Form F-7004 - Corporate Income Tax, Form F-1120 - Change Of Address Or Business Name, Form F-1120es - Declaration/installment Of Florida Estimated Income/franchise And/or Emergency Excise Tax

ADVERTISEMENT

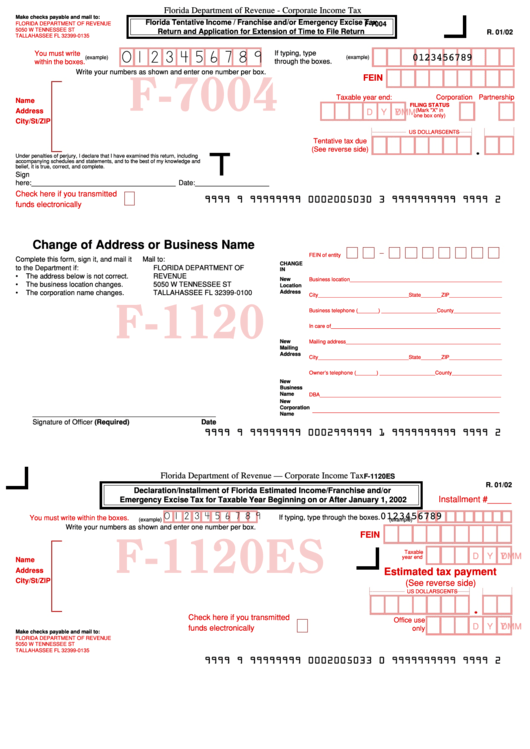

Florida Department of Revenue - Corporate Income Tax

Make checks payable and mail to:

Florida Tentative Income / Franchise and/or Emergency Excise Tax

F-7004

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

Return and Application for Extension of Time to File Return

R. 01/02

TALLAHASSEE FL 32399-0135

If typing, type

You must write

0 1 2 3 4 5 6 7 8 9

0123456789

(example)

(example)

through the boxes.

within the boxes.

Write your numbers as shown and enter one number per box.

F-7004

FEIN

Taxable year end:

Corporation Partnership

Name

FILING STATUS

Address

(Mark "X" in

M

M

D

D Y

Y

one box only)

City/St/ZIP

US DOLLARS

CENTS

Tentative tax due

(See reverse side)

Under penalties of perjury, I declare that I have examined this return, including

accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, correct, and complete.

Sign

here: _____________________________________ Date: ___________________

Check here if you transmitted

9999090999999990000200503003099999999990999902

funds electronically

Change of Address or Business Name

FEIN of entity

Complete this form, sign it, and mail it

Mail to:

CHANGE

to the Department if:

FLORIDA DEPARTMENT OF

IN

•

The address below is not correct.

REVENUE

New

Business location____________________________________________________

•

The business location changes.

5050 W TENNESSEE ST

Location

•

The corporation name changes.

TALLAHASSEE FL 32399-0100

Address

City_______________________________State_______ZIP__________________

F-1120

Business telephone (_______) ___________________County________________

In care of__________________________________________________________

New

Mailing address_____________________________________________________

Mailing

Address

City_______________________________State_______ZIP__________________

Owner’s telephone (_______) ___________________County_________________

New

Business

Name

DBA______________________________________________________________

New

Corporation

________________________________________________________________

_______________________________________________

Name

Signature of Officer (Required)

Date

9999090999999990000299999901099999999990999902

Florida Department of Revenue — Corporate Income Tax

F-1120ES

R. 01/02

Declaration/Installment of Florida Estimated Income/Franchise and/or

Installment #_____

Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2002

0123456789

0 1 2 3 4 5 6 7 8 9

If typing, type through the boxes.

You must write within the boxes.

(example)

(example)

Write your numbers as shown and enter one number per box.

FEIN

F-1120ES

Taxable

Y

M

M

D

D Y

year end

Name

Address

Estimated tax payment

City/St/ZIP

(See reverse side)

US DOLLARS

CENTS

Check here if you transmitted

Office use

Y

M

M

D

D Y

funds electronically

only

Make checks payable and mail to:

FLORIDA DEPARTMENT OF REVENUE

5050 W TENNESSEE ST

TALLAHASSEE FL 32399-0135

9999090999999990000200503300099999999990999902

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1