Form Dr 0145 - Power Of Attorney

Download a blank fillable Form Dr 0145 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Dr 0145 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

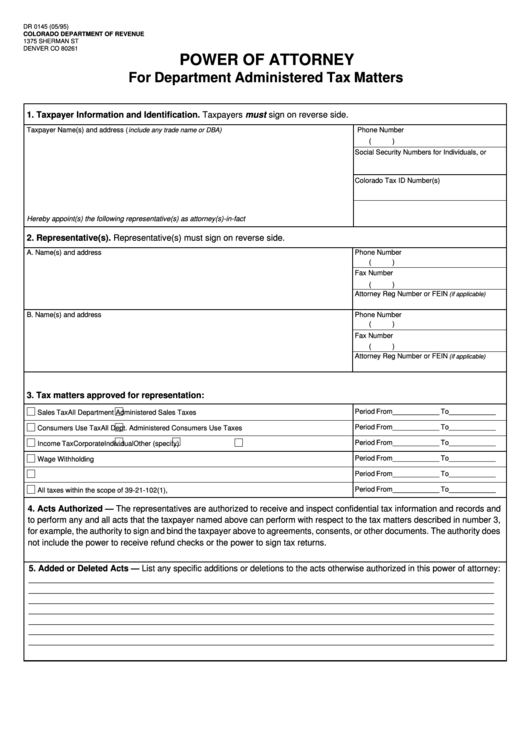

DR 0145 (05/95)

COLORADO DEPARTMENT OF REVENUE

1375 SHERMAN ST

DENVER CO 80261

POWER OF ATTORNEY

For Department Administered Tax Matters

1. Taxpayer Information and Identification. Taxpayers must sign on reverse side.

Taxpayer Name(s) and address

( include any trade name or DBA)

Phone Number

(

)

Social Security Numbers for Individuals, or

Colorado Tax ID Number(s)

Hereby appoint(s) the following representative(s) as attorney(s)-in-fact

2. Representative(s). Representative(s) must sign on reverse side.

Phone Number

A. Name(s) and address

(

)

Fax Number

(

)

Attorney Reg Number or FEIN

(if applicable)

B. Name(s) and address

Phone Number

(

)

Fax Number

(

)

Attorney Reg Number or FEIN

(if applicable)

3. Tax matters approved for representation:

Period From ____________ To ____________

Sales Tax

All Department Administered Sales Taxes

Period From ____________ To ____________

Consumers Use Tax

All Dept. Administered Consumers Use Taxes

Period From ____________ To ____________

Income Tax

Corporate

Individual

Other (specify)

Period From ____________ To ____________

Wage Withholding

Period From ____________ To ____________

Period From ____________ To ____________

All taxes within the scope of 39-21-102(1), C.R.S.

4. Acts Authorized — The representatives are authorized to receive and inspect confidential tax information and records and

to perform any and all acts that the taxpayer named above can perform with respect to the tax matters described in number 3,

for example, the authority to sign and bind the taxpayer above to agreements, consents, or other documents. The authority does

not include the power to receive refund checks or the power to sign tax returns.

5. Added or Deleted Acts — List any specific additions or deletions to the acts otherwise authorized in this power of attorney:

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

__________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2