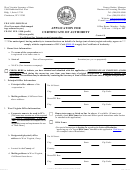

Form Cf-5 - Application For Certificate Of Withdrawal Form - West Virginia Secretary Of State Page 2

ADVERTISEMENT

APPLYING FOR A CERTIFICATE OF WITHDRAWAL

(Foreign Profit or Non-Profit Corporation)

In order for the office of the Secretary of State to issue a certificate of withdrawal for a foreign profit or

non-profit corporation, the corporation must submit duplicate originals of this application. You must

also publish a statement of intent to withdraw in a qualified newspaper one day per week for two

consecutive weeks in the West Virginia county of the corporation’s principal office and obtain an

affidavit from the publisher attesting to the publication.

The Above-Mentioned Forms and Applications Are Available From the Secretary of State’s Office.

Upon receipt of the applications we must first notify the following divisions and departments for formal

clearances:

State Tax Department

304-558-8613

Workers Compensation

304-926-5000

Dept. of Employment Security

304-558-2675

All of the formal releases must be received by our office before we can issue your certificate of with-

drawal (West Virginia Code §31-1-60).

REMINDER: You will be held liable for all taxes, fees, penalties, interest, etc. (such as the annual

corporate license tax) until clearances are obtained from all the applicable departments and divisions

listed above by June 30th of this fiscal year (West Virginia Code §31-1-60).

For More Information Concerning Withdrawals Please Contact Our Office.

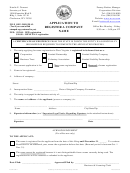

SAMPLE: Intent to Withdraw

Publish as Class II legal advertisement in county in which principal office is located, or if

there is no office in West Virginia, then in any county in which the company conducts its

affairs.

NOTICE

The members of (NAME OF CORPORATION)

have adopted a resolution to withdraw the corporation.

Claims against the corporation should be addressed to:

(ADDRESS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2