Ministerial Income Worksheet

ADVERTISEMENT

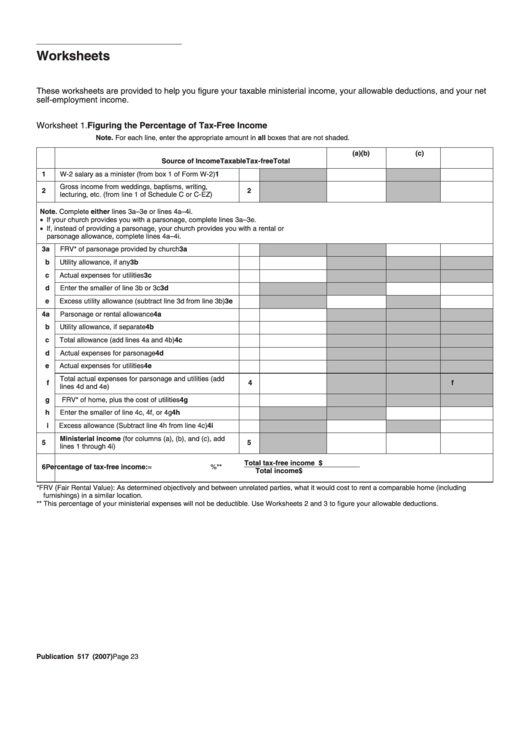

Worksheets

These worksheets are provided to help you figure your taxable ministerial income, your allowable deductions, and your net

self-employment income.

Worksheet 1. Figuring the Percentage of Tax-Free Income

Note. For each line, enter the appropriate amount in all boxes that are not shaded.

(a)

(b)

(c)

Source of Income

Taxable

Tax-free

Total

1

W-2 salary as a minister (from box 1 of Form W-2)

1

Gross income from weddings, baptisms, writing,

2

2

lecturing, etc. (from line 1 of Schedule C or C-EZ)

Note. Complete either lines 3a – 3e or lines 4a – 4i.

• If your church provides you with a parsonage, complete lines 3a – 3e.

• If, instead of providing a parsonage, your church provides you with a rental or

parsonage allowance, complete lines 4a – 4i.

3a

FRV* of parsonage provided by church

3a

b

Utility allowance, if any

3b

c

Actual expenses for utilities

3c

d

Enter the smaller of line 3b or 3c

3d

e

Excess utility allowance (subtract line 3d from line 3b)

3e

4a

Parsonage or rental allowance

4a

b

Utility allowance, if separate

4b

c

Total allowance (add lines 4a and 4b)

4c

d

Actual expenses for parsonage

4d

e

Actual expenses for utilities

4e

Total actual expenses for parsonage and utilities (add

f

4f

lines 4d and 4e)

g

FRV* of home, plus the cost of utilities

4g

h

Enter the smaller of line 4c, 4f, or 4g

4h

i

Excess allowance (Subtract line 4h from line 4c)

4i

Ministerial income (for columns (a), (b), and (c), add

5

5

lines 1 through 4i)

Total tax-free income

$

6

Percentage of tax-free income:

=

%**

Total income

$

* FRV (Fair Rental Value): As determined objectively and between unrelated parties, what it would cost to rent a comparable home (including

furnishings) in a similar location.

** This percentage of your ministerial expenses will not be deductible. Use Worksheets 2 and 3 to figure your allowable deductions.

Publication 517 (2007)

Page 23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3