Form Dr 230 - Entertainment Industry Qualified Production Company Application For Certificate Of Exemption

ADVERTISEMENT

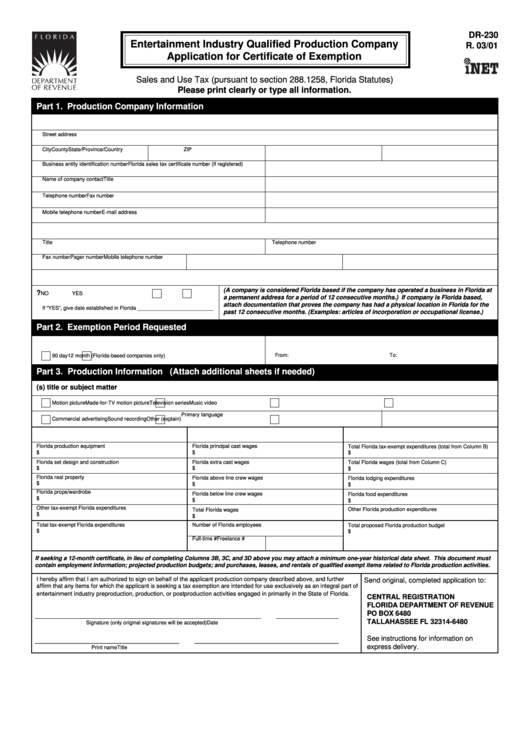

DR-230

Entertainment Industry Qualified Production Company

R. 03/01

Application for Certificate of Exemption

Sales and Use Tax (pursuant to section 288.1258, Florida Statutes)

Please print clearly or type all information.

Part 1. Production Company Information

A. Company name

Street address

City

County

State/Province/Country

ZIP

Business entity identification number

Florida sales tax certificate number (if registered)

Name of company contact

Title

Telephone number

Fax number

Mobile telephone number

E-mail address

B. Name of location production contact

Title

Telephone number

Fax number

Pager number

Mobile telephone number

C. Provide a description of company activities and operations. Attach a brochure or a one-page description on company letterhead.

(A company is considered Florida based if the company has operated a business in Florida at

D. Is company Florida based?

NO

YES

a permanent address for a period of 12 consecutive months.) If company is Florida based,

attach documentation that proves the company has had a physical location in Florida for the

If “YES”, give date established in Florida __________________________

past 12 consecutive months. (Examples: articles of incorporation or occupational license.)

Part 2. Exemption Period Requested

A. Exemption period requested

B. Projected Florida purchases/production dates

From:

To:

90 day

12 month (Florida-based companies only)

Part 3. Production Information (Attach additional sheets if needed)

A. Production/Product(s) title or subject matter

Motion picture

Made-for-TV motion picture

Television series

Music video

Primary language

Commercial advertising

Sound recording

Other (explain)

B. Proposed Florida Tax-Exempt Expenditures

C. Proposed Florida Employment Information

D. Total Proposed Florida Production Expenditures

Florida production equipment

Florida principal cast wages

Total Florida tax-exempt expenditures (total from Column B)

$

$

$

Florida set design and construction

Florida extra cast wages

Total Florida wages (total from Column C)

$

$

$

Florida real property

Florida above line crew wages

Florida lodging expenditures

$

$

$

Florida props/wardrobe

Florida below line crew wages

Florida food expenditures

$

$

$

Other tax-exempt Florida expenditures

Other Florida production expenditures

Total Florida wages

$

$

Total tax-exempt Florida expenditures

Number of Florida employees

Total proposed Florida production budget

$

$

Full-time #

Freelance #

If seeking a 12-month certificate, in lieu of completing Columns 3B, 3C, and 3D above you may attach a minimum one-year historical data sheet. This document must

contain employment information; projected production budgets; and purchases, leases, and rentals of qualified exempt items related to Florida production activities.

I hereby affirm that I am authorized to sign on behalf of the applicant production company described above, and further

Send original, completed application to:

affirm that any items for which the applicant is seeking a tax exemption are intended for use exclusively as an integral part of

entertainment industry preproduction, production, or postproduction activities engaged in primarily in the State of Florida.

CENTRAL REGISTRATION

FLORIDA DEPARTMENT OF REVENUE

PO BOX 6480

__________________________________________________________

________________

TALLAHASSEE FL 32314-6480

Signature (only original signatures will be accepted)

Date

See instructions for information on

_____________________________________

_____________________________________

express delivery.

Print name

Title

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1