Form Ss-6058 - Summary Of Financial Activities Of An Exempt Charitable Organization

ADVERTISEMENT

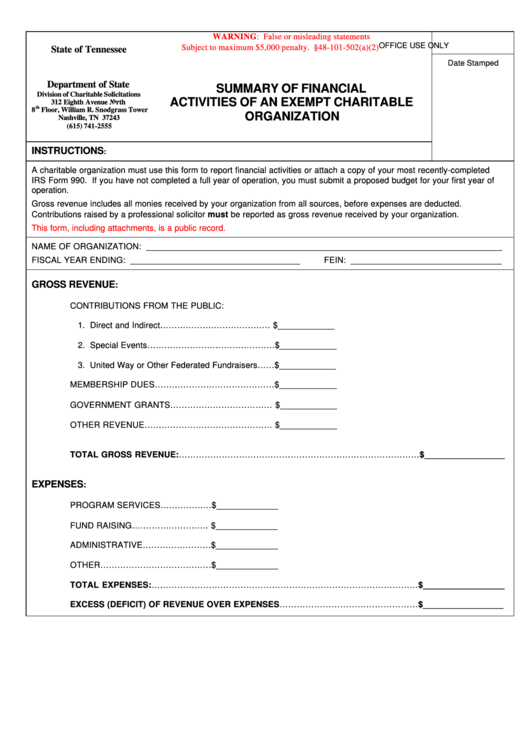

WARNING: False or misleading statements

OFFICE USE ONLY

Subject to maximum $5,000 penalty. T.C.A. §48-101-502(a)(2)

State of Tennessee

Date Stamped

Department of State

SUMMARY OF FINANCIAL

Division of Charitable Solicitations

ACTIVITIES OF AN EXEMPT CHARITABLE

312 Eighth Avenue North

th

8

Floor, William R. Snodgrass Tower

ORGANIZATION

Nashville, TN 37243

(615) 741-2555

INSTRUCTIONS

:

A charitable organization must use this form to report financial activities or attach a copy of your most recently-completed

IRS Form 990. If you have not completed a full year of operation, you must submit a proposed budget for your first year of

operation.

Gross revenue includes all monies received by your organization from all sources, before expenses are deducted.

Contributions raised by a professional solicitor must be reported as gross revenue received by your organization.

This form, including attachments, is a public record.

NAME OF ORGANIZATION: ___________________________________________________________________________

FISCAL YEAR ENDING: ____________________________________

FEIN: ________________________________

GROSS REVENUE

:

CONTRIBUTIONS FROM THE PUBLIC:

1. Direct and Indirect………………………………… $____________

2. Special Events………………………………………$____________

3. United Way or Other Federated Fundraisers……$____________

MEMBERSHIP DUES……………………………………$____________

GOVERNMENT GRANTS……………………………… $____________

OTHER REVENUE……………………………………… $____________

TOTAL GROSS REVENUE:………………………………………………………………………… $_________________

EXPENSES

:

PROGRAM SERVICES………………$_____________

FUND RAISING……………………… $_____________

ADMINISTRATIVE……………………$_____________

OTHER…………………………………$_____________

TOTAL EXPENSES:…………………………………………………………………………………$_________________

EXCESS (DEFICIT) OF REVENUE OVER EXPENSES…………………………………………$_________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2