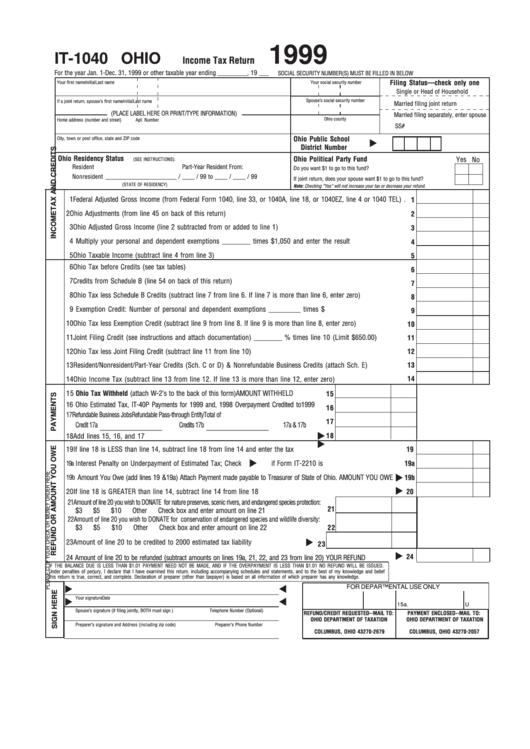

Form It-1040 - Incone Tax Return 1999 - Ohio

ADVERTISEMENT

1999

IT-1040 OHIO

Income Tax Return

For the year Jan. 1-Dec. 31, 1999 or other taxable year ending _________, 19 ___

SOCIAL SECURITY NUMBER(S) MUST BE FILLED IN BELOW

Filing Status—check only one

Your first name

Initial

Last name

Your social security number

n

Single or Head of Household

Spouse’s social security number

If a joint return, spouse’s first name

Initial

Last name

n

Married filing joint return

n

(PLACE LABEL HERE OR PRINT/TYPE INFORMATION)

Married filing separately, enter spouse

Ohio county

Home address (number and street)

Apt. Number

SS#

Ohio Public School

City, town or post office, state and ZIP code

District Number

Ohio Residency Status

Ohio Political Party Fund

Yes No

(SEE INSTRUCTIONS):

n

n

Resident

Part-Year Resident From:

Do you want $1 to go to this fund? .....................................................

n

Nonresident __________________

____ / ____ / 99 to ____ / ____ / 99

If joint return, does your spouse want $1 to go to this fund? ..............

(STATE OF RESIDENCY)

Note: Checking “Yes” will not increase your tax or decrease your refund.

1 Federal Adjusted Gross Income (from Federal Form 1040, line 33, or 1040A, line 18, or 1040EZ, line 4 or 1040 TEL) .

1

2 Ohio Adjustments (from line 45 on back of this return) ..................................................................................................

2

3 Ohio Adjusted Gross Income (line 2 subtracted from or added to line 1) ......................................................................

3

4 Multiply your personal and dependent exemptions ________ times $1,050 and enter the result here .......................

4

5 Ohio Taxable Income (subtract line 4 from line 3) ...........................................................................................................

5

6 Ohio Tax before Credits (see tax tables) ...........................................................................................................................

6

7 Credits from Schedule B (line 54 on back of this return) ................................................................................................

7

8 Ohio Tax less Schedule B Credits (subtract line 7 from line 6. If line 7 is more than line 6, enter zero) ........................

8

9 Exemption Credit: Number of personal and dependent exemptions _________ times $20 .........................................

9

10 Ohio Tax less Exemption Credit (subtract line 9 from line 8. If line 9 is more than line 8, enter zero) ..........................

10

11 Joint Filing Credit (see instructions and attach documentation) ________ % times line 10 (Limit $650.00) ..............

11

12 Ohio Tax less Joint Filing Credit (subtract line 11 from line 10) ......................................................................................

12

13

13 Resident/Nonresident/Part-Year Credits (Sch. C or D) & Nonrefundable Business Credits (attach Sch. E) ....................

14

14 Ohio Income Tax (subtract line 13 from line 12. If line 13 is more than line 12, enter zero) .....................................

15 Ohio Tax Withheld (attach W-2’s to the back of this form) .......... AMOUNT WITHHELD

15

16 Ohio Estimated Tax, IT-40P Payments for 1999 and, 1998 Overpayment Credited to1999 ....

16

17 Refundable Business Jobs

Refundable Pass-through Entity

Total of

17

Credit 17a ______________________

Credits 17b ______________________

17a & 17b ...........

18 Add lines 15, 16, and 17 ............................................................... TOTAL PAYMENTS

18

19 If line 18 is LESS than line 14, subtract line 18 from line 14 and enter the tax due .....................................................

19

n

Interest Penalty on Underpayment of Estimated Tax; Check

if Form IT-2210 is attached .............................

19a

19a

Amount You Owe (add lines 19 &19a) Attach Payment made payable to Treasurer of State of Ohio. AMOUNT YOU OWE

19b

19b

20 If line 18 is GREATER than line 14, subtract line 14 from line 18 ...................................... AMOUNT OVERPAID

20

21 Amount of line 20 you wish to DONATE for nature preserves, scenic rivers, and endangered species protection:

21

n

n

n

n

$3

$5

$10

Other

Check box and enter amount on line 21 ...............................

22 Amount of line 20 you wish to DONATE for conservation of endangered species and wildlife diversity:

n

n

n

n

$3

$5

$10

Other

Check box and enter amount on line 22 ...............................

22

23 Amount of line 20 to be credited to 2000 estimated tax liability................CREDIT

23

24

24 Amount of line 20 to be refunded (subtract amounts on lines 19a, 21, 22, and 23 from line 20) ............... YOUR REFUND

IF THE BALANCE DUE IS LESS THAN $1.01 PAYMENT NEED NOT BE MADE, AND IF THE OVERPAYMENT IS LESS THAN $1.01 NO REFUND WILL BE ISSUED.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief

this return is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

FOR DEPARTMENTAL USE ONLY

Your signature

Date

15a.

U

Spouse’s signature (if filing jointly, BOTH must sign )

Telephone Number (Optional)

REFUND/CREDIT REQUESTED--MAIL TO:

PAYMENT ENCLOSED--MAIL TO:

OHIO DEPARTMENT OF TAXATION

OHIO DEPARTMENT OF TAXATION

Preparer’s signature and Address (including zip code)

Preparer’s Phone Number

P.O. BOX 2679

P.O. BOX 2057

COLUMBUS, OHIO 43270-2679

COLUMBUS, OHIO 43270-2057

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2