Form Dr-1con - Application Form For Consolidated Sales And Use Tax Filing Number - 1999

ADVERTISEMENT

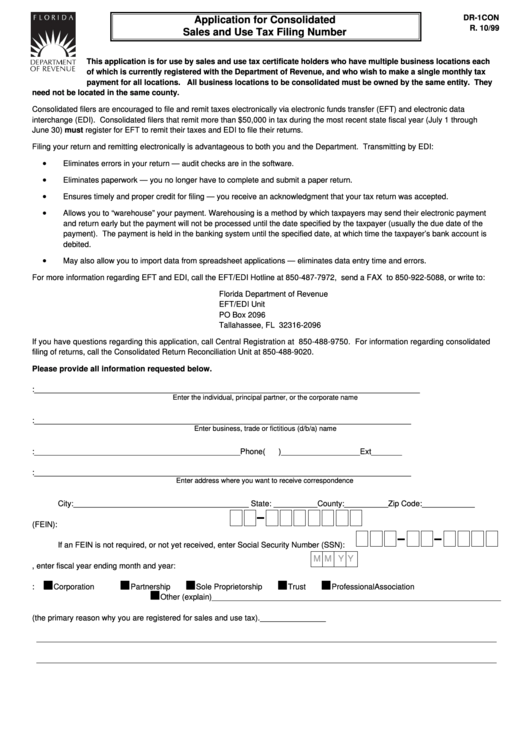

DR-1CON

Application for Consolidated

R. 10/99

Sales and Use Tax Filing Number

This application is for use by sales and use tax certificate holders who have multiple business locations each

of which is currently registered with the Department of Revenue, and who wish to make a single monthly tax

payment for all locations. All business locations to be consolidated must be owned by the same entity. They

need not be located in the same county.

Consolidated filers are encouraged to file and remit taxes electronically via electronic funds transfer (EFT) and electronic data

interchange (EDI). Consolidated filers that remit more than $50,000 in tax during the most recent state fiscal year (July 1 through

June 30) must register for EFT to remit their taxes and EDI to file their returns.

Filing your return and remitting electronically is advantageous to both you and the Department. Transmitting by EDI:

•

Eliminates errors in your return — audit checks are in the software.

•

Eliminates paperwork — you no longer have to complete and submit a paper return.

•

Ensures timely and proper credit for filing — you receive an acknowledgment that your tax return was accepted.

•

Allows you to “warehouse” your payment. Warehousing is a method by which taxpayers may send their electronic payment

and return early but the payment will not be processed until the date specified by the taxpayer (usually the due date of the

payment). The payment is held in the banking system until the specified date, at which time the taxpayer’s bank account is

debited.

•

May also allow you to import data from spreadsheet applications — eliminates data entry time and errors.

For more information regarding EFT and EDI, call the EFT/EDI Hotline at 850-487-7972, send a FAX to 850-922-5088, or write to:

Florida Department of Revenue

EFT/EDI Unit

PO Box 2096

Tallahassee, FL 32316-2096

If you have questions regarding this application, call Central Registration at 850-488-9750. For information regarding consolidated

filing of returns, call the Consolidated Return Reconciliation Unit at 850-488-9020.

Please provide all information requested below.

1.

Owner Name: ________________________________________________________________________________________

Enter the individual, principal partner, or the corporate name

2.

Business Name: ______________________________________________________________________________________

Enter business, trade or fictitious (d/b/a) name

3.

Contact Person: _______________________________________________ Phone(

) __________________ Ext _______

4.

Mailing Address: ______________________________________________________________________________________

Enter address where you want to receive correspondence

City: ________________________________________ State: __________ County: __________ Zip Code: ____________

5.

Federal Employer Identification Number (FEIN):

If an FEIN is not required, or not yet received, enter Social Security Number (SSN):

M M Y Y

6.

If a corporation or partnership, enter fiscal year ending month and year:

7.

Type of Organization:

Corporation

Partnership

Sole Proprietorship

Trust

Professional Association

Other (explain) __________________________________________________________________

8.

Describe your major business activities (the primary reason why you are registered for sales and use tax). _______________

_________________________________________________________________________________________________________

_________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1