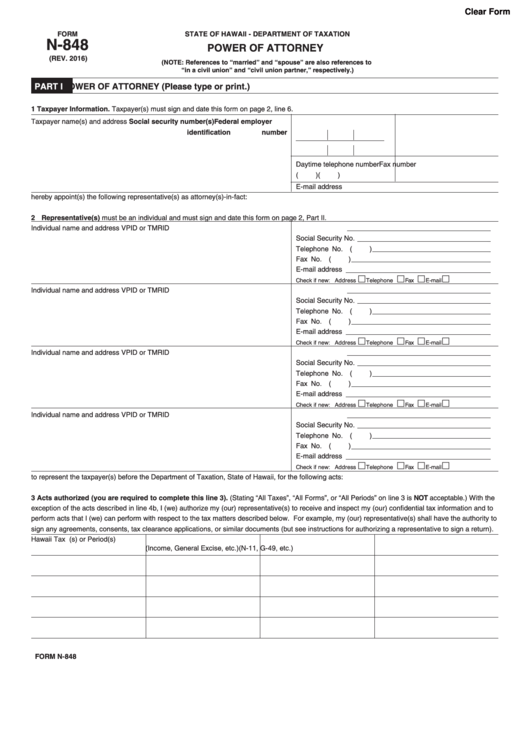

Clear Form

FORM

STATE OF HAWAII - DEPARTMENT OF TAXATION

N-848

POWER OF ATTORNEY

(REV. 2016)

(NOTE: References to “married” and “spouse” are also references to

“in a civil union” and “civil union partner,” respectively.)

PART I

POWER OF ATTORNEY (Please type or print.)

1 Taxpayer Information. Taxpayer(s) must sign and date this form on page 2, line 6.

Social security number(s)

Federal employer

Taxpayer name(s) and address

identification number

Daytime telephone number

Fax number

(

)

(

)

E-mail address

hereby appoint(s) the following representative(s) as attorney(s)-in-fact:

2 Representative(s) must be an individual and must sign and date this form on page 2, Part II.

Individual name and address

VPID or TMRID

Social Security No.

Telephone No. (

)

Fax No. (

)

E-mail address

Check if new: Address

Telephone

Fax

E-mail

Individual name and address

VPID or TMRID

Social Security No.

Telephone No. (

)

Fax No. (

)

E-mail address

Check if new: Address

Telephone

Fax

E-mail

Individual name and address

VPID or TMRID

Social Security No.

Telephone No. (

)

Fax No. (

)

E-mail address

Check if new: Address

Telephone

Fax

E-mail

Individual name and address

VPID or TMRID

Social Security No.

Telephone No. (

)

Fax No. (

)

E-mail address

Check if new: Address

Telephone

Fax

E-mail

to represent the taxpayer(s) before the Department of Taxation, State of Hawaii, for the following acts:

3 Acts authorized (you are required to complete this line 3). (Stating “All Taxes”, “All Forms”, or “All Periods” on line 3 is NOT acceptable.) With the

exception of the acts described in line 4b, I (we) authorize my (our) representative(s) to receive and inspect my (our) confidential tax information and to

perform acts that I (we) can perform with respect to the tax matters described below. For example, my (our) representative(s) shall have the authority to

sign any agreements, consents, tax clearance applications, or similar documents (but see instructions for authorizing a representative to sign a return).

Hawaii Tax I.D. Number

Type of Tax

Tax Form Number

Year(s) or Period(s)

(Income, General Excise, etc.)

(N-11, G-49, etc.)

FORM N-848

1

1 2

2