Form Au-736a - Motor Vehicle Fuels Tax Refund Claim Gasoline -Motor Bus/taxicab 2002

ADVERTISEMENT

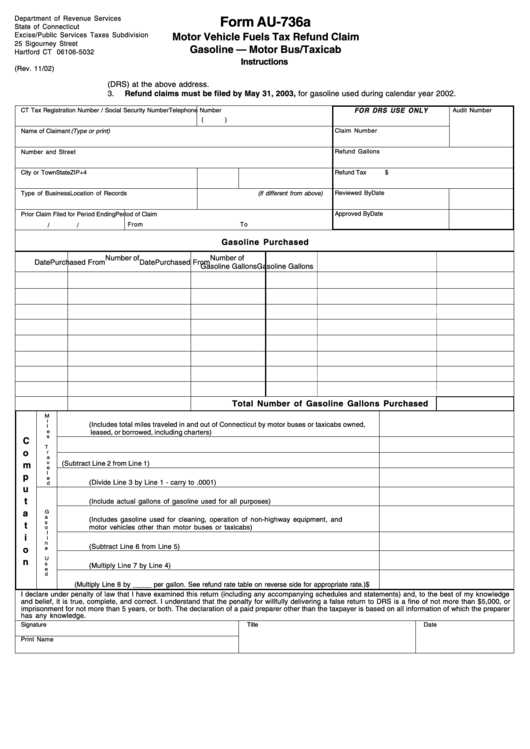

Department of Revenue Services

Form AU-736a

State of Connecticut

Excise/Public Services Taxes Subdivision

Motor Vehicle Fuels Tax Refund Claim

25 Sigourney Street

Gasoline — Motor Bus/Taxicab

Hartford CT 06106-5032

Instructions

(Rev. 11/02)

1.

For instructions and additional information see reverse side.

2.

Mail original to the Department of Revenue Services (DRS) at the above address.

3.

Refund claims must be filed by May 31, 2003, for gasoline used during calendar year 2002.

FOR DRS USE ONLY

CT Tax Registration Number / Social Security Number

Telephone Number

Audit Number

(

)

Name of Claimant (Type or print)

Claim Number

Number and Street

Refund Gallons

City or Town

State

ZIP+4

Refund Tax

$

Reviewed By

Date

Type of Business

Location of Records (if different from above)

Approved By

Date

Prior Claim Filed for Period Ending

Period of Claim

From

To

/

/

Gasoline Purchased

Number of

Number of

Date

Purchased From

Date

Purchased From

Gasoline Gallons

Gasoline Gallons

Total Number of Gasoline Gallons Purchased

M

1. Total operating miles

i

(Includes total miles traveled in and out of Connecticut by motor buses or taxicabs owned,

l

e

leased, or borrowed, including charters)

s

C

T

2. Out-of-state mileage

o

r

a

v

3. Total - miles operated on Connecticut roads (Subtract Line 2 from Line 1)

m

e

l

4. Percent of miles traveled on Connecticut roads

p

e

(Divide Line 3 by Line 1 - carry to .0001)

d

u

5. Total gallons of gasoline used

t

(Include actual gallons of gasoline used for all purposes)

6. Gasoline used other than in operation of motor buses or taxicabs

a

G

a

(Includes gasoline used for cleaning, operation of non-highway equipment, and

s

t

motor vehicles other than motor buses or taxicabs)

o

l

i

i

7. Net operating gallons used exclusively in motor buses or taxicabs

n

(Subtract Line 6 from Line 5)

o

e

8. Gallons used to operate motor buses or taxicabs on Connecticut roads

U

n

s

(Multiply Line 7 by Line 4)

e

d

9. Tax Refund Claimed

(Multiply Line 8 by _____ per gallon. See refund rate table on reverse side for appropriate rate.)

$

I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge

and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than $5,000, or

imprisonment for not more than 5 years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer

has any knowledge.

Signature

Title

Date

Print Name

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1