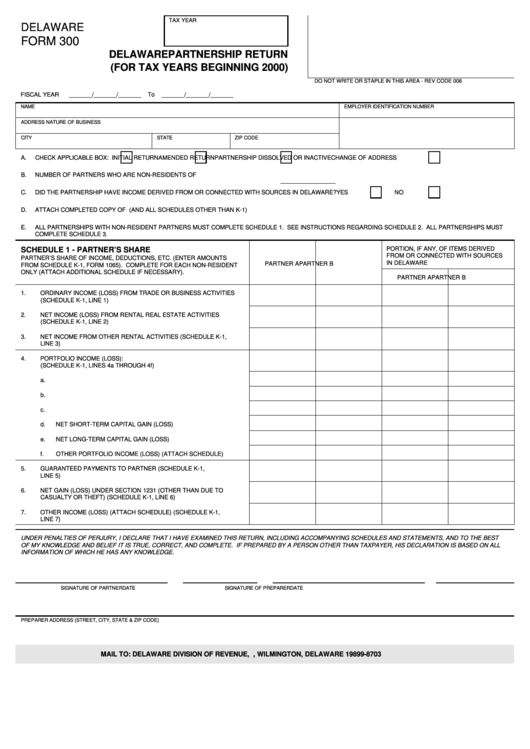

Form 300 - Delaware Partnership Return (For Tax Years Beginning 2000) - 2000

ADVERTISEMENT

TAX YEAR

DELAWARE

FORM 300

DELAWARE PARTNERSHIP RETURN

(FOR TAX YEARS BEGINNING 2000)

DO NOT WRITE OR STAPLE IN THIS AREA - REV CODE 006

FISCAL YEAR

_______/_______/_______

To

_______/_______/_______

NAME

EMPLOYER IDENTIFICATION NUMBER

ADDRESS

NATURE OF BUSINESS

CITY

STATE

ZIP CODE

A.

CHECK APPLICABLE BOX:

INITIAL RETURN

AMENDED RETURN

PARTNERSHIP DISSOLVED OR INACTIVE

CHANGE OF ADDRESS

B.

NUMBER OF PARTNERS WHO ARE NON-RESIDENTS OF DELAWARE......................

C.

DID THE PARTNERSHIP HAVE INCOME DERIVED FROM OR CONNECTED WITH SOURCES IN DELAWARE?

YES

NO

D.

ATTACH COMPLETED COPY OF U.S. PARTNERSHIP RETURN OF INCOME FORM 1065 (AND ALL SCHEDULES OTHER THAN K-1)

E.

ALL PARTNERSHIPS WITH NON-RESIDENT PARTNERS MUST COMPLETE SCHEDULE 1. SEE INSTRUCTIONS REGARDING SCHEDULE 2. ALL PARTNERSHIPS MUST

COMPLETE SCHEDULE 3.

SCHEDULE 1 - PARTNER’S SHARE

PORTION, IF ANY, OF ITEMS DERIVED

FROM OR CONNECTED WITH SOURCES

PARTNER’S SHARE OF INCOME, DEDUCTIONS, ETC. (ENTER AMOUNTS

IN DELAWARE

PARTNER A

PARTNER B

FROM SCHEDULE K-1, FORM 1065). COMPLETE FOR EACH NON-RESIDENT

ONLY (ATTACH ADDITIONAL SCHEDULE IF NECESSARY).

PARTNER A

PARTNER B

1.

ORDINARY INCOME (LOSS) FROM TRADE OR BUSINESS ACTIVITIES

(SCHEDULE K-1, LINE 1)...................................................................................

2.

NET INCOME (LOSS) FROM RENTAL REAL ESTATE ACTIVITIES

(SCHEDULE K-1, LINE 2)..................................................................................

3.

NET INCOME FROM OTHER RENTAL ACTIVITIES (SCHEDULE K-1,

LINE 3)................................................................................................................

4.

PORTFOLIO INCOME (LOSS):

(SCHEDULE K-1, LINES 4a THROUGH 4f).......................................................

a.

INTEREST.................................................................................................

b.

DIVIDENDS................................................................................................

c.

ROYALTIES...............................................................................................

d.

NET SHORT-TERM CAPITAL GAIN (LOSS)............................................

e.

NET LONG-TERM CAPITAL GAIN (LOSS)..............................................

f.

OTHER PORTFOLIO INCOME (LOSS) (ATTACH SCHEDULE).............

5.

GUARANTEED PAYMENTS TO PARTNER (SCHEDULE K-1,

LINE 5)................................................................................................................

6.

NET GAIN (LOSS) UNDER SECTION 1231 (OTHER THAN DUE TO

CASUALTY OR THEFT) (SCHEDULE K-1, LINE 6)..........................................

7.

OTHER INCOME (LOSS) (ATTACH SCHEDULE) (SCHEDULE K-1,

LINE 7)................................................................................................................

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS, AND TO THE BEST

OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER, HIS DECLARATION IS BASED ON ALL

INFORMATION OF WHICH HE HAS ANY KNOWLEDGE.

SIGNATURE OF PARTNER

DATE

SIGNATURE OF PREPARER

DATE

PREPARER ADDRESS (STREET, CITY, STATE & ZIP CODE)

MAIL TO: DELAWARE DIVISION OF REVENUE, P.O. BOX 8703, WILMINGTON, DELAWARE 19899-8703

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2