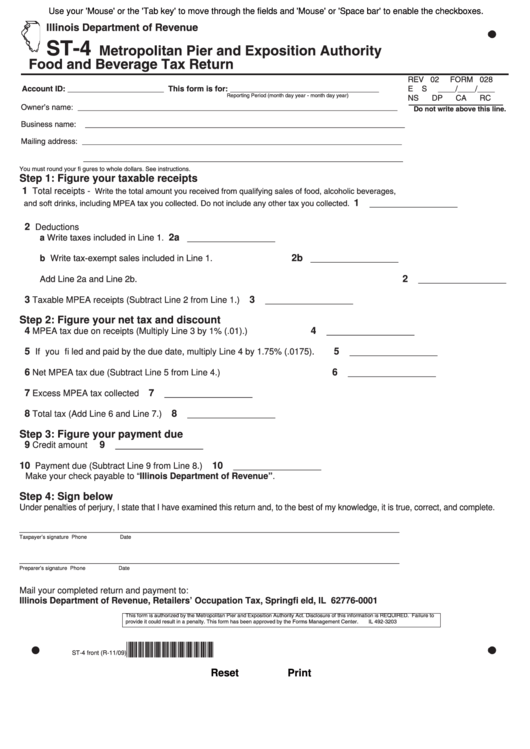

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

ST-4

Metropolitan Pier and Exposition Authority

Food and Beverage Tax Return

REV 02

FORM 028

Account ID: ______________________ This form is for: __________________________________

E

S

____/____/____

Reporting Period (month day year - month day year)

NS

DP

CA

RC

Owner’s name:

_________________________________________________________________________

Do not write above this line.

Business name: _________________________________________________________________________

Mailing address: _________________________________________________________________________

_________________________________________________________________________

You must round your fi gures to whole dollars. See instructions.

Step 1: Figure your taxable receipts

1

Total receipts -

Write the total amount you received from qualifying sales of food, alcoholic beverages,

1

__________________

and soft drinks, including MPEA tax you collected. Do not include any other tax you collected.

2

Deductions

2a

a Write taxes included in Line 1.

__________________

2b

b Write tax-exempt sales included in Line 1.

__________________

2

Add Line 2a and Line 2b.

__________________

3

3

Taxable MPEA receipts (Subtract Line 2 from Line 1.)

__________________

Step 2: Figure your net tax and discount

4

4

MPEA tax due on receipts (Multiply Line 3 by 1% (.01).)

__________________

5

5

If you fi led and paid by the due date, multiply Line 4 by 1.75% (.0175).

__________________

6

6

Net MPEA tax due (Subtract Line 5 from Line 4.)

__________________

7

7

Excess MPEA tax collected

__________________

8

8

Total tax (Add Line 6 and Line 7.)

__________________

Step 3: Figure your payment due

9

9

Credit amount

__________________

10

10

Payment due (Subtract Line 9 from Line 8.)

__________________

Make your check payable to “Illinois Department of Revenue”.

Step 4: Sign below

Under penalties of perjury, I state that I have examined this return and, to the best of my knowledge, it is true, correct, and complete.

______________________________________________________________________________

Taxpayer’s signature

Phone

Date

______________________________________________________________________________

Preparer’s signature

Phone

Date

Mail your completed return and payment to:

Illinois Department of Revenue, Retailers’ Occupation Tax, Springfi eld, IL 62776-0001

This form is authorized by the Metropolitan Pier and Exposition Authority Act. Disclosure of this information is REQUIRED. Failure to

provide it could result in a penalty. This form has been approved by the Forms Management Center.

IL 492-3203

*902821110*

ST-4 front (R-11/09)

Reset

Print

1

1