Instructions For Form 4913

ADVERTISEMENT

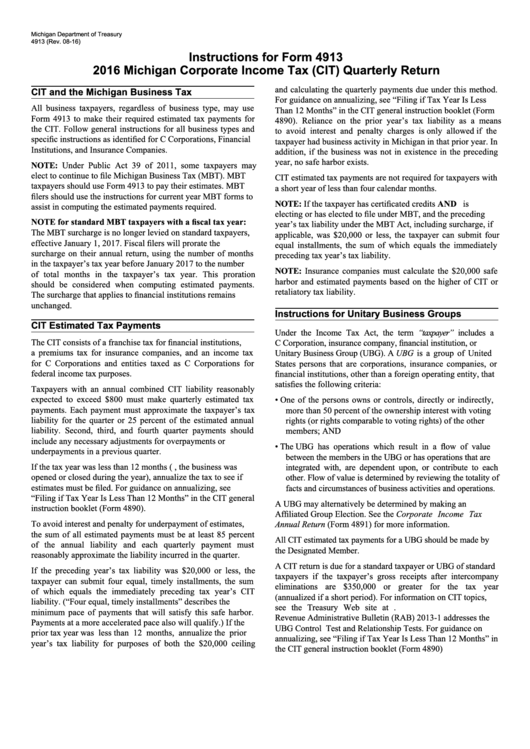

Michigan Department of Treasury

4913 (Rev. 08-16)

Instructions for Form 4913

2016 Michigan Corporate Income Tax (CIT) Quarterly Return

and calculating the quarterly payments due under this method.

CIT and the Michigan Business Tax

For guidance on annualizing, see “Filing if Tax Year Is Less

All business taxpayers, regardless of business type, may use

Than 12 Months” in the CIT general instruction booklet (Form

Form 4913 to make their required estimated tax payments for

4890). Reliance on the prior year’s tax liability as a means

the CIT. Follow general instructions for all business types and

to avoid interest and penalty charges is only allowed if the

specific instructions as identified for C Corporations, Financial

taxpayer had business activity in Michigan in that prior year. In

Institutions, and Insurance Companies.

addition, if the business was not in existence in the preceding

year, no safe harbor exists.

NOTE: Under Public Act 39 of 2011, some taxpayers may

elect to continue to file Michigan Business Tax (MBT). MBT

CIT estimated tax payments are not required for taxpayers with

taxpayers should use Form 4913 to pay their estimates. MBT

a short year of less than four calendar months.

filers should use the instructions for current year MBT forms to

NOTE: If the taxpayer has certificated credits AND is

assist in computing the estimated payments required.

electing or has elected to file under MBT, and the preceding

NOTE for standard MBT taxpayers with a fiscal tax year:

year’s tax liability under the MBT Act, including surcharge, if

The MBT surcharge is no longer levied on standard taxpayers,

applicable, was $20,000 or less, the taxpayer can submit four

effective January 1, 2017. Fiscal filers will prorate the

equal installments, the sum of which equals the immediately

surcharge on their annual return, using the number of months

preceding tax year’s tax liability.

in the taxpayer’s tax year before January 2017 to the number

NOTE: Insurance companies must calculate the $20,000 safe

of total months in the taxpayer’s tax year. This proration

harbor and estimated payments based on the higher of CIT or

should be considered when computing estimated payments.

retaliatory tax liability.

The surcharge that applies to financial institutions remains

unchanged.

Instructions for Unitary Business Groups

CIT Estimated Tax Payments

Under the Income Tax Act, the term “taxpayer” includes a

The CIT consists of a franchise tax for financial institutions,

C Corporation, insurance company, financial institution, or

a premiums tax for insurance companies, and an income tax

Unitary Business Group (UBG). A UBG is a group of United

for C Corporations and entities taxed as C Corporations for

States persons that are corporations, insurance companies, or

federal income tax purposes.

financial institutions, other than a foreign operating entity, that

satisfies the following criteria:

Taxpayers with an annual combined CIT liability reasonably

expected to exceed $800 must make quarterly estimated tax

• One of the persons owns or controls, directly or indirectly,

payments. Each payment must approximate the taxpayer’s tax

more than 50 percent of the ownership interest with voting

liability for the quarter or 25 percent of the estimated annual

rights (or rights comparable to voting rights) of the other

liability. Second, third, and fourth quarter payments should

members; AND

include any necessary adjustments for overpayments or

• The UBG has operations which result in a flow of value

underpayments in a previous quarter.

between the members in the UBG or has operations that are

If the tax year was less than 12 months (e.g., the business was

integrated with, are dependent upon, or contribute to each

opened or closed during the year), annualize the tax to see if

other. Flow of value is determined by reviewing the totality of

estimates must be filed. For guidance on annualizing, see

facts and circumstances of business activities and operations.

“Filing if Tax Year Is Less Than 12 Months” in the CIT general

A UBG may alternatively be determined by making an

instruction booklet (Form 4890).

Affiliated Group Election. See the Corporate Income Tax

To avoid interest and penalty for underpayment of estimates,

Annual Return (Form 4891) for more information.

the sum of all estimated payments must be at least 85 percent

All CIT estimated tax payments for a UBG should be made by

of the annual liability and each quarterly payment must

the Designated Member.

reasonably approximate the liability incurred in the quarter.

A CIT return is due for a standard taxpayer or UBG of standard

If the preceding year’s tax liability was $20,000 or less, the

taxpayers if the taxpayer’s gross receipts after intercompany

taxpayer can submit four equal, timely installments, the sum

eliminations are $350,000 or greater for the tax year

of which equals the immediately preceding tax year’s CIT

(annualized if a short period). For information on CIT topics,

liability. (“Four equal, timely installments” describes the

see the Treasury Web site at

minimum pace of payments that will satisfy this safe harbor.

Revenue Administrative Bulletin (RAB) 2013-1 addresses the

Payments at a more accelerated pace also will qualify.) If the

UBG Control Test and Relationship Tests. For guidance on

prior tax year was less than 12 months, annualize the prior

annualizing, see “Filing if Tax Year Is Less Than 12 Months” in

year’s tax liability for purposes of both the $20,000 ceiling

the CIT general instruction booklet (Form 4890)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4