Cpa Form 6t - Cpa Firm Triennial Registration - New York The State Education Department

ADVERTISEMENT

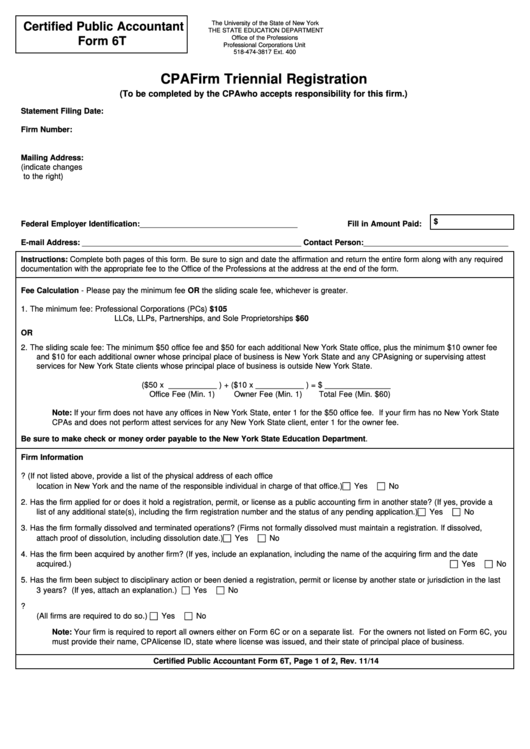

The University of the State of New York

Certified Public Accountant

THE STATE EDUCATION DEPARTMENT

Office of the Professions

Form 6T

Professional Corporations Unit

518-474-3817 Ext. 400

opcorp@nysed.gov

CPA Firm Triennial Registration

(To be completed by the CPA who accepts responsibility for this firm.)

Statement Filing Date:

Firm Number:

Mailing Address:

(indicate changes

to the right)

$

Federal Employer Identification: ____________________________________

Fill in Amount Paid:

E-mail Address: __________________________________________________ Contact Person: _________________________________

Instructions: Complete both pages of this form. Be sure to sign and date the affirmation and return the entire form along with any required

documentation with the appropriate fee to the Office of the Professions at the address at the end of the form.

Fee Calculation - Please pay the minimum fee OR the sliding scale fee, whichever is greater.

1.

The minimum fee:

Professional Corporations (PCs) $105

LLCs, LLPs, Partnerships, and Sole Proprietorships $60

OR

2.

The sliding scale fee: The minimum $50 office fee and $50 for each additional New York State office, plus the minimum $10 owner fee

and $10 for each additional owner whose principal place of business is New York State and any CPA signing or supervising attest

services for New York State clients whose principal place of business is outside New York State.

($50 x ___________ ) + ($10 x ___________ ) = $ _______________

Office Fee (Min. 1)

Owner Fee (Min. 1)

Total Fee (Min. $60)

Note: If your firm does not have any offices in New York State, enter 1 for the $50 office fee. If your firm has no New York State

CPAs and does not perform attest services for any New York State client, enter 1 for the owner fee.

Be sure to make check or money order payable to the New York State Education Department.

Firm Information

1.

Does the firm have one or more offices in New York State? (If not listed above, provide a list of the physical address of each office

Yes

No

location in New York and the name of the responsible individual in charge of that office.)

2.

Has the firm applied for or does it hold a registration, permit, or license as a public accounting firm in another state? (If yes, provide a

Yes

No

list of any additional state(s), including the firm registration number and the status of any pending application.)

3.

Has the firm formally dissolved and terminated operations? (Firms not formally dissolved must maintain a registration. If dissolved,

Yes

No

attach proof of dissolution, including dissolution date.)

4.

Has the firm been acquired by another firm? (If yes, include an explanation, including the name of the acquiring firm and the date

Yes

No

acquired.)

5.

Has the firm been subject to disciplinary action or been denied a registration, permit or license by another state or jurisdiction in the last

Yes

No

3 years? (If yes, attach an explanation.)

6.

Has the firm attached a CPA Form 6C and a complete list of all other owners who are not on the Form 6C if any?

Yes

No

(All firms are required to do so.)

Note: Your firm is required to report all owners either on Form 6C or on a separate list. For the owners not listed on Form 6C, you

must provide their name, CPA license ID, state where license was issued, and their state of principal place of business.

Certified Public Accountant Form 6T, Page 1 of 2, Rev. 11/14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2