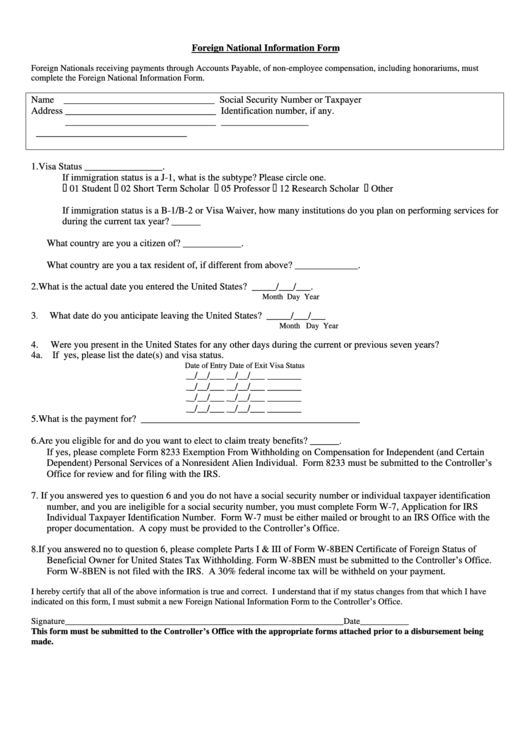

Foreign National Information Form

ADVERTISEMENT

Foreign National Information Form

Foreign Nationals receiving payments through Accounts Payable, of non-employee compensation, including honorariums, must

complete the Foreign National Information Form.

Name _______________________________

Social Security Number or Taxpayer

Address _______________________________

Identification number, if any.

_______________________________

__________________

_______________________________

1. Visa Status ________________.

If immigration status is a J-1, what is the subtype? Please circle one.

01 Student 02 Short Term Scholar

05 Professor 12 Research Scholar

Other

If immigration status is a B-1/B-2 or Visa Waiver, how many institutions do you plan on performing services for

during the current tax year? ______

What country are you a citizen of? ____________.

What country are you a tax resident of, if different from above? _____________.

2. What is the actual date you entered the United States? _____/___/___.

Month Day Year

3

What date do you anticipate leaving the United States? _____/___/___

.

Month Day Year

4.

Were you present in the United States for any other days during the current or previous seven years?

4a. If yes, please list the date(s) and visa status.

Date of Entry

Date of Exit

Visa Status

_/__/___

_/__/___

_______

_

_

_/__/___

_/__/___

_______

_

_

_/__/___

_/__/___

_______

_

_

_/__/___

_/__/___

_______

_

_

5. What is the payment for? _____________________________________________

6. Are you eligible for and do you want to elect to claim treaty benefits? ______.

If yes, please complete Form 8233 Exemption From Withholding on Compensation for Independent (and Certain

Dependent) Personal Services of a Nonresident Alien Individual. Form 8233 must be submitted to the Controller’s

Office for review and for filing with the IRS.

7. If you answered yes to question 6 and you do not have a social security number or individual taxpayer identification

number, and you are ineligible for a social security number, you must complete Form W-7, Application for IRS

Individual Taxpayer Identification Number. Form W-7 must be either mailed or brought to an IRS Office with the

proper documentation. A copy must be provided to the Controller’s Office.

8. If you answered no to question 6, please complete Parts I & III of Form W-8BEN Certificate of Foreign Status of

Form W-8BEN must be submitted to the Controller’s Office.

Beneficial Owner for United States Tax Withholding

.

Form W-8BEN is not filed with the IRS. A 30% federal income tax will be withheld on your payment.

I hereby certify that all of the above information is true and correct. I understand that if my status changes from that which I have

indicated on this form, I must submit a new Foreign National Information Form to the Controller’s Office.

Signature_______________________________________________________________Date___________

This form must be submitted to the Controller’s Office with the appropriate forms attached prior to a disbursement being

made.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1