Form 72a161 - Monthly Report

ADVERTISEMENT

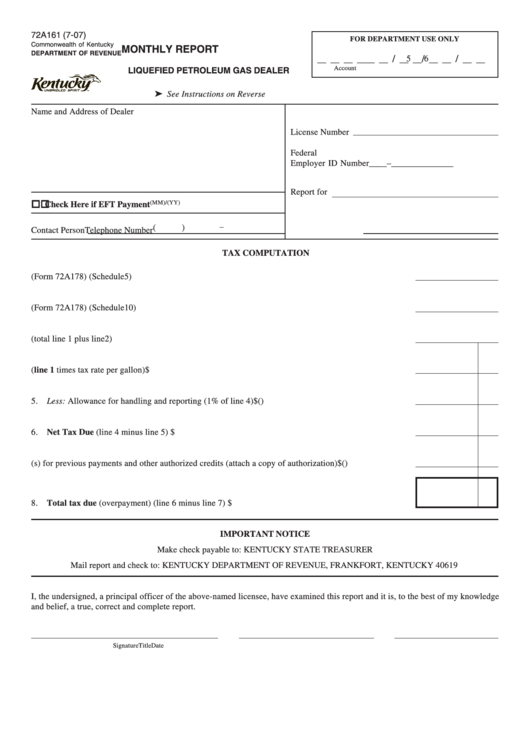

72A161 (7-07)

FOR DEPARTMENT USE ONLY

Commonwealth of Kentucky

MONTHLY REPORT

DEPARTMENT OF REVENUE

/

/

/

5 6

__ __ __ __ __ __

__ __

__ __

__ __

Account Number

Tax

Mo.

Yr.

LIQUEFIED PETROLEUM GAS DEALER

➤ See Instructions on Reverse

Name and Address of Dealer

License Number

Federal

Employer ID Number __ __ – __ __ __ __ __ __ __

Report for

(MM)/(YY)

Check Here if EFT Payment

–

Telephone Number (

)

Contact Person

TAX COMPUTATION

1. Taxable gallons (Form 72A178) (Schedule 5) ..............................................................................................

2. Tax-exempt gallons (Form 72A178) (Schedule 10) .....................................................................................

3. Total gallons of liquefied petroleum gas motor fuel (total line 1 plus line 2) ..............................................

4. Gross tax liability (line 1 times tax rate per gallon) .................................................................................. $

5. Less: Allowance for handling and reporting (1% of line 4) ..................................................................... $ (

)

6. Net Tax Due (line 4 minus line 5) ............................................................................................................ $

7. Credit(s) for previous payments and other authorized credits (attach a copy of authorization) .............. $ (

)

8. Total tax due (overpayment) (line 6 minus line 7) ................................................................................... $

IMPORTANT NOTICE

Make check payable to: KENTUCKY STATE TREASURER

Mail report and check to: KENTUCKY DEPARTMENT OF REVENUE, FRANKFORT, KENTUCKY 40619

I, the undersigned, a principal officer of the above-named licensee, have examined this report and it is, to the best of my knowledge

and belief, a true, correct and complete report.

Signature

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2