Form St-19 - Claim For Refund Of Colorado Springs Sales And/or Use Tax

ADVERTISEMENT

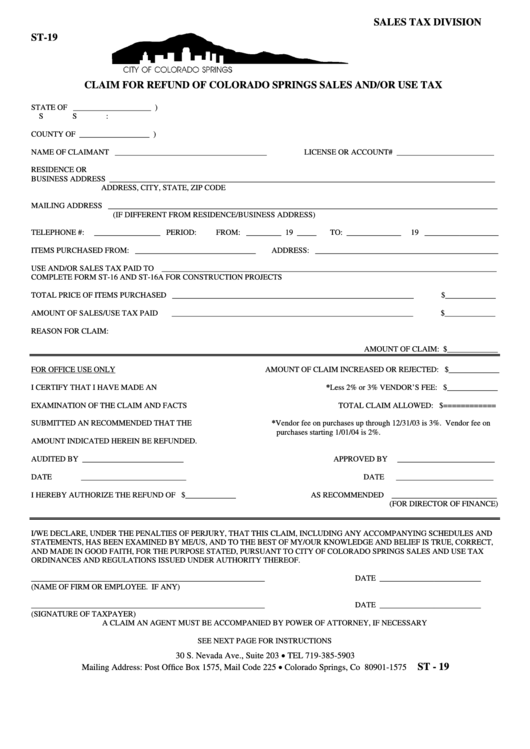

SALES TAX DIVISION

ST-19

CLAIM FOR REFUND OF COLORADO SPRINGS SALES AND/OR USE TAX

STATE OF ____________________ )

SS:

COUNTY OF __________________ )

NAME OF CLAIMANT _______________________________________

LICENSE OR ACCOUNT# _________________________

RESIDENCE OR

BUSINESS ADDRESS ___________________________________________________________________________________________________

P.O. BOX OR STREET ADDRESS, CITY, STATE, ZIP CODE

MAILING ADDRESS ____________________________________________________________________________________________________

(IF DIFFERENT FROM RESIDENCE/BUSINESS ADDRESS)

TELEPHONE #:

_________________ PERIOD:

FROM: _________ 19 _____

TO: ______________

19 ___________________

ITEMS PURCHASED FROM: _______________________________

ADDRESS: _______________________________________________

USE AND/OR SALES TAX PAID TO ______________________________________________________________________________________

COMPLETE FORM ST-16 AND ST-16A FOR CONSTRUCTION PROJECTS

TOTAL PRICE OF ITEMS PURCHASED ______________________________________________________________

$_____________

AMOUNT OF SALES/USE TAX PAID

______________________________________________________________

$_____________

REASON FOR CLAIM:

AMOUNT OF CLAIM: $_____________

FOR OFFICE USE ONLY

AMOUNT OF CLAIM INCREASED OR REJECTED: $_____________

I CERTIFY THAT I HAVE MADE AN

*Less 2% or 3% VENDOR’S FEE: $_____________

EXAMINATION OF THE CLAIM AND FACTS

TOTAL CLAIM ALLOWED: $============

SUBMITTED AN RECOMMENDED THAT THE

*Vendor fee on purchases up through 12/31/03 is 3%. Vendor fee on

purchases starting 1/01/04 is 2%.

AMOUNT INDICATED HEREIN BE REFUNDED.

AUDITED BY __________________________

APPROVED BY

_________________________

DATE

___________________________

DATE

_________________________

I HEREBY AUTHORIZE THE REFUND OF $_____________

AS RECOMMENDED ___________________________

(FOR DIRECTOR OF FINANCE)

I/WE DECLARE, UNDER THE PENALTIES OF PERJURY, THAT THIS CLAIM, INCLUDING ANY ACCOMPANYING SCHEDULES AND

STATEMENTS, HAS BEEN EXAMINED BY ME/US, AND TO THE BEST OF MY/OUR KNOWLEDGE AND BELIEF IS TRUE, CORRECT,

AND MADE IN GOOD FAITH, FOR THE PURPOSE STATED, PURSUANT TO CITY OF COLORADO SPRINGS SALES AND USE TAX

ORDINANCES AND REGULATIONS ISSUED UNDER AUTHORITY THEREOF.

____________________________________________________________

DATE __________________________

(NAME OF FIRM OR EMPLOYEE. IF ANY)

____________________________________________________________

DATE __________________________

(SIGNATURE OF TAXPAYER)

A CLAIM AN AGENT MUST BE ACCOMPANIED BY POWER OF ATTORNEY, IF NECESSARY

SEE NEXT PAGE FOR INSTRUCTIONS

30 S. Nevada Ave., Suite 203 • TEL 719-385-5903

Mailing Address: Post Office Box 1575, Mail Code 225 • Colorado Springs, Co 80901-1575

ST - 19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2