Schedule Mo-Ft Draft - Corporation Franchise Tax Return - 2009

ADVERTISEMENT

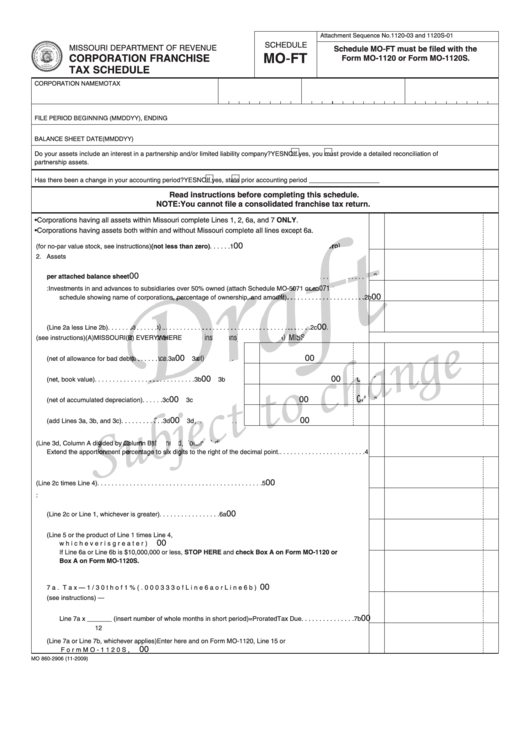

Attachment Sequence No. 1120-03 and 1120S-01

SCHEDULE

MISSOURI DEPARTMENT OF REVENUE

Schedule MO-FT must be filed with the

MO-FT

CORPORATION FRANCHISE

Form MO-1120 or Form MO-1120S.

TAX SCHEDULE

CORPORATION NAME

MO TAX I.D. NUMBER

CHARTER NUMBER

FEDERAL I.D. NUMBER

FILE PERIOD BEGINNING (MMDDYY)

, ENDING

BALANCE SHEET DATE (MMDDYY)

Do your assets include an interest in a partnership and/or limited liability company? YES

NO

If yes, you must provide a detailed reconciliation of

partnership assets.

Has there been a change in your accounting period? YES

NO

If yes, state prior accounting period ____________________

Read instructions before completing this schedule.

NOTE: You cannot file a consolidated franchise tax return.

• Corporations having all assets within Missouri complete Lines 1, 2, 6a, and 7 ONLY.

• Corporations having assets both within and without Missouri complete all lines except 6a.

00

1. Par value of issued and outstanding stock (for no-par value stock, see instructions) (not less than zero) . . . . . .

1

2. Assets

00

2a. Total assets per attached balance sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2a

2b. Less: Investments in and advances to subsidiaries over 50% owned (attach Schedule MO-5071 or a

00

schedule showing name of corporations, percentage of ownership, and amount) . . . . . . . . . . . . . . . . . . . . . .

2b

00

2c. Adjusted total (Line 2a less Line 2b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2c

3. Allocation per attached balance sheet or schedule (see instructions)

(A) MISSOURI

(B) EVERYWHERE

00

00

3a. Accounts receivable (net of allowance for bad debt) . . . . . . . . . .

3a

3a

00

00

3b. Inventories (net, book value) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3b

3b

00

00

3c. Land and fixed assets (net of accumulated depreciation) . . . . . .

3c

3c

00

00

3d. Total allocated assets (add Lines 3a, 3b, and 3c) . . . . . . . . . . . .

3d

3d

4. Missouri percentage for apportionment (Line 3d, Column A divided by Column B)

Extend the apportionment percentage to six digits to the right of the decimal point. . . . . . . . . . . . . . . . . . . . . . . . .

4

00

5. Assets apportioned to Missouri (Line 2c times Line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6. Tax basis:

00

6a. Corporations having all assets within Missouri (Line 2c or Line 1, whichever is greater) . . . . . . . . . . . . . . . . .

6a

6b. Corporations having assets both within and without Missouri (Line 5 or the product of Line 1 times Line 4,

00

whichever is greater) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

If Line 6a or Line 6b is $10,000,000 or less, STOP HERE and check Box A on Form MO-1120 or

Box A on Form MO-1120S.

7. Tax Computation

00

7a. Tax — 1/30th of 1% (.000333 of Line 6a or Line 6b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a

7b. Short periods (see instructions) —

00

Line 7a x _______ (insert number of whole months in short period) = Prorated Tax Due . . . . . . . . . . . . . . .

7b

12

7c. Tax due (Line 7a or Line 7b, whichever applies) Enter here and on Form MO-1120, Line 15 or

00

Form MO-1120S, Line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7c

MO 860-2906 (11-2009)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1