Form 51a600 - Application For Kentucky Disaster Relief Sales And Use Tax Refund 2012

ADVERTISEMENT

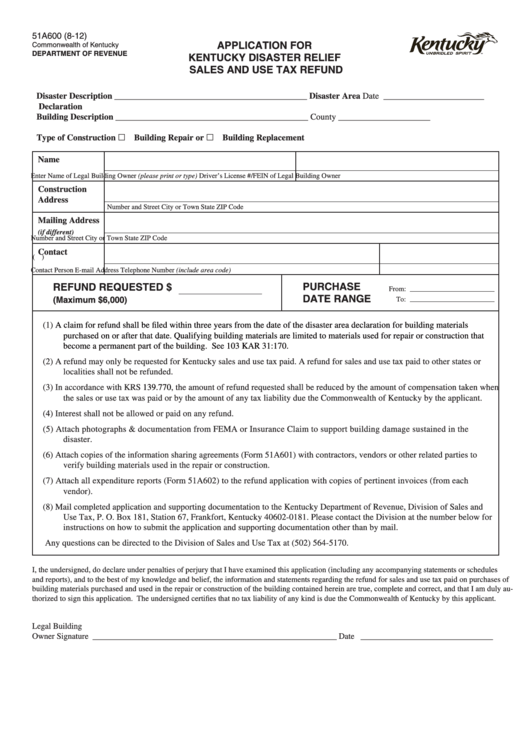

51A600 (8-12)

APPLICATION FOR

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

KENTUCKY DISASTER RELIEF

SALES AND USE TAX REFUND

Disaster Description ____________________________________________

Disaster Area

Date _______________________

Declaration

Building Description ____________________________________________

County _____________________

Type of Construction £ Building Repair or £ Building Replacement

Name

Enter Name of Legal Building Owner (please print or type)

Driver’s License #/FEIN of Legal Building Owner

Construction

Address

Number and Street

City or Town

State

ZIP Code

Mailing Address

(if different)

Number and Street

City or Town

State

ZIP Code

Contact

(

)

Contact Person

E-mail Address

Telephone Number (include area code)

PURCHASE

REFUND REQUESTED $

From:

DATE RANGE

(Maximum $6,000)

To:

(1)

A claim for refund shall be filed within three years from the date of the disaster area declaration for building materials

purchased on or after that date. Qualifying building materials are limited to materials used for repair or construction that

become a permanent part of the building. See 103 KAR 31:170.

(2)

A refund may only be requested for Kentucky sales and use tax paid. A refund for sales and use tax paid to other states or

localities shall not be refunded.

(3)

In accordance with KRS 139.770, the amount of refund requested shall be reduced by the amount of compensation taken when

the sales or use tax was paid or by the amount of any tax liability due the Commonwealth of Kentucky by the applicant.

(4)

Interest shall not be allowed or paid on any refund.

(5)

Attach photographs & documentation from FEMA or Insurance Claim to support building damage sustained in the

disaster.

(6)

Attach copies of the information sharing agreements (Form 51A601) with contractors, vendors or other related parties to

verify building materials used in the repair or construction.

(7)

Attach all expenditure reports (Form 51A602) to the refund application with copies of pertinent invoices (from each

vendor).

(8)

Mail completed application and supporting documentation to the Kentucky Department of Revenue, Division of Sales and

Use Tax, P. O. Box 181, Station 67, Frankfort, Kentucky 40602-0181. Please contact the Division at the number below for

instructions on how to submit the application and supporting documentation other than by mail.

Any questions can be directed to the Division of Sales and Use Tax at (502) 564-5170.

I, the undersigned, do declare under penalties of perjury that I have examined this application (including any accompanying statements or schedules

and reports), and to the best of my knowledge and belief, the information and statements regarding the refund for sales and use tax paid on purchases of

building materials purchased and used in the repair or construction of the building contained herein are true, complete and correct, and that I am duly au-

thorized to sign this application. The undersigned certifies that no tax liability of any kind is due the Commonwealth of Kentucky by this applicant.

Legal Building

Owner Signature ___________________________________________________________

Date ________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1