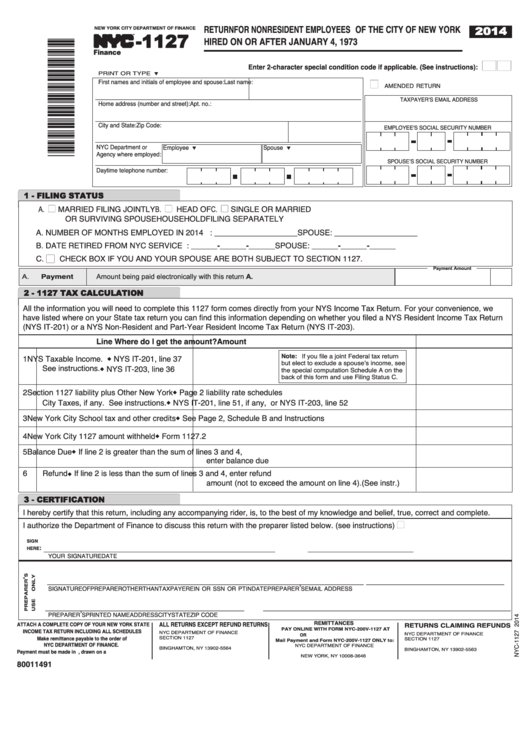

Form Nyc-1127 - Return For Nonresident Employees Of The City Of New York Hired On Or After January 4, 1973 - 2014

ADVERTISEMENT

-1127

RETURN FoR NoNRESIDENT EMPloyEES oF ThE CITy oF NEw yoRk

2014

NEw yoRk CITy DEPARTMENT oF FINANCE

hIRED oN oR AFTER JANUARy 4, 1973

TM

Finance

nn

Enter 2‑character special condition code if applicable. (See instructions):

PRINT OR TYPE

▼

n

First names and initials of employee and spouse:

Last name:

AMENDED RETURN

TAXPAYER’S EMAIL ADDRESS

Home address (number and street):

Apt. no.:

City and State:

Zip Code:

EMPLOYEE'S SOCIAL SECURITY NUMBER

NYC Department or

Employee

Spouse

Agency where employed:

▼

▼

SPOUSE’S SOCIAL SECURITY NUMBER

Daytime telephone number:

1 - FILING STATUS

MARRIED FILING JOINTLY

HEAD OF

SINGLE OR MARRIED

A.

B.

C.

n

n

n

OR SURVIVING SPOUSE

HOUSEHOLD

FILING SEPARATELY

A. NUMBER OF MONTHS EMPLOYED IN 2014 ......

EMPLOYEE: ___________________

SPOUSE: ___________________

B. DATE RETIRED FROM NYC SERVICE ................

EMPLOYEE: ______-______-______

SPOUSE: ______-______-______

C.

CHECK BOX IF YOU AND YOUR SPOUSE ARE BOTH SUBJECT TO SECTION 1127.

n

Payment Amount

Payment

A.

Amount being paid electronically with this return

A

2 - 1127 TAX CALCULATION

All the information you will need to complete this 1127 form comes directly from your NYS Income Tax Return. For your convenience, we

have listed where on your State tax return you can find this information depending on whether you filed a NYS Resident Income Tax Return

(NYS IT-201) or a NYS Non-Resident and Part-Year Resident Income Tax Return (NYS IT-203).

line

where do I get the amount?

Amount

1

NYS Taxable Income.

NYS IT-201, line 37

Note: If you file a joint Federal tax return

but elect to exclude a spouse’s income, see

◆

See instructions.

NYS IT-203, line 36

the special computation Schedule A on the

◆

back of this form and use Filing Status C.

2

Section 1127 liability plus Other New York

Page 2 liability rate schedules

◆

City Taxes, if any. See instructions.

NYS IT-201, line 51, if any, or NYS IT-203, line 52

◆

3

New York City School tax and other credits

See Page 2, Schedule B and Instructions

◆

4

New York City 1127 amount withheld

Form 1127.2

◆

5

Balance Due

If line 2 is greater than the sum of lines 3 and 4,

◆

enter balance due

6

Refund

If line 2 is less than the sum of lines 3 and 4, enter refund

◆

amount (not to exceed the amount on line 4). (See instr.)

3 - CERTIFICATION

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions) ...................................YES

n

SIgN

_________________________________________________________

__________________________

:

hERE

YOUR SIGNATURE

DATE

_________________________________________ _____________________ ________________ __________________________________

’

SIGNATURE OF PREPARER OTHER THAN TAXPAYER

EIN OR SSN OR PTIN

DATE

PREPARER

S EMAIL ADDRESS

_________________________________________________

_____________________________________________________________

’

PREPARER

S PRINTED NAME

ADDRESS

CITY

STATE

ZIP CODE

All RETURNS ExCEPT REFUND RETURNS

REMITTANCES

RETURNS ClAIMINg REFUNDS

ATTACh A CoMPlETE CoPy oF yoUR NEw yoRk STATE

PAy oNlINE wITh FoRM NyC-200V-1127 AT

INCoME TAx RETURN INClUDINg All SChEDUlES

NYC DEPARTMENT OF FINANCE

NyC.goV/ESERVICES

NYC DEPARTMENT OF FINANCE

oR

Make remittance payable to the order of

SECTION 1127

SECTION 1127

Mail Payment and Form NyC-200V-1127 oNly to:

NyC DEPARTMENT oF FINANCE.

P.O. BOX 5564

P.O. BOX 5563

NYC DEPARTMENT OF FINANCE

BINGHAMTON, NY 13902-5564

BINGHAMTON, NY 13902-5563

Payment must be made in U.S. dollars, drawn on a U.S. bank.

P.O. BOX 3646

NEW YORK, NY 10008-3646

80011491

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4