Form Ct-1096 - Connecticut Annual Summary And Transmittal Of Information Returns - 2015

ADVERTISEMENT

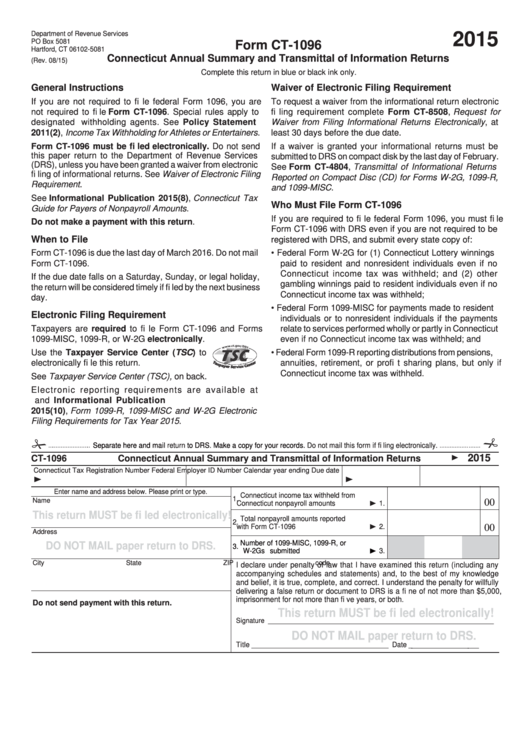

Department of Revenue Services

2015

PO Box 5081

Form CT-1096

Hartford, CT 06102-5081

Connecticut Annual Summary and Transmittal of Information Returns

(Rev. 08/15)

Complete this return in blue or black ink only.

General Instructions

Waiver of Electronic Filing Requirement

If you are not required to fi le federal Form 1096, you are

To request a waiver from the informational return electronic

not required to fi le Form CT-1096. Special rules apply to

fi ling requirement complete Form CT-8508, Request for

designated withholding agents. See Policy Statement

Waiver from Filing Informational Returns Electronically, at

2011(2), Income Tax Withholding for Athletes or Entertainers.

least 30 days before the due date.

Form CT-1096 must be fi led electronically. Do not send

If a waiver is granted your informational returns must be

this paper return to the Department of Revenue Services

submitted to DRS on compact disk by the last day of February.

(DRS), unless you have been granted a waiver from electronic

See Form CT-4804, Transmittal of Informational Returns

fi ling of informational returns. See Waiver of Electronic Filing

Reported on Compact Disc (CD) for Forms W-2G, 1099-R,

Requirement.

and 1099-MISC.

See Informational Publication 2015(8), Connecticut Tax

Who Must File Form CT-1096

Guide for Payers of Nonpayroll Amounts.

If you are required to fi le federal Form 1096, you must fi le

Do not make a payment with this return.

Form CT-1096 with DRS even if you are not required to be

When to File

registered with DRS, and submit every state copy of:

Form CT-1096 is due the last day of March 2016. Do not mail

• Federal Form W-2G for (1) Connecticut Lottery winnings

Form CT-1096.

paid to resident and nonresident individuals even if no

Connecticut income tax was withheld; and (2) other

If the due date falls on a Saturday, Sunday, or legal holiday,

gambling winnings paid to resident individuals even if no

the return will be considered timely if fi led by the next business

Connecticut income tax was withheld;

day.

• Federal Form 1099-MISC for payments made to resident

Electronic Filing Requirement

individuals or to nonresident individuals if the payments

Taxpayers are required to fi le Form CT-1096 and Forms

relate to services performed wholly or partly in Connecticut

1099-MISC, 1099-R, or W-2G electronically.

even if no Connecticut income tax was withheld; and

Use the Taxpayer Service Center (TSC) to

• Federal Form 1099-R reporting distributions from pensions,

electronically fi le this return.

annuities, retirement, or profi t sharing plans, but only if

Connecticut income tax was withheld.

See Taxpayer Service Center (TSC), on back.

Electronic reporting requirements are available at

and Informational Publication

2015(10), Form 1099-R, 1099-MISC and W-2G Electronic

Filing Requirements for Tax Year 2015.

Separate here and mail

return

to DRS. Make a copy for your records.

Do not mail this form if fi ling electronically.

2015

CT-1096

Connecticut Annual Summary and Transmittal of Information Returns

Connecticut Tax Registration Number

Federal Employer ID Number

Calendar year ending

Due date

Enter name and address below. Please print or type.

1. Connecticut income tax withheld from

Name

00

Connecticut nonpayroll amounts

1.

This return MUST be fi led electronically!

2. Total nonpayroll amounts reported

with Form CT-1096

2.

00

Address

3. Number of 1099-MISC, 1099-R, or

DO NOT MAIL paper return to DRS.

W-2Gs submitted

3.

City

State

ZIP code

I declare under penalty of law that I have examined this return (including any

accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand the penalty for willfully

delivering a false return or document to DRS is a fi ne of not more than $5,000,

imprisonment for not more than fi ve years, or both.

Do not send payment with this return.

This return MUST be fi led electronically!

Signature _____________________________________________________________

DO NOT MAIL paper return to DRS.

Title

Date

_____________________________________

____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2