Cpa Form 6c - Certification Of Ownership And Attest Competency - New York The State Education Department

ADVERTISEMENT

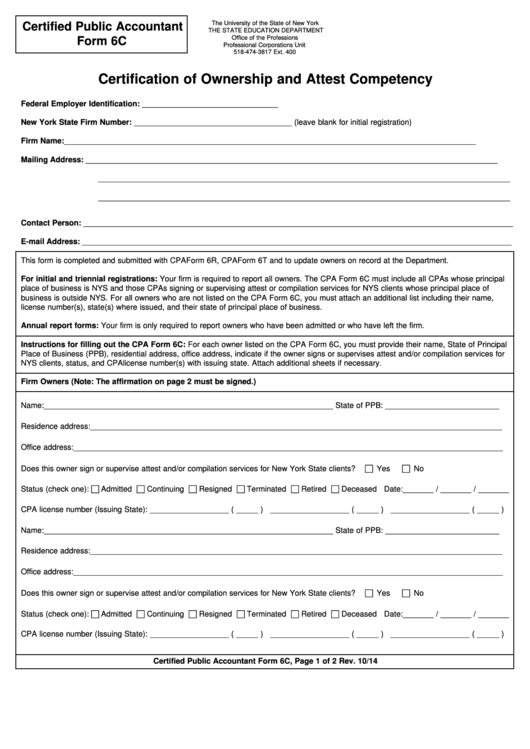

The University of the State of New York

Certified Public Accountant

THE STATE EDUCATION DEPARTMENT

Office of the Professions

Form 6C

Professional Corporations Unit

518-474-3817 Ext. 400

opcorp@nysed.gov

Certification of Ownership and Attest Competency

Federal Employer Identification: _______________________________

New York State Firm Number: ____________________________________ (leave blank for initial registration)

Firm Name:

______________________________________________________________________________________________

Mailing Address:

______________________________________________________________________________________________

______________________________________________________________________________________________

______________________________________________________________________________________________

Contact Person: __________________________________________________________________________________________________

E-mail Address: __________________________________________________________________________________________________

This form is completed and submitted with CPA Form 6R, CPA Form 6T and to update owners on record at the Department.

For initial and triennial registrations: Your firm is required to report all owners. The CPA Form 6C must include all CPAs whose principal

place of business is NYS and those CPAs signing or supervising attest or compilation services for NYS clients whose principal place of

business is outside NYS. For all owners who are not listed on the CPA Form 6C, you must attach an additional list including their name,

license number(s), state(s) where issued, and their state of principal place of business.

Annual report forms: Your firm is only required to report owners who have been admitted or who have left the firm.

Instructions for filling out the CPA Form 6C: For each owner listed on the CPA Form 6C, you must provide their name, State of Principal

Place of Business (PPB), residential address, office address, indicate if the owner signs or supervises attest and/or compilation services for

NYS clients, status, and CPA license number(s) with issuing state. Attach additional sheets if necessary.

Firm Owners (Note: The affirmation on page 2 must be signed.)

Name: __________________________________________________________________ State of PPB: __________________________

Residence address: ______________________________________________________________________________________________

Office address: __________________________________________________________________________________________________

Yes

No

Does this owner sign or supervise attest and/or compilation services for New York State clients?

Status (check one): Admitted Continuing Resigned Terminated Retired Deceased Date: _______ / _______ / _______

CPA license number (Issuing State): __________________ ( _____ ) __________________ ( _____ ) __________________ ( _____ )

Name: __________________________________________________________________ State of PPB: __________________________

Residence address: ______________________________________________________________________________________________

Office address: __________________________________________________________________________________________________

Yes

No

Does this owner sign or supervise attest and/or compilation services for New York State clients?

Status (check one): Admitted Continuing Resigned Terminated Retired Deceased Date: _______ / _______ / _______

CPA license number (Issuing State): __________________ ( _____ ) __________________ ( _____ ) __________________ ( _____ )

Certified Public Accountant Form 6C, Page 1 of 2 Rev. 10/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2