refund has been requested for the gallons claimed prior

to this date. All supporting documents will be maintained for a period of not less than four (4) years from the date of refund issuance.

X

Claimant’s Signature

Title

Date

______________________________________

______________________________

____________________

(Original Signature Required)

(Job Classification)

(_______)________________

Claimant’s Name

Phone

_____________________________________________________________________

(Please print clearly)

(_______)________________

Preparer’s Name

Title

Phone

_______________________________________

_________________________

(If different, please print clearly)

(Job Classification)

For SCO Use Only

Desk Audit Exception

County

SCO Date

Date

Industry

Desk Audit

By

Date

Sent for

Rates

Field Audit

To

Date

1

1