Form Ri-1040v - Rhode Island Payment Voucher

ADVERTISEMENT

2001

RI-1040V

Rhode Island Payment Voucher

What Is Form RI-1040V and Do You Need To Use It?

How To Prepare Your Payment?

It is a statement you send with your payment of any balance

Make your check or money order payable to the "R.I.

due on line 19 of your Form RI-1040 or Form RI-1040NR.

Division of Taxation." Do not send cash.

Using Form RI-1040V allows us to process your payment more

accurately and efficiently. We strongly encourage you to use

Make sure your name and address appears on your check or

Form RI-1040V, but there is no penalty if you do not do so.

money order.

Write "Form RI-1040V," your daytime phone number and

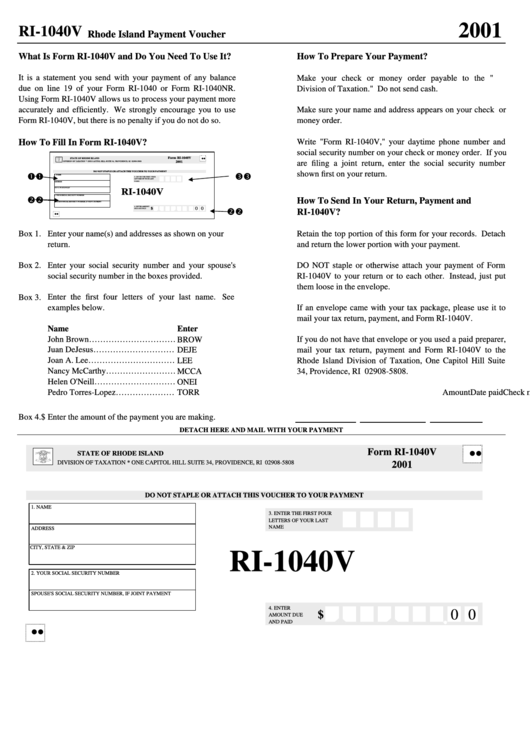

How To Fill In Form RI-1040V?

social security number on your check or money order. If you

Form RI-1040V

l l

STATE OF RHODE ISLAND

are filing a joint return, enter the social security number

DIVISION OF TAXATION * ONE CAPITOL HILL SUITE 34, PROVIDENCE, RI 02908-5808

2001

shown first on your return.

DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT

Œ Œ

Ž Ž

1. NAME

3. ENTER THE FIRST FOUR

LETTERS OF YOUR LAST

NAME

ADDRESS

CITY, STATE & ZIP

RI-1040V

• •

2. YOUR SOCIAL SECURITY NUMBER

How To Send In Your Return, Payment and

SPOUSE'S SOCIAL SECURITY NUMBER, IF JOINT PAYMENT

4. ENTER AMOUNT

0 0

$

• •

DUE AND PAID

RI-1040V?

l l

Box 1.

Enter your name(s) and addresses as shown on your

Retain the top portion of this form for your records. Detach

return.

and return the lower portion with your payment.

Enter your social security number and your spouse's

DO NOT staple or otherwise attach your payment of Form

Box 2.

social security number in the boxes provided.

RI-1040V to your return or to each other. Instead, just put

them loose in the envelope.

Box 3.

Enter the first four letters of your last name. See

examples below.

If an envelope came with your tax package, please use it to

mail your tax return, payment, and Form RI-1040V.

Name

Enter

If you do not have that envelope or you used a paid preparer,

John Brown……………………………………….

BROW

Juan DeJesus………………………………………

DEJE

mail your tax return, payment and Form RI-1040V to the

Rhode Island Division of Taxation, One Capitol Hill Suite

Joan A. Lee………………………………………

LEE

Nancy McCarthy………………………………

MCCA

34, Providence, RI 02908-5808.

Helen O'Neill…………………………………….

ONEI

Pedro Torres-Lopez…………………………

TORR

Date paid

Check number

Amount

Box 4.

Enter the amount of the payment you are making.

$

DETACH HERE AND MAIL WITH YOUR PAYMENT

Form RI-1040V

l l

STATE OF RHODE ISLAND

DIVISION OF TAXATION * ONE CAPITOL HILL SUITE 34, PROVIDENCE, RI 02908-5808

2001

DO NOT STAPLE OR ATTACH THIS VOUCHER TO YOUR PAYMENT

1. NAME

3. ENTER THE FIRST FOUR

LETTERS OF YOUR LAST

NAME

ADDRESS

CITY, STATE & ZIP

RI-1040V

2. YOUR SOCIAL SECURITY NUMBER

SPOUSE'S SOCIAL SECURITY NUMBER, IF JOINT PAYMENT

4. ENTER

0 0

$

AMOUNT DUE

AND PAID

l l

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1