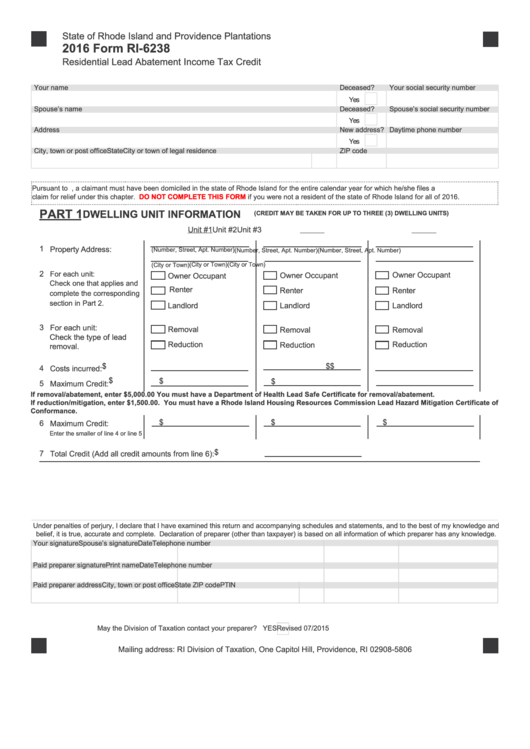

State of Rhode Island and Providence Plantations

2016 Form RI-6238

Residential Lead Abatement Income Tax Credit

Your name

Deceased?

Your social security number

Yes

Spouse’s name

Deceased?

Spouse’s social security number

Yes

Address

New address?

Daytime phone number

Yes

City, town or post office

State

ZIP code

City or town of legal residence

Pursuant to R.I.G.L. 44-30.3-3, a claimant must have been domiciled in the state of Rhode Island for the entire calendar year for which he/she files a

claim for relief under this chapter.

DO NOT COMPLETE THIS FORM

if you were not a resident of the state of Rhode Island for all of 2016.

PART 1

DWELLING UNIT INFORMATION

(CREDIT MAY BE TAKEN FOR UP TO THREE (3) DWELLING UNITS)

Unit #1

Unit #2

Unit #3

1 Property Address:

(Number, Street, Apt. Number)

(Number, Street, Apt. Number)

(Number, Street, Apt. Number)

(City or Town)

(City or Town)

(City or Town)

2

For each unit:

Owner Occupant

Owner Occupant

Owner Occupant

Check one that applies and

Renter

Renter

Renter

complete the corresponding

section in Part 2.

Landlord

Landlord

Landlord

3 For each unit:

Removal

Removal

Removal

Check the type of lead

Reduction

Reduction

Reduction

removal.

$

$

$

4 Costs incurred:

$

$

$

5 Maximum Credit:

If removal/abatement, enter $5,000.00 You must have a Department of Health Lead Safe Certificate for removal/abatement.

If reduction/mitigation, enter $1,500.00. You must have a Rhode Island Housing Resources Commission Lead Hazard Mitigation Certificate of

Conformance.

$

$

$

6 Maximum Credit:

Enter the smaller of line 4 or line 5

$

7 Total Credit (Add all credit amounts from line 6):

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Spouse’s signature

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP code

PTIN

May the Division of Taxation contact your preparer? YES

Revised 07/2015

Mailing address: RI Division of Taxation, One Capitol Hill, Providence, RI 02908-5806

1

1 2

2 3

3