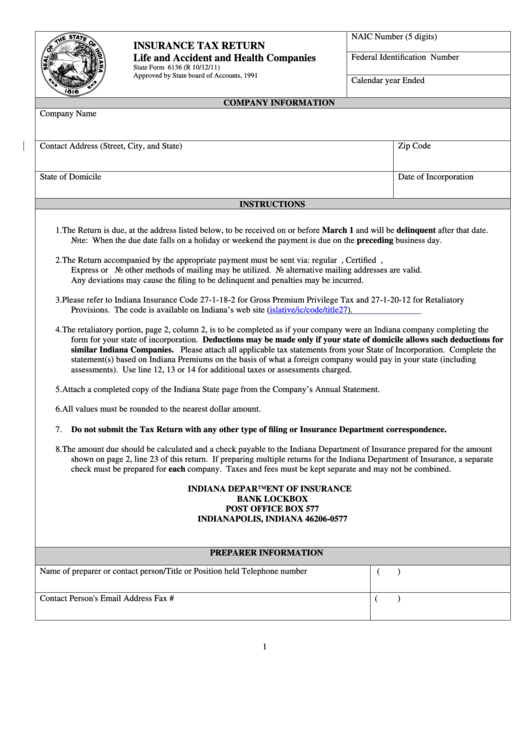

NAIC Number (5 digits)

INSURANCE TAX RETURN

Life and Accident and Health Companies

Federal Identification Number

State Form 6136 (R 10/12/11)

Approved by State board of Accounts, 1991

Calendar year Ended

COMPANY INFORMATION

Company Name

Contact Address (Street, City, and State)

Zip Code

State of Domicile

Date of Incorporation

INSTRUCTIONS

1. The Return is due, at the address listed below, to be received on or before March 1 and will be delinquent after that date.

Note: When the due date falls on a holiday or weekend the payment is due on the preceding business day.

2. The Return accompanied by the appropriate payment must be sent via: regular U.S. Mail, Certified U.S. Mail, U.S. Postal

Express or U.S. Priority Mail. No other methods of mailing may be utilized. No alternative mailing addresses are valid.

Any deviations may cause the filing to be delinquent and penalties may be incurred.

3. Please refer to Indiana Insurance Code 27-1-18-2 for Gross Premium Privilege Tax and 27-1-20-12 for Retaliatory

Provisions. The code is available on Indiana’s web site ( ).

4. The retaliatory portion, page 2, column 2, is to be completed as if your company were an Indiana company completing the

form for your state of incorporation. Deductions may be made only if your state of domicile allows such deductions for

similar Indiana Companies. Please attach all applicable tax statements from your State of Incorporation. Complete the

statement(s) based on Indiana Premiums on the basis of what a foreign company would pay in your state (including

assessments). Use line 12, 13 or 14 for additional taxes or assessments charged.

5. Attach a completed copy of the Indiana State page from the Company’s Annual Statement.

6. All values must be rounded to the nearest dollar amount.

7. Do not submit the Tax Return with any other type of filing or Insurance Department correspondence.

8. The amount due should be calculated and a check payable to the Indiana Department of Insurance prepared for the amount

shown on page 2, line 23 of this return. If preparing multiple returns for the Indiana Department of Insurance, a separate

check must be prepared for each company. Taxes and fees must be kept separate and may not be combined.

INDIANA DEPARTMENT OF INSURANCE

BANK LOCKBOX

POST OFFICE BOX 577

INDIANAPOLIS, INDIANA 46206-0577

PREPARER INFORMATION

Name of preparer or contact person/Title or Position held

Telephone number

(

)

Contact Person's Email Address

Fax #

(

)

1

1

1 2

2 3

3 4

4 5

5