Form Lgl-001 - Power Of Attorney

Download a blank fillable Form Lgl-001 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Lgl-001 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

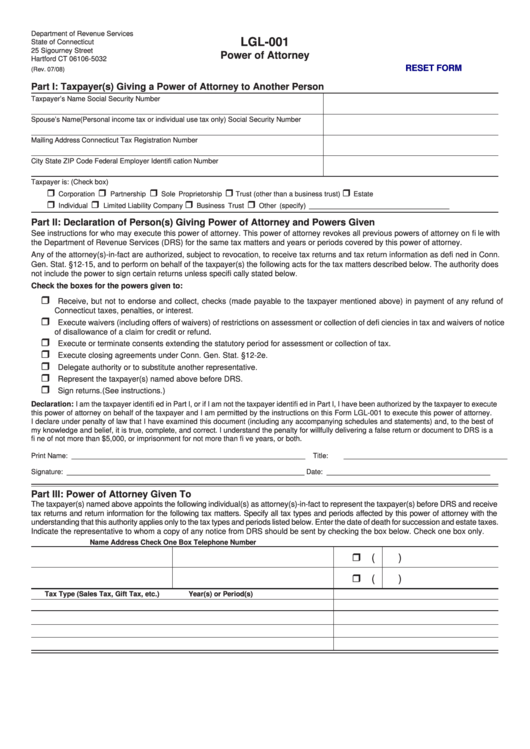

Department of Revenue Services

LGL-001

State of Connecticut

25 Sigourney Street

Power of Attorney

Hartford CT 06106-5032

RESET FORM

(Rev. 07/08)

Part I: Taxpayer(s) Giving a Power of Attorney to Another Person

Taxpayer’s Name

Social Security Number

Spouse’s Name (Personal income tax or individual use tax only)

Social Security Number

Mailing Address

Connecticut Tax Registration Number

City

State

ZIP Code

Federal Employer Identifi cation Number

Taxpayer is: (Check box)

Corporation

Partnership

Sole Proprietorship

Trust (other than a business trust)

Estate

Individual

Limited Liability Company

Business Trust

Other (specify) ____________________________________

Part II: Declaration of Person(s) Giving Power of Attorney and Powers Given

See instructions for who may execute this power of attorney. This power of attorney revokes all previous powers of attorney on fi le with

the Department of Revenue Services (DRS) for the same tax matters and years or periods covered by this power of attorney.

Any of the attorney(s)-in-fact are authorized, subject to revocation, to receive tax returns and tax return information as defi ned in Conn.

Gen. Stat. §12-15, and to perform on behalf of the taxpayer(s) the following acts for the tax matters described below. The authority does

not include the power to sign certain returns unless specifi cally stated below.

Check the boxes for the powers given to:

Receive, but not to endorse and collect, checks (made payable to the taxpayer mentioned above) in payment of any refund of

Connecticut taxes, penalties, or interest.

Execute waivers (including offers of waivers) of restrictions on assessment or collection of defi ciencies in tax and waivers of notice

of disallowance of a claim for credit or refund.

Execute or terminate consents extending the statutory period for assessment or collection of tax.

Execute closing agreements under Conn. Gen. Stat. §12-2e.

Delegate authority or to substitute another representative.

Represent the taxpayer(s) named above before DRS.

Sign returns. (See instructions.)

Declaration: I am the taxpayer identifi ed in Part I, or if I am not the taxpayer identifi ed in Part I, I have been authorized by the taxpayer to execute

this power of attorney on behalf of the taxpayer and I am permitted by the instructions on this Form LGL-001 to execute this power of attorney.

I declare under penalty of law that I have examined this document (including any accompanying schedules and statements) and, to the best of

my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a

fi ne of not more than $5,000, or imprisonment for not more than fi ve years, or both.

Print Name: ____________________________________________________________

Title: __________________________________________

Signature: _____________________________________________________________

Date: __________________________________________

Part III: Power of Attorney Given To

The taxpayer(s) named above appoints the following individual(s) as attorney(s)-in-fact to represent the taxpayer(s) before DRS and receive

tax returns and return information for the following tax matters. Specify all tax types and periods affected by this power of attorney with the

understanding that this authority applies only to the tax types and periods listed below. Enter the date of death for succession and estate taxes.

Indicate the representative to whom a copy of any notice from DRS should be sent by checking the box below. Check one box only.

Name

Address

Check One Box

Telephone Number

(

)

(

)

Tax Type (Sales Tax, Gift Tax, etc.)

Year(s) or Period(s)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1