Form Sp-2009 Draft - Combined Tax Return For Individuals

ADVERTISEMENT

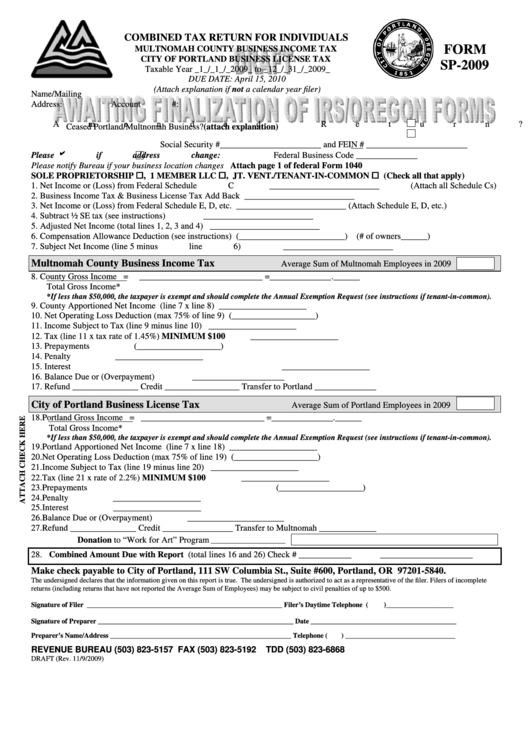

COMBINED TAX RETURN FOR INDIVIDUALS

FORM

MULTNOMAH COUNTY BUSINESS INCOME TAX

CITY OF PORTLAND BUSINESS LICENSE TAX

SP-2009

Taxable Year _1_/_1_/_2009_ to _12_/_31_/_2009_

DUE DATE: April 15, 2010

(Attach explanation if not a calendar year filer)

Name/Mailing

Address:

Account #:

Amended Return?

Ceased Portland/Multnomah Business?

(attach explanation)

Social Security #_______________________ and FEIN # _______________________

b

Please

if address change:

Federal Business Code ______________

Please notify Bureau if your business location changes

Attach page 1 of federal Form 1040

SOLE PROPRIETORSHIP

, 1 MEMBER LLC

, JT. VENT./TENANT-IN-COMMON

(Check all that apply)

1. Net Income or (Loss) from Federal Schedule C

_________________________ (Attach all Schedule Cs)

2. Business Income Tax & Business License Tax Add Back

_________________________

3. Net Income or (Loss) from Federal Schedule E, D, etc.

_________________________ (Attach Schedule E, D, etc.)

4. Subtract ½ SE tax (see instructions)

_________________________

5. Adjusted Net Income (total lines 1, 2, 3 and 4)

_________________________

6. Compensation Allowance Deduction (see instructions)

(________________________)

(# of owners______)

7. Subject Net Income (line 5 minus line 6)

_________________________

Multnomah County Business Income Tax

Average Sum of Multnomah Employees in 2009

8. County Gross Income =

____________________________ =______________.______

Total Gross Income*

*If less than $50,000, the taxpayer is exempt and should complete the Annual Exemption Request (see instructions if tenant-in-common).

9. County Apportioned Net Income (line 7 x line 8)

____________________

10. Net Operating Loss Deduction (max 75% of line 9)

(___________________)

11. Income Subject to Tax (line 9 minus line 10)

____________________

12. Tax (line 11 x tax rate of 1.45%) MINIMUM $100

____________________

13. Prepayments

(___________________)

14. Penalty

____________________

15. Interest

____________________

16. Balance Due or (Overpayment)

_____________________

17. Refund _______________ Credit _________________ Transfer to Portland ______________

City of Portland Business License Tax

Average Sum of Portland Employees in 2009

18. Portland Gross Income = ____________________________ =______________.______

Total Gross Income*

*If less than $50,000, the taxpayer is exempt and should complete the Annual Exemption Request (see instructions if tenant-in-common).

19. Portland Apportioned Net Income (line 7 x line 18)

____________________

20. Net Operating Loss Deduction (max 75% of line 19)

(___________________)

21. Income Subject to Tax (line 19 minus line 20)

____________________

22. Tax (line 21 x rate of 2.2%) MINIMUM $100

____________________

23. Prepayments

(___________________)

24. Penalty

____________________

25. Interest

____________________

26. Balance Due or (Overpayment)

______________________

27. Refund _______________ Credit ________________ Transfer to Multnomah _____________

Donation to “Work for Art” Program

_____________________

28. Combined Amount Due with Report (total lines 16 and 26) Check # ____________

_____________________

Make check payable to City of Portland, 111 SW Columbia St., Suite #600, Portland, OR 97201-5840.

The undersigned declares that the information given on this report is true. The undersigned is authorized to act as a representative of the filer. Filers of incomplete

returns (including returns that have not reported the Average Sum of Employees) may be subject to civil penalties of up to $500.

Signature of Filer _______________________________________________________ Filer’s Daytime Telephone (

)___________________

Signature of Preparer _______________________________________________________ Date _________________________________________

Preparer’s Name/Address ___________________________________________________ Telephone (

) _______________________________

REVENUE BUREAU (503) 823-5157

FAX (503) 823-5192

TDD (503) 823-6868

DRAFT (Rev. 11/9/2009)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2