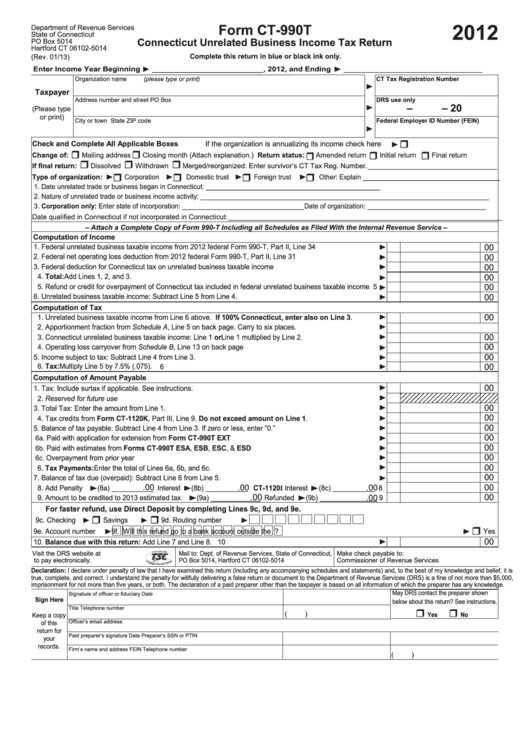

Form Ct-990t - Connecticut Unrelated Business Income Tax Return - 2012

ADVERTISEMENT

2012

Form CT-990T

Department of Revenue Services

State of Connecticut

Connecticut Unrelated Business Income Tax Return

PO Box 5014

Hartford CT 06102-5014

Complete this return in blue or black ink only.

(Rev. 01/13)

Enter Income Year Beginning

__________________________ , 2012, and Ending

_____________________________

Organization name

(please type or print)

CT Tax Registration Number

Taxpayer

Address

number and street

PO Box

DRS use only

–

– 20

(Please type

or print)

Federal Employer ID Number (FEIN)

City or town

State

ZIP code

Check and Complete All Applicable Boxes

If the organization is annualizing its income check here

Change of:

Mailing address

Closing month (Attach explanation.) Return status:

Amended return

Initial return

Final return

If final return:

Dissolved

Withdrawn

Merged/reorganized: Enter survivor’s CT Tax Reg. Number. ___________________________________

Type of organization:

Corporation

Domestic trust

Foreign trust

Other: Explain _____________________________________

1. Date unrelated trade or business began in Connecticut: _______________________________________________

2. Nature of unrelated trade or business income activity: ______________________________________________________________________________

3. Corporation only: Enter state of incorporation: _________________________________ Date of organization: ________________________________

Date qualified in Connecticut if not incorporated in Connecticut: __________________________________________________________________________

– Attach a Complete Copy of Form 990-T Including all Schedules as Filed With the Internal Revenue Service –

Computation of Income

1. Federal unrelated business taxable income from 2012 federal Form 990-T, Part II, Line 34 .........................

1

00

2. Federal net operating loss deduction from 2012 federal Form 990-T, Part II, Line 31 ...................................

2

00

3. Federal deduction for Connecticut tax on unrelated business taxable income ..............................................

3

00

4. Total: Add Lines 1, 2, and 3. ..........................................................................................................................

4

00

5. Refund or credit for overpayment of Connecticut tax included in federal unrelated business taxable income

5

00

6. Unrelated business taxable income: Subtract Line 5 from Line 4. .................................................................

6

00

Computation of Tax

00

1. Unrelated business taxable income from Line 6 above. If 100% Connecticut, enter also on Line 3. ........

1

2. Apportionment fraction from Schedule A, Line 5 on back page. Carry to six places. .....................................

2

0.

00

3. Connecticut unrelated business taxable income: Line 1 or Line 1 multiplied by Line 2. ................................

3

00

4. Operating loss carryover from Schedule B, Line 13 on back page ................................................................

4

00

5. Income subject to tax: Subtract Line 4 from Line 3. .......................................................................................

5

6. Tax: Multiply Line 5 by 7.5% (.075). ...............................................................................................................

00

6

Computation of Amount Payable

00

1. Tax: Include surtax if applicable. See instructions. .........................................................................................

1

2. Reserved for future use ..................................................................................................................................

2

00

3. Total Tax: Enter the amount from Line 1. ........................................................................................................

3

00

4. Tax credits from Form CT-1120K, Part III, Line 9. Do not exceed amount on Line 1. ................................

4

00

5. Balance of tax payable: Subtract Line 4 from Line 3. If zero or less, enter “0.” ..............................................

5

00

Paid with application for extension from Form CT-990T EXT

6a.

............................................................................

6a

00

Paid with estimates from Forms CT-990T ESA, ESB, ESC, & ESD

6b.

.................................................................

6b

00

Overpayment from prior year

6c.

.................................................................................................................................

6c

00

6. Tax Payments: Enter the total of Lines 6a, 6b, and 6c. .................................................................................

6

00

7. Balance of tax due (overpaid): Subtract Line 6 from Line 5. ..........................................................................

7

.

00

.

.

00

00

00

8. Add Penalty

(8a) ___________ Interest

(8b) ___________ CT-1120I Interest

(8c) ___________

8

.00

.

00

00

9. Amount to be credited to 2013 estimated tax

(9a) _____________ Refunded

(9b) _______________

9

For faster refund, use Direct Deposit by completing Lines 9c, 9d, and 9e.

9c. Checking

Savings

9d. Routing number

9e. Account number

9f. Will this refund go to a bank account outside the U.S.?

Yes

00

10. Balance due with this return: Add Line 7 and Line 8.

10

Visit the DRS website at

Mail to: Dept. of Revenue Services, State of Connecticut,

Make check payable to:

to pay electronically.

PO Box 5014, Hartford CT 06102-5014

Commissioner of Revenue Services

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is

true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000,

imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

May DRS contact the preparer shown

Signature of officer or fiduciary

Date

Sign Here

below about this return? See instructions.

Title

Telephone number

(

)

Yes

No

Keep a copy

Officer’s email address

of this

return for

Paid preparer’s signature

Date

Preparer’s SSN or PTIN

your

records.

Firm’s name and address

FEIN

Telephone number

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2