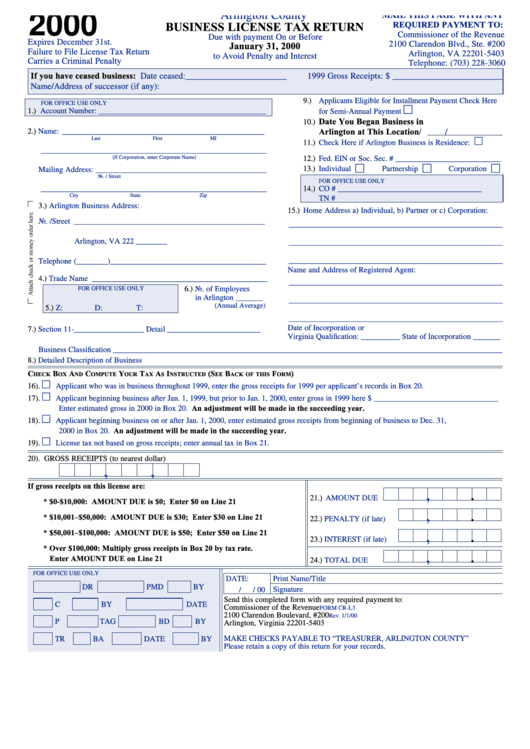

Form Cr-L3 - Business License Tax Return

ADVERTISEMENT

Arlington County

MAIL THIS PAGE WITH ANY

2000

BUSINESS LICENSE TAX RETURN

REQUIRED PAYMENT TO:

Commissioner of the Revenue

Due with payment On or Before

Expires December 31st.

January 31, 2000

2100 Clarendon Blvd., Ste. #200

Failure to File License Tax Return

Arlington, VA 22201-5403

to Avoid Penalty and Interest

Carries a Criminal Penalty

Telephone: (703) 228-3060

If you have ceased business:

Date ceased: _______________________

1999 Gross Receipts: $ _________________________

Name/Address of successor (if any):

9.)

Applicants Eligible for Installment Payment Check Here

FOR OFFICE USE ONLY

1.)

Account Number: ___________________________________________

□

for Semi-Annual Payment

Date You Began Business in

10.)

Arlington at This Location

2.)

Name: ____________________________________________________

/

/

Last

First

MI

□

11.)

Check Here if Arlington Business is Residence:

__________________________________________________________

(If Corporation, enter Corporate Name)

12.)

Fed. EIN or Soc. Sec. # ___________________________

13.)

Individual

Partnership

Corporation

Mailing Address: ____________________________________________

□

□

□

No. / Street

FOR OFFICE USE ONLY

__________________________________________________________

14.)

CO # _____________________________________

City

State

Zip

TN #

3.)

Arlington Business Address:

15.)

Home Address a) Individual, b) Partner or c) Corporation:

No. /Street _________________________________________________

_______________________________________________________

Arlington, VA 222 ________

_______________________________________________________

_______________________________________________________

Telephone (________) ________________________________________

Name and Address of Registered Agent:

4.)

Trade Name _____________________________________________

_______________________________________________________

6.)

No. of Employees

FOR OFFICE USE ONLY

in Arlington _______

_______________________________________________________

(Annual Average)

5.)

Z:

D:

T:

_______________________________________________________

Date of Incorporation or

7.)

Section 11- __________________ Detail ________________________

Virginia Qualification: __________ State of Incorporation _______

Business Classification ____________________________________________________________________________________________________

8.)

Detailed Description of Business

C

B

A

C

Y

T

A

I

(S

B

F

)

HECK

OX

ND

OMPUTE

OUR

AX

S

NSTRUCTED

EE

ACK OF THIS

ORM

□

16).

Applicant who was in business throughout 1999, enter the gross receipts for 1999 per applicant’s records in Box 20.

□

17).

Applicant beginning business after Jan. 1, 1999, but prior to Jan. 1, 2000, enter gross in 1999 here $ ________________________________

An adjustment will be made in the succeeding year.

Enter estimated gross in 2000 in Box 20.

□

18).

Applicant beginning business on or after Jan. 1, 2000, enter estimated gross receipts from beginning of business to Dec. 31,

An adjustment will be made in the succeeding year.

2000 in Box 20.

□

19).

License tax not based on gross receipts; enter annual tax in Box 21.

20). GROSS RECEIPTS (to nearest dollar)

,

,

If gross receipts on this license are:

.

,

21.)

AMOUNT DUE

* $0-$10,000: AMOUNT DUE is $0; Enter $0 on Line 21

.

,

* $10,001–$50,000: AMOUNT DUE is $30; Enter $30 on Line 21

22.)

PENALTY (if late)

* $50,001–$100,000: AMOUNT DUE is $50; Enter $50 on Line 21

.

,

23.)

INTEREST (if late)

* Over $100,000: Multiply gross receipts in Box 20 by tax rate.

.

,

Enter AMOUNT DUE on Line 21

24.)

TOTAL DUE

FOR OFFICE USE ONLY

DATE:

Print Name/Title

DR

PMD

BY

Signature

/

/ 00

Send this completed form with any required payment to:

C

BY

DATE

Commissioner of the Revenue

FORM CR-L3

2100 Clarendon Boulevard, #200

Rev. 1/1/00

P

TAG

BD

BY

Arlington, Virginia 22201-5403

MAKE CHECKS PAYABLE TO “TREASURER, ARLINGTON COUNTY”

TR

BA

DATE

BY

Please retain a copy of this return for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2