2

FinCEN Form 103 (03-1 1)

Page

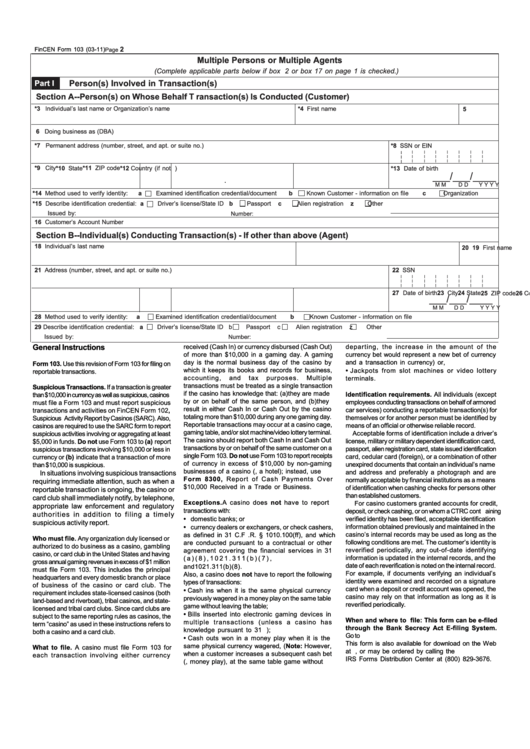

Multiple Persons or Multiple Agents

(Complete applicable parts below if box 2 or box 17 on page 1 is checked.)

Person(s) Involved in Transaction(s)

Part I

Section A--Person(s) on Whose Behalf T ransaction(s) Is Conducted (Customer)

*3 Individual’s last name or Organization’s name

*4 First name

5 M.I.

6 Doing business as (DBA)

*7 Permanent address (number, street, and apt. or suite no.)

*8 SSN or EIN

*9 City

*10 State *11 ZIP code

*12 Country (if not U.S.)

*13 Date of birth

___/___/____

M M

D D

Y Y Y Y

*14 Method used to verify identity:

a

Examined identification credential/document

b

Known Customer - information on file

c

Organization

*15 Describe identification credential: a

Driver’s license/State ID

b

Passport

c

Alien registration

z

Other

Issued by:

Number:

16 Customer’s Account Number

Section B--Individual(s) Conducting Transaction(s) - If other than above (Agent)

18 Individual’s last name

19 First name

20 M.I.

21 Address (number, street, and apt. or suite no.)

22 SSN

23 City

24 State

25 ZIP code

26 Country (if not U.S.)

27 Date of birth

___/___/____

M M

D D

Y Y Y Y

28 Method used to verify identity:

a

Examined identification credential/document

b

Known Customer - information on file

29 Describe identification credential:

a

Driver’s license/State ID b

Passport

c

Alien registration

z

Other

Issued by:

Number:

General Instructions

received (Cash In) or currency disbursed (Cash Out)

departing, the increase in the amount of the

of more than $10,000 in a gaming day. A gaming

currency bet would represent a new bet of currency

day is the normal business day of the casino by

and a transaction in currency) or ,

Form 103. Use this revision of Form 103 for filing on

which it keeps its books and records for business,

Jackpots from slot machines or video lottery

reportable transactions.

•

accounting, and tax purposes. Multiple

terminals.

transactions must be treated as a single transaction

Suspicious Transactions. If a transaction is greater

if the casino has knowledge that: (a) they are made

Identification requirements. All individuals (except

than $10,000 in currency as well as suspicious, casinos

by or on behalf of the same person, and (b) they

employees conducting transactions on behalf of armored

must file a Form 103 and must report suspicious

result in either Cash In or Cash Out by the casino

transactions and activities on FinCEN Form 102 ,

car services) conducting a reportable transaction(s) for

totaling more than $10,000 during any one gaming day .

Suspicious Activity Report by Casinos (SARC). Also,

themselves or for another person must be identified by

Reportable transactions may occur at a casino cage,

means of an official or otherwise reliable record.

casinos are required to use the SARC form to report

gaming table, and/or slot machine/video lottery terminal.

Acceptable forms of identification include a driver’s

suspicious activities involving or aggregating at least

The casino should report both Cash In and Cash Out

license, military or military dependent identification card,

$5,000 in funds. Do not use Form 103 to (a) report

transactions by or on behalf of the same customer on a

passport, alien registration card, state issued identification

suspicious transactions involving $10,000 or less in

single Form 103. Do not use Form 103 to report receipts

card, cedular card (foreign), or a combination of other

currency or (b) indicate that a transaction of more

of currency in excess of $10,000 by non-gaming

unexpired documents that contain an individual’s name

than $10,000 is suspicious.

businesses of a casino ( e.g., a hotel); instead, use

In situations involving suspicious transactions

and address and preferably a photograph and are

Form 8300, Report of Cash Payments Over

normally acceptable by financial institutions as a means

requiring immediate attention, such as when a

$10,000 Received in a Trade or Business.

of identification when cashing checks for persons other

reportable transaction is ongoing, the casino or

than established customers.

card club shall immediately notify , by telephone,

Exceptions. A casino does not have to report

For casino customers granted accounts for credit,

appropriate law enforcement and regulatory

transactions with:

deposit, or check cashing, or on whom a CTRC cont aining

authorities in addition to filing a timely

domestic banks; or

verified identity has been filed, acceptable identification

•

suspicious activity report.

currency dealers or exchangers, or check cashers,

information obtained previously and maintained in the

•

casino’s internal records may be used as long as the

as defined in 31 C.F .R. § 1010.100(f f), and which

Who must file. Any organization duly licensed or

following conditions are met. The customer’s identity is

are conducted pursuant to a contractual or other

authorized to do business as a casino, gambling

reverified periodically, any out-of-date identifying

agreement covering the financial services in 31

casino, or card club in the United States and having

information is updated in the internal records, and the

C . F. R . 1 0 2 1 . 3 1 1 ( a ) ( 8 ) , 1 0 2 1 . 3 1 1 ( b ) ( 7 ) ,

gross annual gaming revenues in excess of $1 million

date of each reverification is noted on the internal record.

and1021.311(b)(8).

must file Form 103. This includes the principal

For example, if documents verifying an individual’s

Also, a casino does not have to report the following

headquarters and every domestic branch or place

identity were examined and recorded on a signature

types of transactions:

of business of the casino or card club. The

card when a deposit or credit account was opened, the

Cash ins when it is the same physical currency

•

requirement includes state-licensed casinos (both

casino may rely on that information as long as it is

previously wagered in a money play on the same table

land-based and riverboat), tribal casinos, and state-

reverified periodically.

game without leaving the table;

licensed and tribal card clubs. Since card clubs are

Bills inserted into electronic gaming devices in

•

subject to the same reporting rules as casinos, the

When and where to file: This form can be e-filed

multiple transactions (unless a casino has

term “casino” as used in these instructions refers to

through the Bank Secrecy Act E-filing System.

knowledge pursuant to 31 C.F .R. 1021.313);

both a casino and a card club.

Go to to register .

Cash outs won in a money play when it is the

•

This form is also available for download on the Web

same physical currency wagered, ( Note: However,

What to file. A casino must file Form 103 for

at , or may be ordered by calling the

when a customer increases a subsequent cash bet

each transaction involving either currency

IRS Forms Distribution Center at (800) 829-3676.

(i.e., money play), at the same table game without

1

1 2

2 3

3