Denver Sales/use Tax Return Form - Colorado Department Of Revenue

ADVERTISEMENT

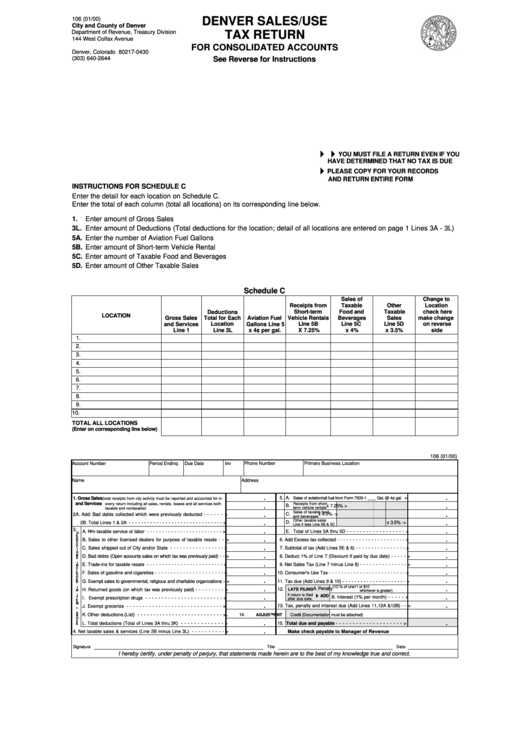

106 (01/00)

DENVER SALES/USE

City and County of Denver

TAX RETURN

Department of Revenue, Treasury Division

144 West Colfax Avenue

P.O. Box 17430

FOR CONSOLIDATED ACCOUNTS

Denver, Colorado 80217-0430

See Reverse for Instructions

(303) 640-2644

4 4

YOU MUST FILE A RETURN EVEN IF YOU

HAVE DETERMINED THAT NO TAX IS DUE

4

PLEASE COPY FOR YOUR RECORDS

AND RETURN ENTIRE FORM

INSTRUCTIONS FOR SCHEDULE C

Enter the detail for each location on Schedule C.

Enter the total of each column (total all locations) on its corresponding line below.

1.

Enter amount of Gross Sales

3L. Enter amount of Deductions (Total deductions for the location; detail of all locations are entered on page 1 Lines 3A - 3L)

5A. Enter the number of Aviation Fuel Gallons

5B. Enter amount of Short-term Vehicle Rental

5C. Enter amount of Taxable Food and Beverages

5D. Enter amount of Other Taxable Sales

Schedule C

Sales of

Change to

Receipts from

Taxable

Other

Location

Deductions

Short-term

Food and

Taxable

check here

LOCATION

Gross Sales

Total for Each

Aviation Fuel

Vehicle Rentals

Beverages

Sales

make change

and Services

Location

Gallons Line 5

Line 5B

Line 5C

Line 5D

on reverse

Line 1

Line 3L

x 4¢ per gal.

X 7.25%

x 4%

x 3.5%

side

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

TOTAL ALL LOCATIONS

(Enter on corresponding line below)

106 (01/00)

Phone Number

Primary Business Location

Account Number

Period Ending

Due Date

Inv

Name

Address

.

5. A.

>

.

1. Gross Sales

Sales of aviation/rail fuel from Form 7505-1 ____ Gal. @ 4¢ gal.

(total receipts from city activity must be reported and accounted for in

and Services

every return including all sales, rentals, leases and all services both

Receipts from short-

.

B.

x 7.25% >

.

term vehicle rentals

taxable and nontaxable)

Sales of taxable food

C.

x 4.0% ->

2A. Add: Bad debts collected which were previously deducted - - - - - - >

.

.

and beverages

Other taxable sales

D.

x 3.5% ->

2B. Total Lines 1 & 2A - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

.

Line 4 less Line 5B & 5C

3.

.

.

A. Non-taxable service or labor - - - - - - - - - - - - - - - - - - - - - - - - - >

E. Total of Lines 5A thru 5D - - - - - - - - - - - - - - - - - - >

D

E

D

.

.

B. Sales to other licensed dealers for purpose of taxable resale - - >

6. Add Excess tax collected - - - - - - - - - - - - - - - - - - - - - - >

U

C

T

.

.

C. Sales shipped out of City and/or State - - - - - - - - - - - - - - - - - >

7. Subtotal of tax (Add Lines 5E & 6) - - - - - - - - - - - - - - - - >

I

O

N

.

.

D. Bad debts (Open accounts sales on which tax was previously paid) - - >

8. Deduct 1% of Line 7 (Discount if paid by due date) - - - - - >

S

I

.

.

E. Trade-ins for taxable resale - - - - - - - - - - - - - - - - - - - - - - - - - >

9. Net Sales Tax (Line 7 minus Line 8) - - - - - - - - - - - - - - - >

N

C

L

.

.

F. Sales of gasoline and cigarettes - - - - - - - - - - - - - - - - - - - - - - >

10. Consumer's Use Tax - - - - - - - - - - - - - - - - - - - - - - - - - >

U

D

E

.

.

G. Exempt sales to governmental, religious and charitable organizations - >

11. Tax due (Add Lines 9 & 10) - - - - - - - - - - - - - - - - - - - - - >

D

(1O % of Line11 or $10

I

A. Penalty

.

12.

.

H. Returned goods (on which tax was previously paid) - - - - - - - - - >

LATE FILING

N

whichever is greater)

4

I

If return is filed

ADD

.

B. Interest (1% per month) - - - - - >

.

I. Exempt prescription drugs - - - - - - - - - - - - - - - - - - - - - - - - >

T

after due date,

E

M

.

13. Tax, penalty and interest due (Add Lines 11,12A &12B) - - >

.

J. Exempt groceries - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

1

A

.

K. Other deductions.(List) - - - - - - - - - - - - - - - - - - - - - - - - - - - >

14.

ADJUSTMENT

Credit (Documentation must be attached)

B

O

V

.

.

L. Total deductions (Total of Lines 3A thru 3K) - - - - - - - - - - - - - >

15. Total due and payable - - - - - - - - - - - - - - - - - - - - >

E

.

4. Net taxable sales & services (Line 2B minus Line 3L) - - - - - - - - - - >

Make check payable to Manager of Revenue

Signature

Title

Date

I hereby certify, under penalty of perjury, that statements made herein are to the best of my knowledge true and correct.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2